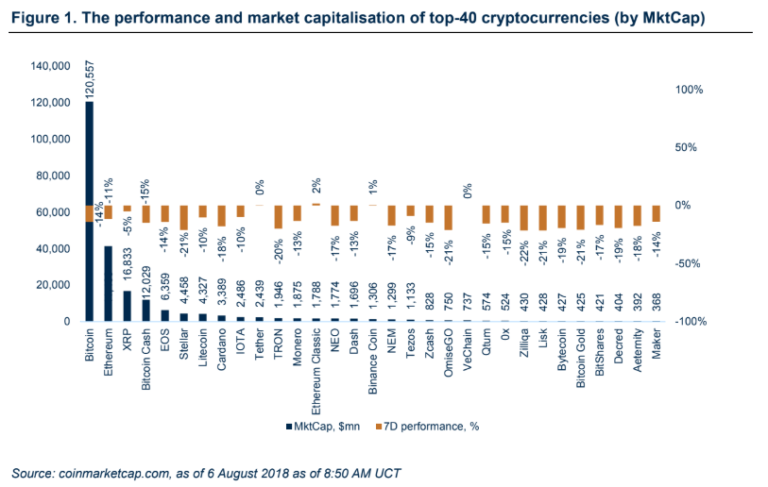

Bitcoin has been in a downward trend since last week correcting from over $8200 to under $7000. Best performers among top-40 crypto were Ethereum Classic (2%), Binance Coin (1%). Worst performing top-40 assets were Zilliqa (-22%), Bitcoin Gold (-21%), Stellar (-21%), Lisk (-21%). Analysts see the dip as a technical move as fundamental news was bullish, particulary the NYSE Bakkt and Coinbase Custody announcements.

Crypto Regulation News

NYSE Owner Partners With Microsoft to Launch Cloud-Based Crypto Platform

Intercontinental Exchange (ICE), New York Stock Exchange’s (NYSE) parent company, revealed on Friday that it’s planning to launch a new company called Bakkt. According to ICE, Bakkt will aim to “leverage Microsoft cloud solutions to create an open and regulated, global ecosystem for digital assets.”

This new crypto initiative will reportedly involve giant companies including Microsoft, Starbucks, and the Boston Consulting Group (BCG). Bakkt’s main objective will be to offer a comprehensive digital asset platform through which retail consumers and financial institutions can access an e-commerce system to “buy, sell, store, and spend” cryptocurrencies

Indian State partners with Mahindra to build “blockchain district”

The Indian Telangana state government is planning to build a district within the state capital dedicated to blockchain startups with Tech Mahindra. The IT department of the Telangana state government signed a memorandum of understanding with Mahindra to build the country’s first blockchain district that will be located inside Hyderabad, the state’s capital. The state government will be responsible for buildings and infrastructure while Tech Mahindra will offer expertise focused on the blockchain ecosystem and technological skills. Tech Mahindra is working on developing a blockchain platform tailor-made for startups in the country’s Eleven01 protocol.

SEC subpoenas Long Blockchain

The SEC subpoenas Long Blockchain, the beverage maker. following a claimed blockchain pivot. The firm received the subpoena on 10th July with the SEC “seeking the production of certain documents”. The firm delisted from the Nasdaq stock exchange after losing an appeal over the decision and a drop in its stock. The company, which was named Long Island Iced tea before the pivot, is being accused via a series of public statements designed to mislead investors and to take advantage of general investor interest in bitcoin and blockchain technology. Similar subpoenas were received by Riot Blockchain last year.

The Philippines is close to issuing a new crypto regulation

The Philippines is close to approving a new regulation governing ICO. The country’s SEC published draft rules governing ICOs and now collects feedstock before those rule come into effect. The regulation assumes that all tokens issued in all ICOs conducted in the Philippines are securities by default unless the issuers can prove otherwise. The regulator announced that most ICOs conducted in the Philippines have argued that their tokens were not securities and should not be governed by the SEC.

However, the regulator believes it would be dangerous to let investors make the judgement over the matter as they do not have sufficient resources to identify which ICOs might be scams. Unde the regulation, companies registered in the Philippines and wishing to make a token sale would have to submit the initial assessment application to the SEC at least 90 days ahead of the issuance. The application must contain the review of the ICO proposal, its credibility and the legal opinion from an independent third party to justify it is not a security.

