Weekly Summary

The Week: China Embraces Blockchain and Bitcoin Head-Fake Decimates Bears

- Tony Faccenda

- /

- 28 Oct 2019

Looking back on a week in which Bitcoin defied bearish sentiment to pop more than 40% in a single day, China’s president publicly supported the role of blockchain in the country’s future, Polish police arrested the head of Crypto Capital on suspicion of money laundering, Binance continued its global expansion with the introduction of Nigerian Naira pairs and Jack Dorsey answered the question of whether Twitter would be involved in Libra with a resounding “Hell No!”.

The Week: Bitcoin Hits New Mining Milestone and Binance Cranks up the Leverage

- Tony Faccenda

- /

- 21 Oct 2019

Reflecting on a week in which the 18 millionth bitcoin was mined at block 600,000, Binance upped the stakes by raising leverage on its futures trading platform to a staggering 125X, Telegram delayed the launch of its TON blockchain until April 2019 following US regulatory backlash, BAT-powered Brave browser hits 8 million monthly active users and ‘Satoshi’ was added to the Oxford English Dictionary.

The Week: SEC Files Emergency Order Against TON and Libra Down to 22 Members

- Tony Faccenda

- /

- 15 Oct 2019

Looking back on a week when the SEC brought an abrupt halt to Telegram’s planned TON launch, several prominent members of the Libra Association pulled out due to regulatory pressures, Alipay quickly corrected an official announcement suggesting Chinese users could onboard to Binance using the app.

The Week: Coinbase Hikes Trading Fees and Apple Quashes Crypto Rumours

- Tony Faccenda

- /

- 7 Oct 2019

This week saw mixed fortunes for Coinbase. The company attracted attention with several announcements, including the news it will offer 1.25% interest on its USDC stablecoin and the introduction of a new banking agreement for faster deposits and withdrawals for UK customers.

The Week: No STO for NBA Star and Binance Offers Staking Rewards

- Tony Faccenda

- /

- 30 Sep 2019

Another eventful week in the crypto space has seen an NBA star try to tokenize his $34.4 million contract on the Ethereum blockchain, Binance support the UK’s Cybercrime Unit with investigations into a $51 million phishing scam, Bitmain launch a ‘Tinder for Bitcoin mining’ service to match individual miners with pools, Parity admit prioritizing Polkadot development over Ethereum despite a $5 million grant from the Ethereum Foundation, and decentralized storage network Filecoin announce the date for its long-awaited testnet.

The Week: Hashgraph goes live and EA trolls Crypto Twitter

- Tony Faccenda

- /

- 23 Sep 2019

Over the past week, a cunning hacker managed to steal $200,000 worth of EOS by exploiting a smart contract vulnerability in popular gambling app EOSBet, Electronic Arts trolled crypto fans with a mysterious tweet that turned out to be a crafty game promotion, a well-known ICO advisor was arrested in the US on extortion charges, Binance margin borrowing passed $100 million and Ripple dismissed a pending lawsuit by XRP investors, claiming the token isn’t a security.

The Week: Coinbase Backs DeFi and Bitcoin Makes Premier League Debut

- Tony Faccenda

- /

- 16 Sep 2019

Over the past week, Coinbase hinted at the launch of a new platform to capitalize on interest in IEOs and STOs, Binance opened trading on its Binance Futures platform following a successful beta launch, Dapper Labs launched a new blockchain to support CryptoKitties 2.0 and English Premier League side Watford FC announced it’ll be displaying the Bitcoin logo on players’ shirts as part of a sponsorship deal.

The Week: Binance Announces Futures Testnets, Bakkt Plans to Open up Crypto Deposits

- CryptoGlobe Writer

- /

- 4 Sep 2019

We take a look at the top crypto stories over the last week.

The Week: Binance Launches Crypto Lending Service; Outages Disrupt Exchanges Operations

- Tony Faccenda

- /

- 28 Aug 2019

Over the past week, Brazil’s central bank adopted guidelines from the International Monetary Fund (IMF) on cryptocurrencies, and leading cryptocurrency exchange Binance launched a lending service letting users “earn crypto while you sleep.”

