Cryptocurrency exchanges have over time kept on increasing their operational standards and transparency, to the point most trading platforms are now considered Top-Tier and improved security has led to fewer hacking incidents.

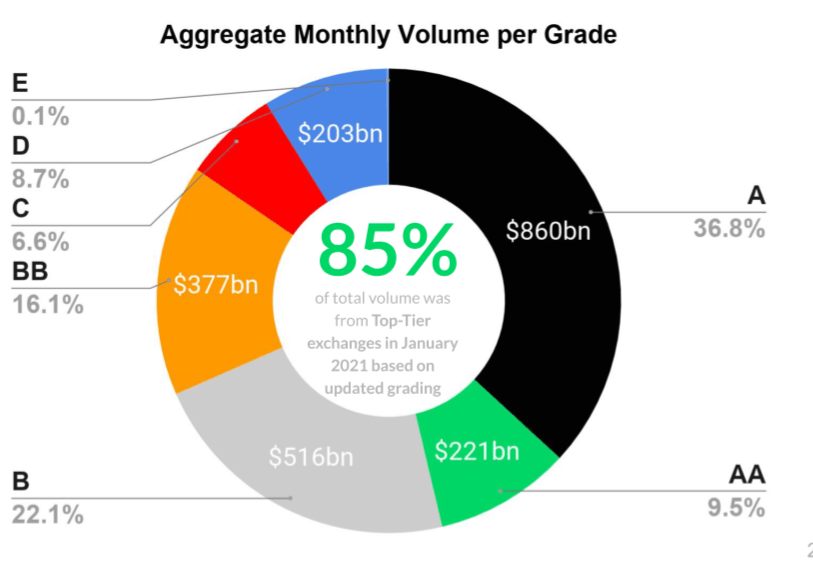

According to CryptoCompare’s Exchange Benchmark report, Top-Tier exchanges, those graded AA-BB, have gained an additional 13% market share in the last four months, from October 2020 to January 2021 – the same time period that saw the price of Bitcoin surge from little over $11,000 to a new high above $40,000.

The report details that Top-Tier exchange market share grew from 61$ to 74% over said period, with these platforms going from trading $347 billion to $1.41 trillion per month. It adds that based on its grading, market share for last month would have been of 85% for these platforms.

Market share for Top-Tier trading platforms partly increased because the number of exchanges being considered Top-Tier also increased to 84, up from 68 in July of last year. This, the report adds, as exchanges “increased their operational standards and transparency due to regulatory requirements and a competitive marketplace.”

Exchanges throughout the cryptocurrency space have generally improved their security since July of last year, the report notes, with 20% of trading platforms in the space now holding more than 95% of their funds in cold wallets, up from 15%.

Moreover, 1% of exchanges were hacked in the last year, compared to 4% at the time of the last report. While security incidents are dropping, exchanges using an external on-chain transaction monitoring provider increased from 16% to 25%, and only one-third of exchanges were rated as “having poor or inadequate KYC (Know Your Customer) programs, down from nearly half in July.

Data transparency, CryptoCompare’s report adds, has also improved, with 44% of exchanges offering the ability to query full historical trade data via a public API endpoint, up from 37% in July. 9% of exchanges now also offer “some form of cryptocurrency insurance,” up from 5%, and 37% are registered as money service businesses or possess a cryptocurrency exchange license.

Featured image via Pixabay.