Despite the number of daily transactions reaching a one year high (280,000), market leader Bitcoin is down 10% over the last week. However, there has been positive news for the crypto industry this week, particulary bitcoin which saw OTC volumes increase recently and two new bitcoin ETFs hit the headlines.

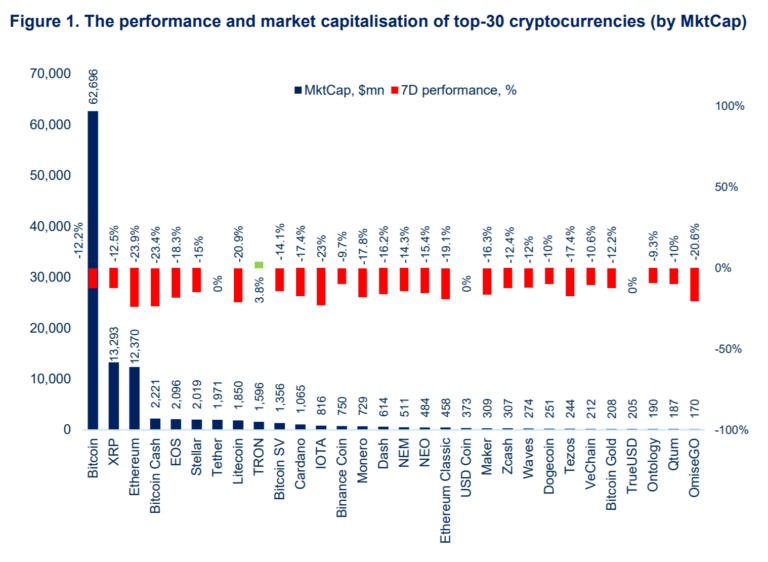

Digital assets recorded a negative week, with the initial sell-off wave on Thursday, wiping out more than 11% of the total market cap and just yesterday a second wave came and erased another 4%, capping the total week-on-week losses at $19 billion. Despite the number of daily transactions reaching a one year high (280,000), market leader Bitcoin is down 12% after it failed to break out from the triangle forming since the end of Nov, currently sitting at $3,540. Ripple (-12.3%) has again surpassed Ethereum (-23.5%) as the second largest asset. XRP sits at $0.32 and ETH is at $116.7. Last week‘s best performing assets among the top 30 coins are ChainLink (10%) and Tron (3.2%). Overall volume reached an intra-week high at $25bn just before the first sell-off wave and is down to $15bn at the time of writing.

Cryptocurrency Regulation

The Colorado Digital Token Act

Colorado senators Stephen Fenberg and Jack Tate have filed a bill titled the ’Colorado Digital Token Act, which, if approved, will “provide limited exemptions from the securities registration and securities broker-dealer and salesperson licensing requirements for persons dealing in digital tokens”.

Kraken Receives More than 450 Subpoenas

The San Franciso-based crypto exchange received 475 subpoenas in 2018 with the majority coming from US agencies. 2018 numbers tripled compared to 160 in 2017. “You can see why many businesses choose to block US users”, Kraken tweeted.

China Starts Regulating Blockchain Startups

The Cyberspace Administration of China, which essentially acts as an internet censorship agency, has approved a set of 23 regulations for domestic blockchain operators starting from 15th February.

Cryptocurrency Markets

Ethereum Classic’s 51% Attack

The 17th largest digital asset Ethereum Classic, experienced a 51% attack last week, which resulted in more than $1m worth of ETC stolen. The attack was spotted on several exchanges, including Coinbase, gate.io and Bitrue.

Ledger Launches Nano X

Hardware wallet manufacturer Ledger has revealed its newest wallet Nano X, a bluetooth-enabled device which allows you to connect your mobile phone directly with the wallet. Ledger will be also launching a mobile app to pair a phone to the wallet.

Japan Considers Approving Bitcoin ETF

Japan’s Financial Services Agency is considering the approval of the first Bitcoin ETF. If approved before the US, this may put the SEC under the pressure.

OTC Buying Pressure Increases

Buying pressure has reportedly increased at many notable OTC crypto trading desks. One of the largest OTC traders, Cumberland, tweeted that the imbalance between buyers and sellers spiked by 60% over the last week. Galaxy Digital saw robust buy back from asset managers, who previously sold assets for tax purposes. The nature of most of Paxos’ trading activity this year was buy tickets from emerging markets traders. Circle’s OTC desk saw a “come back” in January after elevated sell pressure in December. Genesis OTC volume is up by 50% year-on-year. According to a director of the fintech research firm Tabb Group, Monica Summerville, the OTC market is about two to three times larger than trading activity across the whole of the retail exchanges.

70% of Central Banks Show Interest Issuing Digital Currency

The Bank for International Settlements’ survey shows that the majority of central banks are exploring the idea of central bank digital currency in some capacity although they aren’t keen on issuing it for at least another 3 years.

Canaan Eyes a US IPO

After shelving plans for a Hong Kong IPO in November, China-based Bitcoin hardware manufacturer Canaan Inc. is considering listing its shares in New York as soon as the first half of 2019.

Brave Surpasses 5.5 Million MAU

Crypto-powered search engine browser Brave has surpassed 5.5 million monthly active users, thus recording a 5X growth since the launch at the beginning of 2018. Support CryptoGlobe and Brave by trying the Brave browser.

Ethereum Foundation Grants $5 Million to Parity Technologies

The Ethereum Foundation has granted $5 million to Parity Technology, which was co- founded by the Ethereum Foundation’s former CSO, Jutta Steiner. Parity is a blockchain infrastructure startup which has previously been working on several Ethereum software developments.

Bitwise Files for Bitcoin ETF on NYSE

Bitwise Asset Management has filed a Form S-1 registration with the SEC, proposing the Bitwise Bitcoin ETF Trust. If approved, physically settled futures contracts would be listed on NYSE Arca. Bitwise says its ETF will address the regulatory concerns that doomed previous attempts.

Bitmain Appoints New CEO

Chinese cryptocurrency mining giant Bitmain is looking to name a new CEO to replace the company’s founder and former CEO, Jihan Wu, after Wu has come under intense criticism for Bitmain’s involvement in the Bitcoin Cash fork war. The South China Morning Post also stated that the company’s 3Q18 financials are yet to be released, but losses could be above $740 million.

Last Week in Funding

Iceland-based blockchain startup Monerium raised $2m in a seed round led by ConsenSys, to issue an asset-backed and regulated e-money peer-to-peer trading platform built on Augur.

Security Token News

SharesPost Executes a Trade in BCAP Tokens

Registered broker-dealer and ATS SharesPost executed the first secondary market transaction in Blockchain Capital’s BCAP security tokens and has become the first marketplace to allows secondary trading and custody services for digital securities.

tZERO Begins Token Distribution

Security token exchange tZERO has begun the process of distributing its tokens to investors. What remains unclear is when the exchange will start trading other security tokens.

Polymath Partners with Leadbest

Security token platform Polymath has announced its partnership with Taiwanese blockchain asset management firm Leadbest, to expand their security token ecosystem to Asia.