The Week: Bakkt Cleared for Launch and yet More ETF Delays

- Tony Faccenda

- /

- 19 Aug 2019

Over the past week, Bakkt announced it will be launching its bitcoin futures platform on September 23 following several delays, Coinbase acquired institutional custody business Xapo for $55 million, the SEC delayed its decision on three Bitcoin ETF proposals until autumn, Binance paid out a bounty to a white hat hacker who hijacked its Binance Jersey Twitter account, and a Florida federal judge called out inconsistencies in Craig Wright’s court statements in the Kleiman vs Wright case.

The Week: SEC Delays Bitcoin ETF Proposals and Binance Shrugs off Data Breach Speculation

- Tony Faccenda

- /

- 13 Aug 2019

Over the past week, the U.S. SEC delayed Bitcoin ETF proposal it had on the table, Binance CEO CZ labelled reports that the exchange had suffered a hack involving user KYC data as “FUD”, commission-free trading app Robinhood got a thumbs up from UK regulators and Coinbase quietly delisted privacy coin Zcash from its UK platform.

The Week: UK Regulator Offers Crypto Guidance and Jack Dorsey Loves Bitcoin

- Tony Faccenda

- /

- 5 Aug 2019

We take a look at the top stories in the crypto world over the last week.

Justin Sun Postpones $4.6m Lunch and Long Island Blockchain Turns Sour

- Tony Faccenda

- /

- 29 Jul 2019

We take a look at the top crypto stories in the last week.

The Week: Facebook Faces Congress and Roubini Seeks Revenge

- Tony Faccenda

- /

- 22 Jul 2019

We take a look at the top crypto stories in the last week.

Trump Tweets about Bitcoin and Tether Accidentally Prints $5bn USDT

- Tony Faccenda

- /

- 15 Jul 2019

We take a look at the top stories in crypto over the last week.

The Week: Roubini and Hayes Tangle in Taipei and Binance lists Doge

- Tony Faccenda

- /

- 9 Jul 2019

We take a look at top headlines in the crypto space over the last week.

The Week: Bitcoin Pauses for Breath, Craig Wright Sheds a Tear for the Assets Lost Innocence

- Tony Faccenda

- /

- 1 Jul 2019

In our weekly roundup, we take a look at some of the top crypto stories dominating headlines.

The Week: Facebook Drops the Hottest Whitepaper since Satoshi and Bitcoin Breaks $10k

- Tony Faccenda

- /

- 24 Jun 2019

We take a look at the top crypto headlines over the last week.

The Week: Binance Restricts US Users and Facebooks Libra Attracts High-profile Backers

- Tony Faccenda

- /

- 17 Jun 2019

We take a look at some of the top stories dominating crypto headlines in the past week.

The Week: Bitcoin Sees Big Gains, Coinbase Expands and SEC Issues New Framework

- NKB Group

- /

- 9 Apr 2019

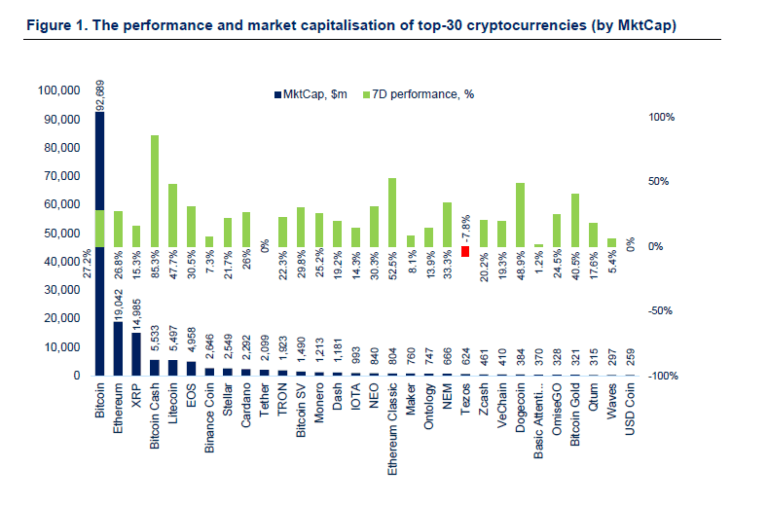

After weeks of accumulation, digital assets saw massive gains over the past week, where the total crypto market cap rose by 23% from $145bn to $183bn

