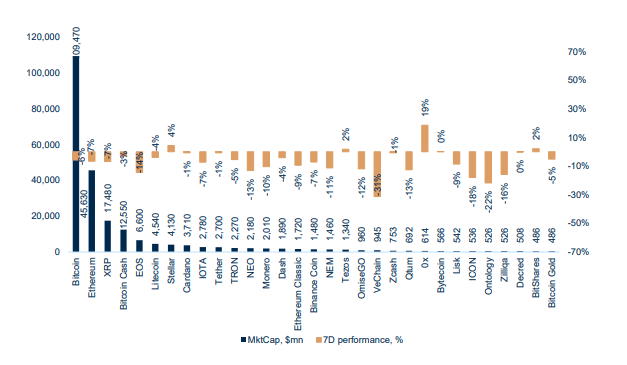

The correction a week ago turned into a recovery for many crypto assets. However, the 7-day performance is still negative for Bitcoin (-6%), Ether (-7%), XRP (-7%), Bitcoin Cash (-3%). The best performers among the top-40 crypto assets were 0x (+19%) on the arrival of the news about Coinbase including it for trading, Stellar (+4%), and Tezos (+2%). VeChain lost 31%, Ontology lost 22%, NEO 13%, EOS 14%.

Cryptocurrency Regulatory News

S. Korean regulators to introduce new rules for crypto space

South Korean lawmakers have announced drafts of bills setting the rules on cryptocurrencies, initial coin offerings and blockchain technology. The drafts will be submitted at an extraordinary session of the National Assembly, which will take place between 13th and 26th July. Drafts may not become law, however they may play a catalyst role in the debate within the Assembly. The opinions of the lawmakers range widely, according to The Korea Times.

Chilean court orders banks to resume business with Orionx crypto exchange

The Chilean Court of Appeals has resolved the case in favour of crypto exchange Orionx, ordering the state-owned bank Banco Estado to reopen the Orionx deposit account. The Banco Estado closed the company’s deposit account in late March 2018, on the grounds of lack of regulatory recognition of crypto trading. In April 2018, the Chile’s anti-monopoly court ruled that Banco del Estado de Chile and Itau Corpbanca have to reopen the accounts of crypto exchange Buda. The President of The Central Bank of Chile Mario Marcel, announced that the CB is considering the development of a regulatory framework for cryptocurrencies to manage the crypto trading risks.

Bank of Thailand considers blockchain for cross-border payments

The Governor of the Bank of Thailand (BoT) Dr. Veerathai Santiprabhob, said that the bank is considering blockchain technology for various applications, including cross-border payments, supply chain financing, and document authentication. The BoT Governor said that blockchain technology plays an important role in reducing fraud and protecting financial information. The new ICO regulation is coming into force on 16th July.

Bermuda Government to introduce new regulations on ICOs

The Premier and Minister of Finance of Bermuda, David Burt, introduced new regulations for initial coin offerings (ICOs), which describe the minimum required information for ICO projects and established compliance measures for companies to conduct an ICO. Any company planning to ICO in Bermuda will be required to disclose information about all persons involved with the ICO, provide information about the technical standards of the digital asset that will be issued, provide information about whether the digital asset can be traded or transferred between persons, provide a description of the technical standards or software, blockchain or other DLT that will be used to identify participants in ICO, and also give details about the product envisaged, the target market and the amount of money they are intending to raise.

Cryptocurrency Market News

Augur launches on the Ethereum network

Augur, a decentralised oracle and prediction market protocol built on the Ethereum blockchain, announced that it is live on the Ethereum main network, as of 9th July. Augur has completed the REP migration. Augur is one of the earliest applications built on Ethereum. It is an open-source software which allows users to create and make bets on almost any event. Augur raised $5.5m during ICO in 2015. Its current market cap is $322m. Augur will set bets in Ethereum, while its REP tokens will be used as incentives for users to accurately report on bets, or dispute outcomes that have been incorrectly reported.

Swiss exchange SIX Group said it is open to offering crypto trading on its platform

Swiss Infrastructure and Exchange (SIX) Group, the parent company for the main Swiss stock exchange, revealed that it is open to offer cryptocurrency trading on its digital trading platform. The platform is under development, and will be launched by mid-2019. The service will include initial coin offering (ICO) consulting for those ICOs that are not classified as securities. The group has not yet made a decision about which specific assets will be offered to list and trade. It will technically be able to add various digital assets to the platform. Switzerland is one of the largest jurisdictions for ICOs, in terms of funds raised.

