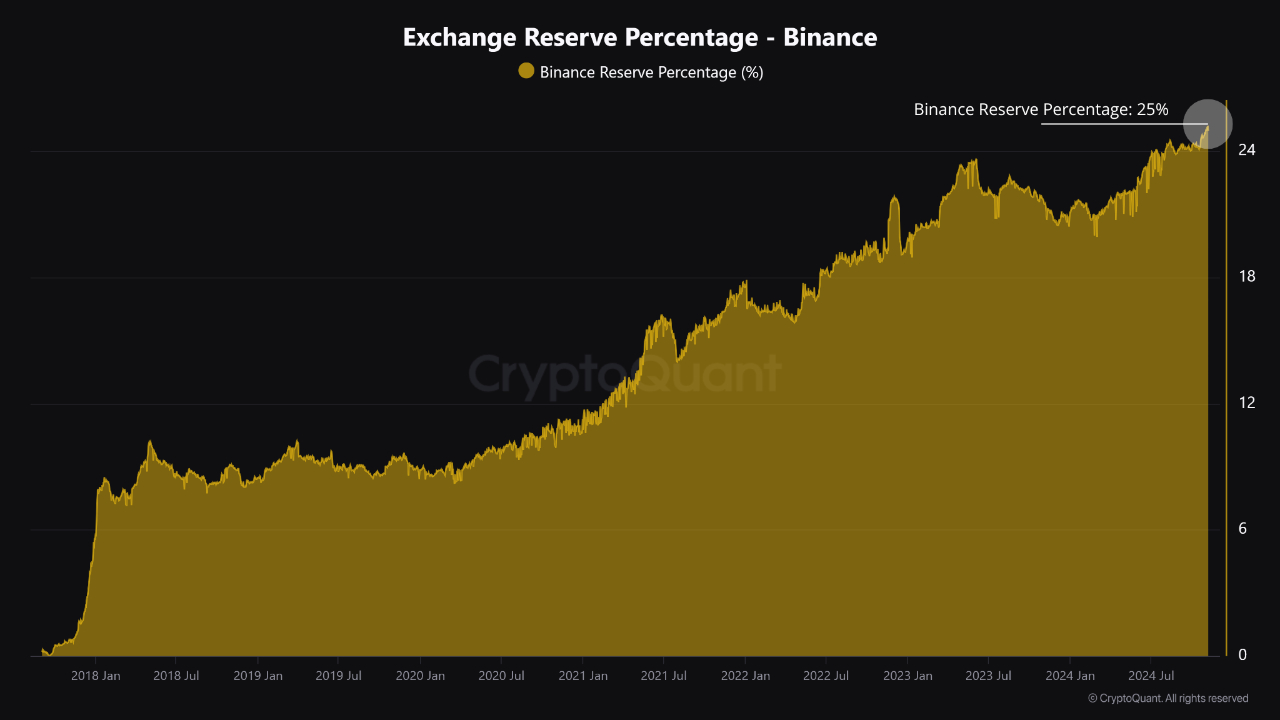

Leading cryptocurrency exchange Binance has seen its researves reach a new all-time high of 25%. The metric, which measures the proportion of total cryptocurrency reserves held on the exchange, underscores Binance’s dominance within the sector.

According to analysis published by CryptoQuant, the percentage of the reserves on Binance was at around 21% back in November 2023, and has surged around 4% over the past year.

The only exchanges with a higher Exchange Reserve Percentage, according to the firm, is the Nasdaq-listed cryptocurrency trading platform Conbase, which has around 33% of total reserves.

As CryptoGlobe reported, both of these trading platforms saw a whopping $9.3 billion worth of stablecoin inflows on the Ethereum network after Republican candidate Donald Trump won the U.S. presidential election.

Out of the $9.3 billion worth of ERC-20 stablecoins deposited not these exchanges, $4.3 billion flowed to Binance, while $3.4 billion moved to the Nasdaq-listed exchange Coinbase. Per CryptoQuant’s analysis, large-scale stablecoin inflows and subsequent upward trends have historically “coincided with bullish market rallies.”

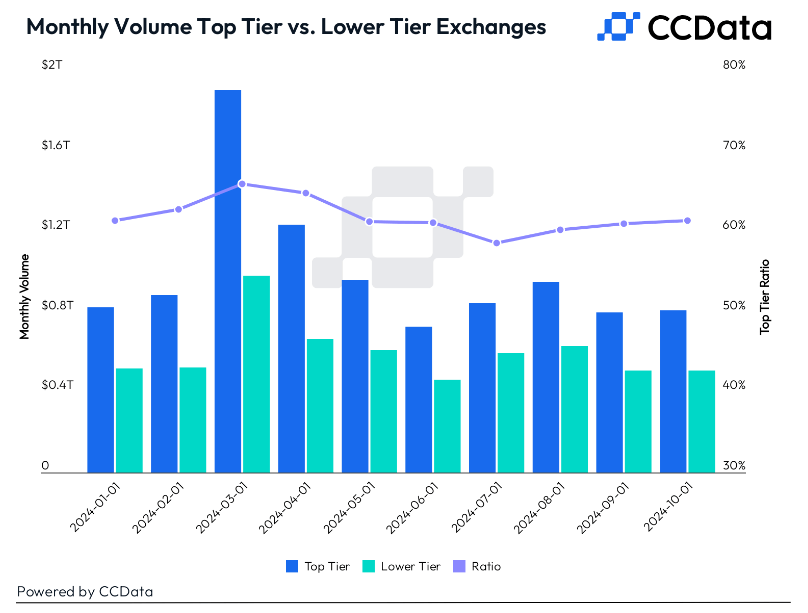

Notably, CCData’s latest Exchange Benchmark report has revealed that Top-Tier cryptocurrency exchanges make up only about 20% of the 81 spot exchanges in the market, but capture over 60% of the total trading volume.

Since April, these exchanges have handled an average of $850 billion per month out of a $1.4 trillion total. Binance leads with $472 billion in average monthly volume, followed by Bybit with $127 billion. Coinbase, the highest-ranked U.S. exchange, ranks fifth with $66 billion in average monthly volume.

Trading volumes in the cryptocurrency space have been growing as stablecoin inflows grow, with prices surging so far that Bitcoin recently hit a new $90,000 all-time high.

These moves come after Republican candidate Donald Trump win the US presidential elections. A Trump victory was widely expected to help boost Bitcoin’s price, as the former U.S. President has expressed strong support for the cryptocurrency sector, meaning the regulatory outlook could improve through the reduction of regulatory ambiguity and the appointment of more crypto-friendly officials to key positions, for example.

Bitcoin’s price, however, has been known to rally after U.S. presidential elections, having seen 90-day returns of 87%, 44%, and 145% after the elections in 2012, 2016, and 2020, respectively.

Featured image via Unsplash.