The Week: Cboe Putting Bitcoin Futures on Hold, Cosmos Goes Live

- NKB Group

- /

- 18 Mar 2019

Digital assets continued in recovery mode for the past week, with all major cryptocurrencies ending the week with gains.

The Week: BlockFi Announces Crypto Saving Accounts, SIX Swiss Exchange Launches Ether and Bitcoin ETPs

- NKB Group

- /

- 11 Mar 2019

Digital assets recorded a positive week, where total the crypto market cap is up by 7% at $134bn.

The Week: Ethereum Hard Forks, Julius Baer to Offer Digital Assets Services, and Putin Plans for Oil-backed Coin

- NKB Group

- /

- 4 Mar 2019

Following a week of consolidation and several failed attempts to break through resistance, Bitcoin and all major cryptocurrencies plummeted as of Monday morning.

The Week: Coinbase Adds XRP, Samsung S10 Blockchain Wallet and Bitmain Reports Losses

- NKB Group

- /

- 26 Feb 2019

After a bullish week across the crypto markets, where the total market cap spiked by more than 14% from $126bn to $144bn on Saturday, the bears came back on Sunday and virtually wiped out the entire gains within a single hour.

The Week: JP Morgan Coin, Coinbase Wallet, Nasdaq Adds BTC & ETH Indices

- NKB Group

- /

- 18 Feb 2019

Last week saw the cryptocurrency markets increase in price and volume, after a extended consolidation period. JP Morgan announced it was launching its own coin and Nasdaq added bitcoin and ethereum indices.

The Week: Kraken Acquires Crypto Facilities & Coinbase Supports PayPal

- NKB Group

- /

- 11 Feb 2019

Digital assets recorded an impressive end of the week with a $10bn injection into the total crypto market, a 9% change from the previous week and a 66% increase in volume.

The Week: Bitcoin OTC Volumes Up, Bitwise ETF & Bitmain Appoints New CEO

- NKB Group

- /

- 15 Jan 2019

Despite the number of daily transactions reaching a one year high (280,000), market leader Bitcoin is down 10% over the last week. However, there has been positive news for the crypto industry this week, particulary bitcoin which saw OTC volumes increase recently and two new bitcoin ETFs hit the headlines.

NKB Crypto Update: Markets Bounce Back

- NKB Group

- /

- 8 Jan 2019

Since our latest edition (17th Dec), digital assets have bounced from the yearly lows of $104 billion back up to $146 billion on 24th Dec, representing a 40% spike in the total crypto market cap.

The Week: Nasdaq BTC Futures, Hashrate Falls, Bitcoin ETF Discussions

- NKB Group

- /

- 3 Dec 2018

Last week saw numerous important and positive institutional and regulatory announcements. Ohio announced it will allow companies to pay taxes with bitcoin, VanEck and Nasdaq partner to launch bitcoin futures and two bitcoin addresses were sanctioned by OFAC.

The Week: Bakkt Postpones Bitcoin Futures, USDC Audit & Hashrate Drops

- NKB Group

- /

- 26 Nov 2018

The crypto sell off continues as last week wiped out almost another 34% off the total market cap, bottoming at $115 million. Bitcoins hashrate continues to drop as miners are forced out by declining prices. Bakkt CEO explains the decision to postpone their bitcoin futures product, and USDC gets audited.

The Week: Crypto ETP ‘HODL5’, Bitcoin Cash ‘HashWar’, SEC Charges ICOs

- NKB Group

- /

- 19 Nov 2018

A bloody week indeed for cryptoassets, where the total market cap has lost more than 19%. The SEC set precedent by charging two Airfox and Paragon ICOs, forcing them to refund investors. Amun AG, is launching the world’s first multi-asset cryptocurrency index exchange-traded product (ETP).

