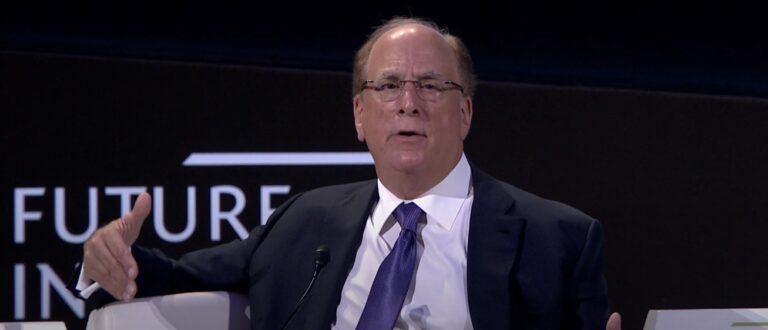

Recently, Larry Fink, Co-Founder, Chairman and CEO of BlackRock, the world’s largest asset manager, said during an interview that crypto “could become a great asset class.”

BlackRock, which was founded in 1988, started with just eight people working in one room. It made its Initial Public Offering on the New York Stock Exchange on 1 October 1999 at $14 a share.In 2006, BlackRock acquired Merrill Lynch Investment Management. Then in 2009, it acquired Barclay’s Global Investors (BGI), “becoming the world’s largest asset manager, with employees in 24 countries.” As of 31 March 2020, BlackRock had $6.47 trillion in assets under management (AUM).

Fink made his comments during an interview on April 15 with CNBC’s Squawk Box.

Fink believes in crypto:

“I’m still fascinated about it, I’m encouraged by how many people are focusing on it, I’m encouraged about the narrative that it may become a great asset class. And I do believe this could become a great asset class.“

However, he does not think crypto will replace fiat currencies:

“I don’t believe it’s a substitute for currencies. I think we’re going to have cryptocurrencies of dollars, cryptocurrencies of other currencies. But I don’t believe we should think about crypto as a substitute of currency. But I’m fascinated by it as an asset class.“

He went on to say that although his firm has been studying and experimenting with crypto, they are not seeing much demand from institutional investors:

“I will tell you of our investors worldwide… we don’t have that much inquiry on it. We are investing in it. Rick Rieder’s been on your show talking about things that we are doing in it. And we’re studying it…

“There are components in the financial markets about crypto that are real, that is growing. But if you’re asking me specifically about long-term investing from sovereign wealth funds, from pension funds, from retirement services, from big family offices, the conversation about crypto is a very minor conversation compared to so many other conversations.“

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a high risk of financial loss.