The cryptocurrency market is enduring a significant sell-off that saw the price of the flagship cryptocurrency bitcoin (BTC) plunge more than 4% from nearly $103,000 to now stand at around $97,900.

The sell-off has affected most top digital currencies, with Ethereum’s ether losing around 7% of its value in the last 24-hour period, while XRP is down by more than 5% and Solana by more than 6%. Among the top cryptocurrencies, some of the worst affected include Avalanche (AVAX) and Chainlink (LINK), which fell more than 9% each.

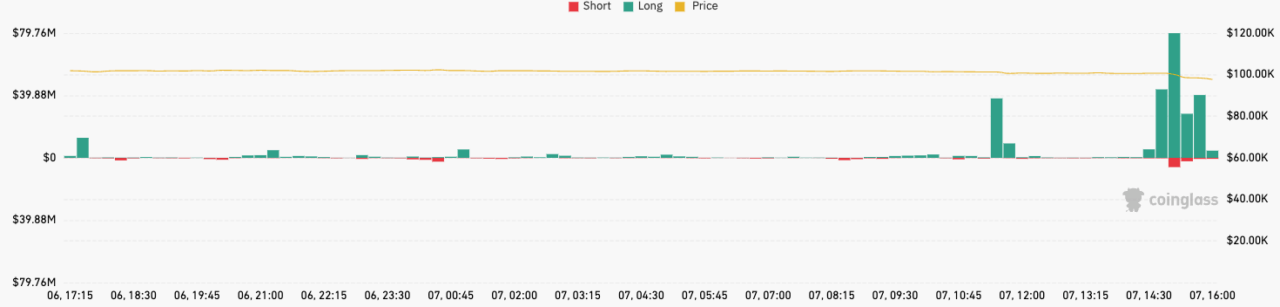

The sudden market downturn has seen liquidations in the cryptocurrency space surge to over $150 million in the last hour, a significant level that helped bring 24-hour liquidations to around $388 million, according to CoinGlass data.

The cryptocurrency market is currently experiencing a decline due to several factors which include a drawdown in traditional markets, with the S&P 500 losing around 0.3% of its value in today’s session, while the NASDAQ is down by more than 1%.

Treasury yields have meanwhile risen significantly, with the interest rate on the U.S. 10-year Treasury surging by around 5 basis points t now stand at 4.683%. The drawdown came as job openings in the U.S. rose more than expected in November in a potential sign the labor market is tightening.

Additionally, profit-taking by long-term holders, who may be selling off portions of their holdings after significant gains, could be contributing to downward pressure on prices.

Featured image via Pexels.