The Week: SEC Charges EtherDelta Founder, $125 Million Airdrop, Tethers Bank In Trouble

- NKB Group

- /

- 13 Nov 2018

Despite flat markets, there were significant developments this week, the Stellar Development Foundation, announced a $125 million community airdrop, bolstering the price of Stellar by 12.8%. The SEC charged EtherDelta with operating an unregistered security exchange and Tether’s new bank – Deltec – has been caught in another bribery case.

The Week: Markets Recover, Coinbase Adds Basic Attention Token and Binance Uganda Launches

- NKB Group

- /

- 5 Nov 2018

The total Crypto Market rose by 1.3%, and overall volume spiked by more than 40% over the past 7-days. Coinbase listed Basic Attention Token (BAT) which is up 30% on the week, Binance Uganda had a successful launch and Global Digital Finance published their Code of Conduct.

The Week: Coinbase and Circle, Bitcoin ETF Meeting, UK Financial Taskforce Report

- NKB Group

- /

- 30 Oct 2018

The total crypto market shrank by 1.2%, and overall volume lost 5% over the past 7-days. A few positive regulatory developments have not buoyed the price and it is unclear what is behind the 4% drop at the end of the week. VanEck, SolidX, CBOE met with the SEC commissioner it what appears to be a productive meeting.

The Week: Stablecoin Wars, CME Bitcoin Volumes Up 41%, BitGo Raises $53m and Fidelity

- NKB Group

- /

- 22 Oct 2018

The cryptocurrency markets calmed down after a turbulent week, Bitcoin is down 1% and Ethereum is down by 1.6%. The best performers were Basic Attention Token (55%), Qtum (24%) and recent Coinbase addition 0x (23%). Cryptoassets did not react to the very bullish news around Fidelity and BitGo, CME bitcoin futures volume increased 41% from Q2-Q3 and stablecoin competition remains fierce.

The Week: Tether Panic, Fidelity and US Senate Showdown

- NKB Group

- /

- 16 Oct 2018

The Tether sell off led to a price spike as traders bought bitcoin and other cryptocurrencies to exit the rapidly devaluing USDT. Several positive regulatory developments have occurred last week and most notably Fidelity will launch crypto custody and brokerage solutions for institutional investors. Nouriel Roubini aka ‘Dr Doom’ spoke at the US Senate hearing alongside Peter Van Valkenburgh, Director of Research at Coin Center.

The Week: Bitcoin Volatility at 3-Year Low, Crypto Money Laundering, SEC ETF Decisions

- NKB Group

- /

- 9 Oct 2018

Despite an exciting news week bitcoin volatility is at a three year low with strong support at around $6,400 and significant resistance at $6,850, many analysts are predicting an imminent breakout. The SEC reviewed decisions on nine Bitcoin ETFs, Gemini Exchange secured an insurance partner and cryptocurrency money laundering came back into the spotlight.

Weekly Report: Bitcoin ETF, Mining Competition, Zaif Hack, Binance Domination

- NKB Group

- /

- 25 Sep 2018

The total cryptocurrency market rose by almost 8%, and the overall volume spiked by 33% over the past 7-days. Mining competition has stepped up with announcements from Bitmain and Bitfury. Zaif suffered a $60 million hack and Binance announced grand plans. The SEC has delayed the Bitcoin ETF yet again whilst the New York Attorney general published a damming 42-page report on crypto exchanges.

Weekly Report: Stablecoins Abound, Institutional Interest, Sharding, Tezos Mainnet

- NKB Group

- /

- 17 Sep 2018

The previous week has reacted positively on the whole despite lows of $170 being seen in ETHUSD markets. Some analysts are claiming that a bottom is finally forming for bitcoin. There are promising signs of institutional interest, three new stablecoins have been announced, Ethereum and Tezos has caused a stir in the altcoin markets.

