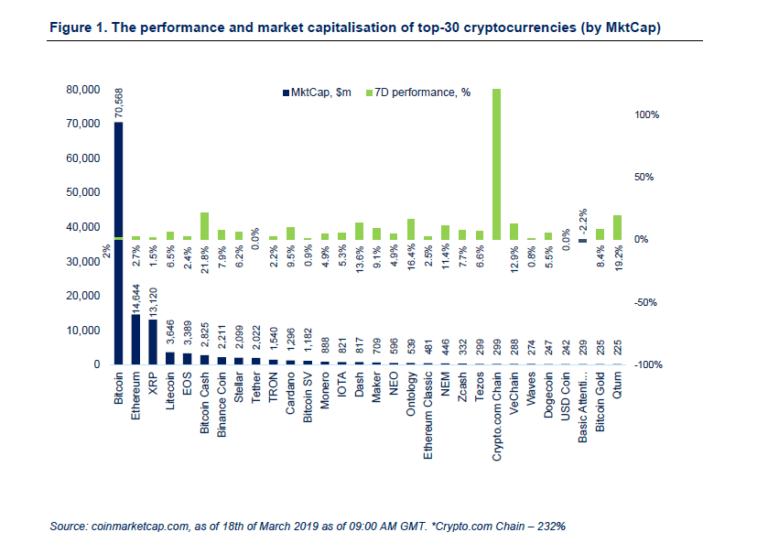

Digital assets continued in recovery mode for the past week, with all major cryptocurrencies ending the week with gains. The total market cap added another 4% ($139bn) last week. Bitcoin’s volume topping $11bn for the first time in a year has resulted in a 4% intra-week push to $4,070, but has failed to move higher to re-test yearly highs and is currently back at $4,000. Ethereum spiked more aggressively than bitcoin last week, adding 8% ($143), but similarly plummeted at the end of the week to back below ($140). The third largest asset XRP, remained more or less around $0.31 level for the whole week, gaining little over 1%. The best performer among the top crypto asset this week is Bitcoin Cash, adding almost 22%.

Crypto Market News

HSBC Seeks Banking Partners in South Korea to Launch Blockchain Platform

Banking giant HSBC is looking for partners to expand their blockchain platform in South Korea. HSBC’s Voltron platform aims to process and settle trading invoices on blockchain and is powered by R3 technology.

Cosmos is Live

After raising $16m in an ICO in 2016, the highly anticipated Cosmos project, which aims to solve the interoperability dilemma, is live after 2 years of research and development.

IBM Quietly Enters Crypto Custody Market

In partnership with New York-based investment firm Shuttle Holdings, IBM are set to launch custodial services for banks and enterprises this month. The technology is built on IBM’s private cloud and offers potential clients tools for custom programming.

Coinbase Completes OTC Trade Directly from Offline Storage

Coinbase Custody has completed its first OTC trade directly out of cold, or offline, storage. This significantly reduces the time required (which can be between 24-48 hours just for the withdrawal of assets), marking the availability of ‘immediate’ liquidity.

Bitfury Partners with HadePay to Bring Bitcoin Lightning Payments to Merchants

Bitcoin mining firm Bitfury has partnered with payment processor HadePay to bring lightning network bitcoin payments to merchants in the US, Canada and EU. Using the lightning network, merchants can significantly “improve the efficiency and lower the cost of bitcoin transaction” Bitfury states.

CBOE Futures Exchange Is Putting Bitcoin Futures on Hold

CBOE Futures Exchange (CFE) is not adding new bitcoin futures contracts for March, and will be assessing its approach with respect to how it plans to continue to offer digital asset derivatives for trading. Currently listed bitcoin futures, however, remain available for trading, with the last contracts expiring in June.

Last Week in Funding

Private blockchain studio StrongBlock has closed $4m Seed round; Crypto miner Canaan has closed a significant round, raising several hundred millions for new operations; Polychain Capital and Digital Currency Group has invested an undisclosed amount into crypto futures exchange CoinFlex; Amun AG raised $4m to launch crypto index products; Kakao Corp raised $90m for its blockchain platform

Security Token News

Deutsche Börse, Swisscom and Sygnum Partner to Create Compliant Digital Asset Ecosystem

German financial markets provider Deutsche Börse, state-owned Swiss telecommunication operator Swisscom and Singapore’s fintech company Sygnum have entered into a strategic partnership to create compliant infrastructure for digital assets. Sygnum has obtained a banking and broker-dealer license from Swiss financial regulator FINMA in order to provide custody, deposits, lending, issuance, brokerage and asset management. Swisscom will manage the blockchain technology infrastructure and Deutsche Börse is working on a secondary market venue for digital assets in the Swiss markets.

Paxos to Launch Gold-Backed Coin in 2019

The US-based blockchain trust company which is behind US dollar-pegged coin Paxos Standard, has announced its plans to launch a gold-backed token in 2019.

Insurance Company AXA XL Launches Security Token and CrowdFunding Insurance

AXA XL, in partnership with insurance tech start-up Assurely, have launched a new insurance product called CrowdProtector which is covering equity crowdfunding and STOs. CrowdProtector protects issuers against investor complaints and lawsuits.

GBX List 5 Stablecoins

Fully regulated and insured digital asset exchange Gibraltar Blockchain Exchange listed 5 stablecoins: PAX, DAI, USDC, GUSD and TUSD now trade on GBX with a 30 day free fee.

Regulatory News

SEC Visits Cities around US to Meet with Crypto Start-ups

The SEC’s branch FinHub has announced its tour to meet with crypto-focused start-ups across the country to discuss token issuance under the regulatory guidance. The road trip begins in San Francisco on 26th March.

Colorado’s Governor Signs Digital Token Act into Law

The governor of US state Colorado, Jared S. Polis, has signed the Colorado Digital Token Act into the state’s law. The Digital Token Act provides limited exemptions for securities registration, traders and salesperson licensing requirements for those dealing with digital tokens.

Digital Asset Definition as Securities “Not Static” According to Jay Clayton

In response to Coin Center and US representative Ted Budd’s letter asking whether the SEC Chairman Jay Clayton agrees with SEC director William Hinman’s comments on Ethereum not being regulated as a security, Jay Clayton responded:

“I agree with Director Hinman’s explanation of how a digital asset transaction may no longer represent an investment contract [a security] if, for example, purchasers would no longer reasonably expect a person or group to carry out the essential managerial or entrepreneurial efforts.”