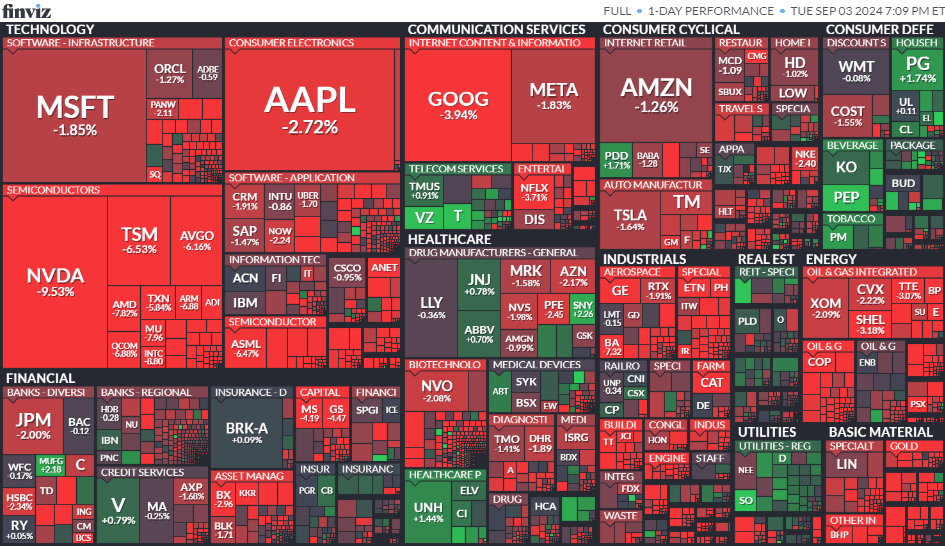

Equities have lost over $1 trillion in market capitalization over the past trading session as large-cap tech stocks endured a massive sell-off that saw the price of Nvidia (NVDA), a company that’s been rallying off of AI growth bets, losing over $360 billion in market capitalization including its after-hours move.

According to the economics outlet Kobeissi Letter on the microblogging platform X (formerly known as Twitter), this marks the “largest single day loss of market cap for a stock in history.”

The price of NVDA plunged more than 9.5% over the past trading session to now trade at around $108, after moving up around 120% in the last year and more than 2,500% over the last five years as investors started betting on the growth of AI.

Notably, the AI chipmaker beat Wall Street’s consensus for its earnings, which were reported last week. The price of the company’s shares nevertheless started plunging after these revealed its growth is slowing, a drop that has been affecting the wider tech sector.

On top of Nvidia’s slowing growth, two manufacturing activity indicators have shown continued sluggish activity in the sector that has been affected by high interest rates. Later this week, the US August jobs report will be released and could lead to further volatility, as last month a hotter-than-expected unemployment reading led to a stock market drawdown.

Notably, according to Investopedia, September is the only calendar month that, over the last 98 years, has recorded negative returns in the stock market, leading to what’s known as the September Effect, which refers to the market’s underperformance during the month.

In the cryptocurrency space September is also known as a not-so-positive month, with CoinGlass data showing that since 2013, the flagship cryptocurrency dropped in eight times in September, and only rose three times.

Featured image via Unsplash.