Weekly Report: Coinbase & Blackrock, Goldman FUD, SEC Suspends BTC and ETH ETNs

- NKB Group

- /

- 11 Sep 2018

Cryptocurrencies saw a massive sell in the latter part of last week, the total market cap shrank by more than 16%. Bitcoin has stabilised, however, analysts claim that ICOs will continue to suppress ETH price with treasury selling. Goldman Sachs ‘Fake News’, Coinbase and Blackrock ETF rumours and positive regulatory moves from South Korea and the EU have all had a bearing on price this week.

Weekly Report: CBOE Plans ETH Futures, Volumes Increase, Yahoo! Adds Crypto Trading

- NKB Group

- /

- 3 Sep 2018

Cryptocurrency markets have rallied over the past week with total market cap increasing by almost 9%. There has been a smattering of relatively small but bullish developments in the space such as Yahoo! finance supporting Bitcoin, Ethereum and Litecoin trading. CBOE said they have plans to launch Ether futures. Satis research released a report on cryptocurrency valueations that had some optimistic 5 year price predictions, notably Bitcoin at $96k.

Weekly Report: Bitcoin ETF Rejections, Short Squeeze Rally, China Ban & Signs of Recovery

- NKB Group

- /

- 29 Aug 2018

Despite negative news from China, signalling they will block access to 124 foreign crypto exchanges and the US SEC rejecting 9 ETFs. It looks like the market has already priced in most of the negative scenarios and is forming a bottom. Bitcoin short positions were at 2018 highs last week and this is thought to have caused a ‘short squeeze’ rally.

Weekly Report: Bearish Market Continues, Scams and ETH Slides Amid Concerns About DApps

- NKB Group

- /

- 20 Aug 2018

This week saw news about crypto scams predominate, while weak summer activity seems to be preventing the market from recovering. With the ether price reaching record lows, concerns about scam DApps and DApp usage sparked questions about the future of the platform. Pantera Capital, however, this week looked beyond the bear market – launching a $175m crypto venture fund.

Weekly Report: Coinbase Custody, SEC Subpoenas, Bitcoin ETF Delay

- NKB Group

- /

- 6 Aug 2018

Bitcoin has been in a downward trend since last week correcting from over $8200 to under $7000. Best performers among top-40 crypto were Ethereum Classic (2%), Binance Coin (1%). Analysts see the dip as a technical move as fundamental news was bullish, particulary the NYSE Bakkt and Coinbase Custody announcements.

Weekly Report: Bitcoin ETF, Blackrock Interest and Coinbase Listings

- NKB Group

- /

- 23 Jul 2018

The Bitcoin dominance increased from 42.7% to 45.6%, moving up due to Bitcoin’s increased trading activity and 19% price appreciation over the course of a week. The best performers among the top-40 crypto assets were Bitcoin Diamond (+117%), Stellar (+33%), and Cardano (+21%). Positive regulatory news and Bitcoin ETF anticpation are drivers.

Next Week in Crypto: Key Events, Hard Forks, ICOs and Airdrops

- John Medley

- /

- 23 Jul 2018

Want to get more involved in the crypto space? Here’s a small list of upcoming events for next week you can attend or monitor. If you’re looking for potential airdrops to increase your crypto wealth or initial coin offerings (ICOs) about to end, CryptoGlobe’s got you covered.

Weekly Report: S Korea Pro Regulation, Augur Launches, Bancor Hacked & More

- NKB Group

- /

- 16 Jul 2018

Markets appear to be stabilizing around a bottom amidst a mostly positive week of developments. Malta, S. Korean and Bermuda move forward with regulation on blockchain technology and ICOs. Augur launches on the Ethereum network. Coinbase looking into adding five new crypto assets to trading: ADA, BAT, XLM, ZEC,ZRX. CBOE files with SEC for Bitcoin ETF.

Whats on Next Week in Crypto? Key Events, Network Upgrades, ICOs and Airdrops

- John Medley

- /

- 15 Jul 2018

If you’re looking to increase your crypto wealth or want to know what’s going on in the crypto space next week, this is the article to read.