South Korea plans to end tax benefits for Crypto Exchanges

The South Korean government has announced a new set of laws, which will end major tax benefits for cryptocurrency exchanges. Under the amended proposals, cryptocurrency exchanges will no longer be eligible for income and corporate tax deductions. In the official statement, government authorities wrote, “from next year, virtual currency handling businesses will be excluded from the industries eligible for the tax reduction for SMEs (small and medium-sized enterprises).” Under the current tax exemption rules, income tax and corporation tax are reduced by 50% to 100% for 5 years for business startups, SMEs and venture companies.

The SEC may delay its decision on Bitcoin ETF proposal to Q1 2019

In a twitter thread, legal expert Jake Chervinsky clears up some of the initial confusion around the VanEck/SolidX Bitcoin ETF proposal. According to Chervinsky, “the SEC can, and probably will, delay its decision on the VanEck/SolidX commodity-backed Bitcoin ETF until March 4th, 2019.” Chervisnky added further that he “can’t imagine the SEC will approve the first ever bitcoin ETF without taking all the time allowed by law.”

Crypto Market News

JP Morgan Chase’s Jamie Dimon coments on blockchain potential

Mr Dimon shied away from commenting on cryptocurrency, however he said that fiat payment apps are “the biggest potential disruption to our buiness” in his interview to HBR. The blockchain technology is “real” and JP Morgan Chase will use it for “a whole lot of things”.

Bitmain $1.1 billion in profit in Q1 2018

China-based cryptocurrency mining giant Bitmain reportedly earned $1.1 billion in profits in Q1 2018 compared to a net profit of $1.2 billion for all of 2017. The company controls a significant amount of bitcoin and bitcoin cash hash rate, and sells mining hardware. Bitmain expects to make $2 to $3 billion in profit for the 2018 fiscal year. The total value of all bitcoin mined in Q1 2018 was $1.3 billion. The company is also in the final stages of preparing for IPO on the Hong Kong stock exchange (HKEX), the date of the Bitmain’s listing has yet to be announced.

Galaxy Digital to begin trading on Toronto Stock Exchange

Cryptocurrency bank Galaxy Digital LP began trading on Canada’s TSX as of 1st of August. The New York-based firm completed the Reverse Take Over (RTO) of an inactive Canadian shell company earlier in January 2018. According to ex-Fortress fund manager and Founder of Galaxy, Mike Novogratz, the whole process took a “frustrating” 8 months. As covered, the crypto merchant bank reported a loss of $134 million in the first quarter of this year, in its first-ever financial disclosure. The firm, based in Manhattan, reported a net loss of $103.3 million on trading, with $13.5 million being on cryptocurrencies and $86.5 million worth of unrealized losses. Galaxy Digital has had a pretty rough start of trading, when stock started trading at $2.75 CAD and closed below $2 CAD at $1.92 CAD later that day.

Coinbase Custody announces plans for 40 digital assets and adding GBP pairs

Coinbase Custody has announced its expansion in terms of custodial services for institutional clients. Among the assets under consideration are Ripple, EOS, Monero, VeChain, Cardano, Bitcoin Gold, and Telegram. According to Sam McIngvale, Coinbase Custody product lead, all of these “assets are only being considered by Custody at this time, and this announcement has no bearing on trading-based products.” In the very same week, Coinbase announced adding British Pound support, enabling their customers to deposit, buy, sell and withdraw fiat via their UK bank accounts. “UK banks have been conservative in terms of working with crypto businesses and we’re proud to be one of the first companies to get access to domestic banking,” the CEO of Coinbase UK, Zheeshan Feroz said.

Binance acquires annonymous mobile wallet for Ethereum tokens

The leading cryptocurrency exchange Binance has acquired the anonymous and open-source mobile application Trust Wallet which is capable of storing more than 20,000 digital assets. Changpeng Zhao, CEO of Binance, commented on the acquisition of Trust Wallet, as follows: “Wallets are the most fundamental interface to the crypto economy, and a secure and easy-to-use wallet is key to proliferate the adoption of cryptocurrencies.” He further added that Binance “want to keep Trust Wallet as an independent brand and product.”