A key indicator of interest in the cryptocurrency space within the United States has slumped to a 12-month low, raising concerns about the flagship cryptocurrency’s near-term price prospects.

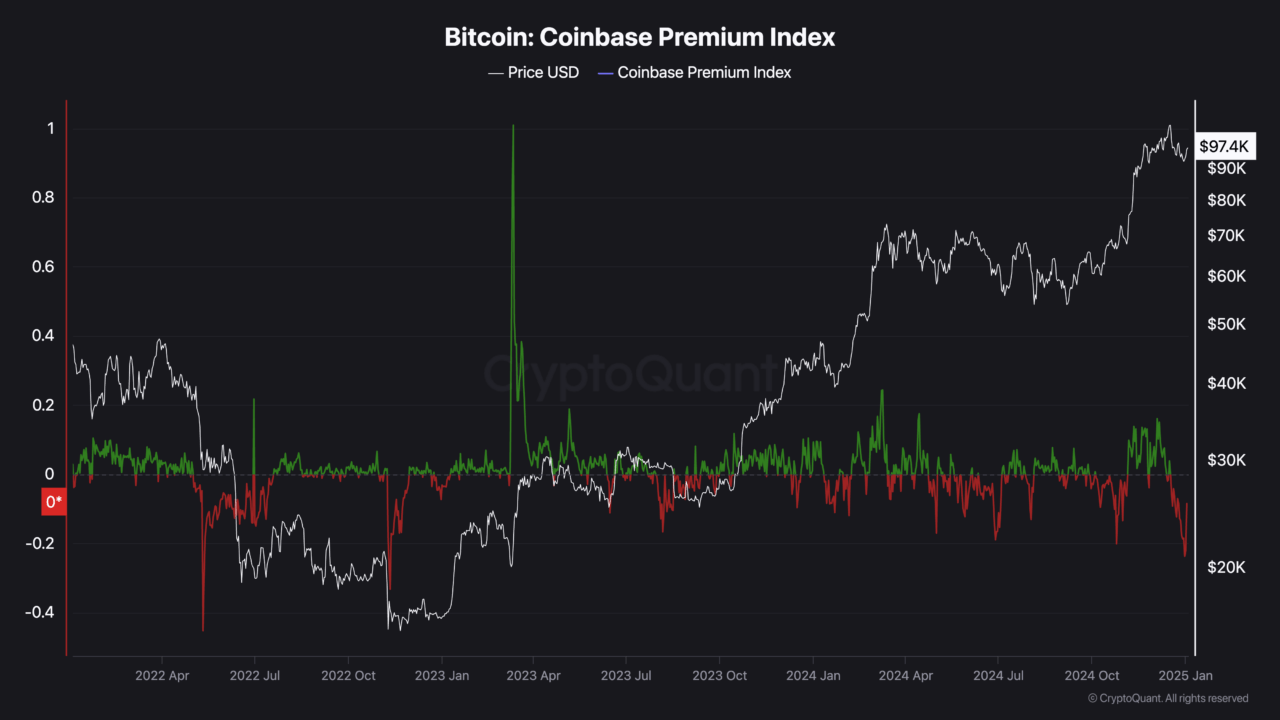

According to a post from CryptoQuant analyst Burak Kesmeci, the Coinbase Premium Index, which measures the bitcoin price difference between Coinbase and other major cryptocurrency exchanges, particularly Binance, has plunged to a 12-month low.

The index is used to gauge market sentiment and demand among U.S. investors, with a positive figure suggesting strong demand from investors in the country, and a negative index implying bitcoin is cheaper on Coinbase compared to Binance over potential selling pressure or lower demand.

Per the post, just before the U.S. elections, the index was at a -0.2 low over heightened uncertainty, but the metric has since dropped further to -0.237, a 12-month low. The drop, Kesmeci wrote, “not only signals a lack of institutional demand but also underscores the cautious sentiment among U.S. investors.”

While investors in the U.S. appear to be taking a cautious approach, leading stablecoin issuer Tether has added an additional 7,629 bitcoin to its balance sheet after a nine-month hiatus from accumulating the flagship cryptocurrency. The firm’s latest move brings its total holdings to 82,983 BTC worth around $7.68 billion.

According to data from Arkham Intelligence, a wallet tagged as belonging to the leading stablecoin issuer has been steadily increasing its BTC holdings, to the point that they’re now its largest holding, above $6 billion worth of the leading stablecoin.

The wallet also holds around $210.5 million worth of Tether’s gold-backed cryptocurrency XAUT, as well as $25.6 million of its discontinued euro-backed stablecoin EURT.

Featured image via Unsplash.