NKB Group: Weekly Market Update

- NKB Group

- /

- 10 Jul 2018

The cryptomarket recovered last week. With 4-6% gains from the top cryptocurrencies, top performers included NEO and ETC. Malta set a regulatory framework for Blockchain technology, Thailand SEC will introduce a new rule governing local ICOs, Ethereum suffered a gas crisis, South Korean banks investments totalled $1.79bn, Bitmain joined the list of EOS block producers and the largest ETF trader in Europe entered the cryptomarket and much more.

Weekly Roundup: Bitcoin Surges, Europe’s Largest ETF Trader Enters Crypto, $12bn Bitmain Valuation

- Avi Rosten

- /

- 9 Jul 2018

The news this week was a notable improvement upon recent weeks, with several positive developments for the industry. With Bitcoin jumping significantly in price, Europe’s largest ETF trader moving into crypto markets and bitcoin mining giant Bitmain reportedly valued at $12 Billion. However, India’s Supreme Court moved forward with its crypto ban.

Weekly Roundup: 250m Tether grant, Bitcoin Rally, Trans-fee mining Exchanges Take out Binance

- Avi Rosten

- /

- 2 Jul 2018

This week saw several interesting developments for exchanges while bitcoin dropped below the $6,000 mark, nearly reaching an eight-month low. New “trans-fee mining” exchanges hit the headlines for topping the trading volume rankings, Tether was also in the news a lot this week as it granted $250m and a report questioning the stablecoin’s trading on Kraken exchange stirred the crypto community.

HODL Your Horses, Heres What’s in Crypto Next Week: Hard Forks, Airdrops, ICOs, Events

- John Medley

- /

- 1 Jul 2018

Here’s a small rundown of what’s going on this week in the cryptospace, including hard forks, token airdrops, and events you should attend or at least keep an eye on.

Weekly Roundup: Relief from the SEC, ETH Classic Gets a Boost, and EOS Goes Live (Just)

- Avi Rosten

- /

- 18 Jun 2018

This week was altogether more positive for the industry, giving investors some much-needed moments of relief from the bearish atmosphere gripping the markets. The major news of the week came from the SEC with their statement on Thursday that they deem bitcoin and ethereum to not be securities. With Binance announcing Euro-crypto pairs, Eth classic surging 20% after Coinbase announced plans to add support, and EOS going live the broader market also seemed to be gaining traction.

Weekly Roundup: Hacks, Exchange Innovation, EOS Mainnet, and Faltering Markets

- Avi Rosten

- /

- 11 Jun 2018

A major trend in this week’s news was crypto security – with Bitfinex suffering a DDoS attack early in the week and South Korean exchange Coinrail experiencing an expensive hack that might have led to a tumble in crypto prices. In more positive news for exchanges, Coinbase announced acquisitions that are a major step towards offering SEC-regulated crypto securities, while BitMex announced EOS futures contracts – ahead of the EOS Mainnet Launch – given the go-ahead by the community over the weekend. Here are the top stories in crypto last week.

Weekly News Summary 5 Mar – 11 Mar

- John Medley

- /

- 11 Mar 2018

Amidst the price decline this week there has been some interesting fundamental developments in the industry. The Binance hack was perhaps the most impactful news story on the price, however, regulation has been the dominant theme over the past week. FinCEN, FSA and the SEC have all taken somewhat contradictory stances as they struggle to make heads or tails of crypto-assets. On the business side Coinbase, Bitmain and Ripple have stolen the medias attention.

Weekly News Summary 19 Jan – 25 Feb

- John Medley

- /

- 25 Feb 2018

Last weeks news has centered heavily on the rapidly evolving regulatory landscape, with important announcements from the US, South Korea, Venezuela, Germany and France. On the whole, the announcements are positive and they signify a maturing ecosystem. Visa and Worldpay accept blame for double charging customers after mainstream press were quick to blame Coinbase.

Weekly News Summary, 29 Jan – 02 Feb

- John Medley

- /

- 2 Feb 2018

The weekly roundup brings you all the biggest news stories that have impacted the crypto-asset markets over the last week in one succicent article.