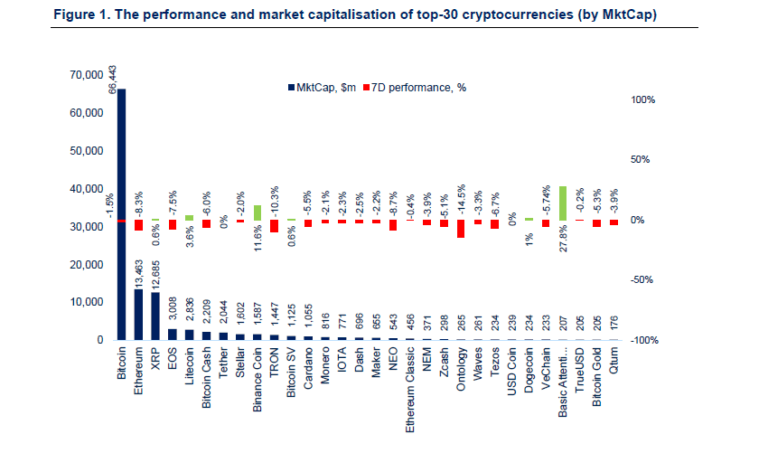

Following a week of consolidation and several failed attempts to break through resistance, Bitcoin and all major cryptocurrencies plummeted as of Monday morning. Total market cap is down by $6bn to $126bn. Bitcoin has tried to break $3,900 resistance several times, but failed and currently sits at $3,750, representing almost a 4% loss from the previous weeks’ highs. The rest of the major cryptocurrencies have naturally followed the leader, where Ethereum is back below $130, down by 9%, and Ripple is closing the gap, with 0.6% gains. The rest of the top-20 market 24h losses are ranging from 4% – 6%. This week’s best performers among the top-30 assets were BAT (27.4%), Binance Coin (11.5%) and Litecoin (3,6%).

Crypto Market News

Bank Frick Launches Institutional Crypto Trading Platform

Liechtenstein-based Bank Frick will offer trading and offline storage of the top 5 cryptocurrencies to professional market participants and intermediaries.

Swiss Bank Julius Baer to Offer Digital Assets Services

Swiss-based private bank Julius Baer ($380bn AUM) has teamed up with SEBA Crypto AG to offer crypto services to its clients. The services are currently awaiting regulatory approval.

Square Sold More Than $166 Worth of Bitcoin in 2018

Mobile payments app Square sold over $166m worth of Bitcoins in 2018, with $52.5m in Q4 alone.

Mizuho Bank to Launch Its Own Coin

Japanese Mizuho Bank is preparing to launch a digital currency, the J-coin Pay, via a joint partnership between the bank and 60 other participants, with the main purpose of reducing cash usage in Japanese society.

EOS Loses More than 2 Million Coins in Hack

Governance blockchain protocol EOS has lost 2.09m coins in the recent hack, where one of the 21 masternodes failed to update the EOS blacklist (bad actors list) in time with the rest of the nodes.

Ethereum Hard Forks Are Live

Constantinople and St. Petersburg hard forks occurred successfully at block height 7,280,000 last week, most notably the block size reward dropped from 3 ETH to 2 ETH.

Facebook In-talks with Exchanges to List Its Coin

Facebook has supposedly opened the conversation with several exchanges to list the fiat-backed token in the first half of 2019. The token will be integrated with WhatsApp and will help to create a digital payment network for the tech giant.

Last Week in Funding

Nivaura raised $20m to tokenize traditional financial instruments; Blockchain venture fund Pangea Ventures raised $22m; Goldman Sachs veteran raised $3m to tackle market manipulation; Crypto data portal Coin Metrics raised $1.9m; Crypto exchange VALR raised $1.5m to become a leading African venue; and blockchain lending startup Figure raised $65m Series B round from RPM Ventures, partners at DST Global, and others.

Security Token News

Inveniam Capital Partners to Tokenize $260m Real Estate

Inveniam Capital Partners plans to tokenize $260m worth of real estate, starting with a $66.5m building in downtown Miami, a $90m student housing facility in North Dakota, a $50m water pipeline also in North Dakota and a family housing facility in South Florida, worth $75m.

Templum Moves to Private Blockchain

Security token issuance platform and registered broker Templum is moving to private blockchain Symbiont, after exploring Ethereum, which looked “more problematic”.

GSR Capital Cuts tZERO Investment by 75%

Hong Kong-based PE firm GSR Capital has cut the investment deal to security token exchange tZERO from $404m to $100m. GSR has already delayed the funding scheduled for December 2018 and February 2019.

Regulatory News

Vladimir Putin Orders Government to Adopt Blockchain Regulation and Plans for Oil-Backed Coin

Russian president Vladimir Putin has set 1st July 2019 as a final deadline for a government regulatory framework on cryptocurrency. Additionally, the former Energy Minister Igor Yusufov is also proposing an oil-backed cryptocurrency to circumvent sanctions in international trade.

Bahrain Central Bank Issues Crypto Rulebook

The Central Bank of Bahrain has issued a cryptocurrency rulebook, establishing parameters for cybersecurity, licensing, business conduct standards and exchange transparency.

Rhode Island Moves to Exempt Some Tokens from Securities Rules

Lawmakers of US state Rhode Island have introduced a bipartisan bill, proposing the exemption of tokens which only have a “consumptive purpose” and are “only exchangeable for, or provided for, the receipt of goods, services or content.”

30 Global Securities Depositaries Are Exploring Crypto Custody

A working group of Central Securities Depositaries (CSDs), the International Securities Services Association (ISSA) in Asia and Europe, is researching infrastructure arrangements for digital assets’ custody.

Update: This article has been updated to clarify blockchain lending startup Figure raised funds from RPM Ventures and partners at DST Global, not DST Global itself.