Tezos Foundation to open grantmaking process

The Tezos Foundation announced that it will be holding its official call for proposals through an open and streamlined grantmaking process which is to begin in August 2018. There are three areas for grantmaking, including research that furthers the Tezos protocol and related technologies; development of tools and applications to support the tezos ecosystem, and efforts to strengthen and nurture the burgeoning Tezos community. Tezos aims to provide grants to researchers, developers and community members who offer projects in those three areas. Tezos also said it committed a significant amount of funds over the last five months to premier research institutions and developers to help advance the protocol: Ocaml Software Foundation (education and traning of the Ocaml programming language), Obsidian Systems (software solutions for baking development), OCaml Labs (improvement of the Lwt programming library), IMDEA Software Institute (multi-year research, training and dissemination program to adddress Tezos and related technologies), Inria (continue crytography, distributed systems, Ocaml and other research efforts), Taderis (research efforts helping to establish nodes on the network), Cryptonomic (graphic wallet development), HackerOne (deployment and management a bug bounty program), and TezBox (audit to improve the safety and security of its wallet).

Coinbase examining to add five new cryto assets to trading

The cryptocurrency exchange Coinbase has announced it is examining the addition of five new crypto assets to its trading. The list of potential new assets includes Cardano (ADA), Basic Attention Token (BAT), Stellar Lumens (XLM), Zcash (ZEC), and 0x (ZRX). Coinbase will negotiate with local banks and regulators to add the assets to as many jurisdictions as possibe. Coinbase announced in June that it will add Ethereum Classic (ETC) to their platform, which resulted in a price increase of over 25% for ETC. According to the blog, new assets will require additional exploratory work and Coinbase cannot guarantee that they will be listed for trading. The listing process may result in some of those assets being listed solely for buy/sell operations by customers without the ability to send/receive those assets using the local wallet.

S.Cohen backing a crypto hedge fund

According to Bloomberg, the head of Point72 Asset Management Steven Cohen, has invested in a hedge fund focusing on cryptocurrencies and blockchain based companies. The investment was into the hedge fund Autonomous Partners, which was started last year by Arianna Simpson. The fund secured investments from Union Square Ventures, Coinbase CEO Brian Armstrong and Craft Ventures Cofounder David Sacks.

Litecoin Foundation and TokenPay acquires 9.9% stake in WEG Bank

Litecoin Foundation and crypto-to-fiat payments platform TokenPay has acquired a 9.9% stake in German WEG Bank, which according to CEO, Matthias von Hauff, was initially not planned, as WEG is mostly perceived as a “very conservative” institution However, Von Hauff further explained that WEG has “thoroughly and diligently examined the prospectus of a common future, and we became convinced that the future of banking will make adoption of such modern payment methods inevitable.” TokenPay purchased the undisclosed stake earlier in May and if approved by German regulators, TokenPay eventually plans to purchase the remaining shares of the bank. Meanwile, the price of Litecoin spiked almost 5% above $80, prior to the news.

CBOE files with SEC for Bitcoin ETF

The SEC has received the application from CBOE to launch the first Bitcoin exchange traded fund (ETF) in partnership with asset manager Van Eyck Investment and blockchain firm SolidX. SolidX already applied for ETF earlier in March, but the SEC rejected the proposition. Seems like this time, the Bitcoin ETF will have a better chance of success due to the SEC’s recent comments about Bitcoin and Ethereum not being considered to be securities. An ETF is essentially a fund which trades like a stock, however shareholders do not directly own the asset, they only benefit from the profits. Each Bitcoin ETF share will be worth 25 Bitcoins and only institutional investors will be able to participate. SEC is currently open for public comments regarding the Bitcoin ETF until the 10th of August, which most likely will be the determination date.

New Study shows over half of ICOs fail within 4 months prior to token sale

The University of Boston revealed a study which shows that around 56% of ICOs fail within a period of 4 months prior to the fund raising. The study has analyzed the intensity of tweets from the 2,390 ICO projects’ twitter accounts before May. The researchers, Leo Kostovetsky and Hugo Benedetti, commented, “What we find is that once you go beyond three months, at most six, they don’t outperform other cryptocurrencies, the strongest return is actually in the first month”. Additionally, the research showed a decline of people who sold the tokens on the first day by 4% per month, which is explainable as startups have become savvier when it comes to the pricing of coin offerings.

Decentralized exchange lost $23 million in recent attack

Hackers managed to steal $23.5 million worth of cryptocurrency from decentralized exchange Bancor, $12.5 million worth of Ether, $1 million of PundiX and $10 million of Bancor Network Token. The exchange was able to limit the damage by freezing the $10 million BNT which raised the debate, whether Bancor is really a decentralized service as they claim. The attackers supposedly compromised the wallet used for smart contracts upgrades to steal the crypto. Founder of Litecoin, Charlie Lee, expressed his opinion on twitter, saying “An exchange is not decentralized if it can lose customer funds or if it can freeze customer funds. Bancor can do both. It’s a false sense of decentralization.”

Statis to launch Stablecoin pegged to Euro

Malta-based cryptocurrency firm Statis has announced their new project EURS, a 1:1 Euro-pegged digital cryptocurrency with “blessings” from the Prime Minister of Malta, Joseph Muscat. CEO of Statis, Gregory Klumov, told CCN that they “recieved a lot of interest from institutional investors who want transparency and security first and foremost”, Klumov further added that these investors also want to reduce the volatility of their portfolios. EURS is available at the London-based trade store DSX.