Norway’s massive sovereign wealth fund, which has nearly $1.7 trillion in assets under management generated an 8.6% return, or $138 billion, in the first half of the year, fueled by a surge in stock prices.

Norges Bank Investment Management (NBIM), which oversees the fund’s investments, reported that equity holdings gained 12% during the six-month period ending in June, according to Bloomberg. Despite this rise, the fund’s overall performance fell slightly short of its benchmark by 0.04 percentage points, due in part to a drag from real estate investments.

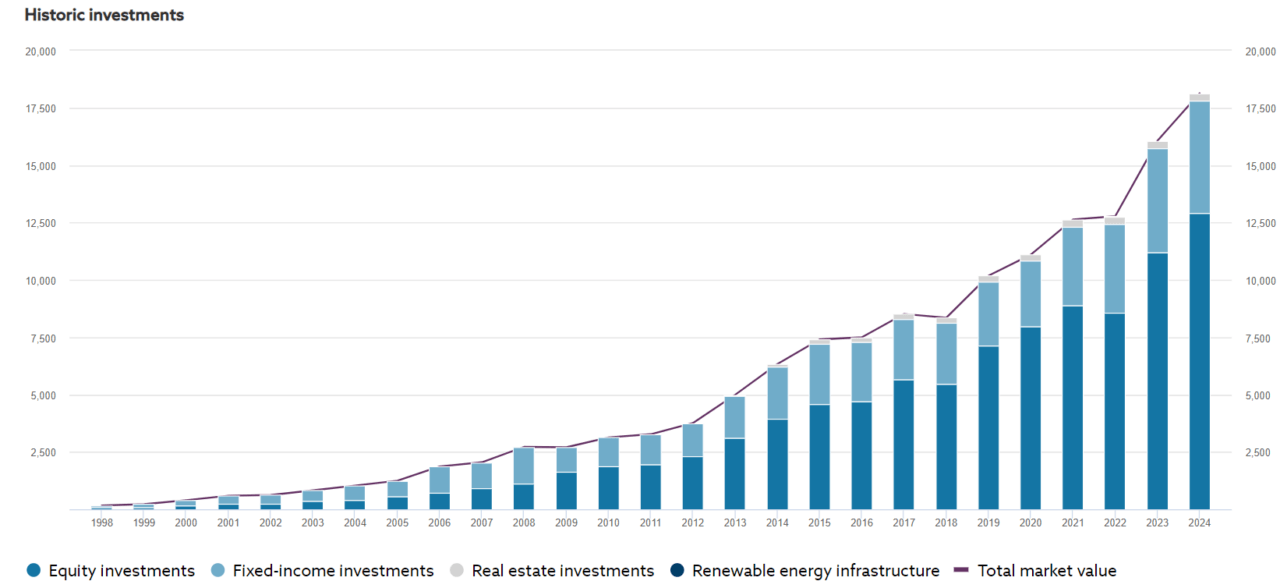

Established in the 1990s to manage Norway’s oil and gas revenues abroad, the fund is the world’s largest single owner of equities. Its investment strategy is guided by strict guidelines set by the Norwegian Ministry of Finance and its performance is measured against a benchmark index comprised of the FTSE Global All Cap Index for equities and Bloomberg Barclays indexes for fixed income.

The bulk of NBIM’s capital is invested in publicly traded stocks, having shares of 8,763 companies across 66 countries that make up 72% of its fund. Fixed income securities from 49 countries represent 26.1% of the fund’s investments, while nearly 900 properties in 14 countries represent 1.7% of the fund.

The remaining 0.1% of the fund’s investments are in renewable energy infrastructure, across five investments in four different countries, according to its website.

The fund’s Chief Executive Officer Nicolai Tangen was quoted as saying that equity investments “gave a very strong return in the first half of the year,” adding that the technology sector was mainly driven by “increased demand for new solutions in artificial intelligence.”

According to Bloomberg, Tangen reported that fixed-income investments declined by 1% during the period, while the value of unlisted real estate holdings also falling, while the fund’s investments in unlisted renewable energy infrastructure dropped by 18%.

NBIM has disclosed that it reduced its holdings in Meta Platforms, Novo Nordisk, and ASML Holding during the first half of the year. These companies are all among the fund’s top 10 holdings, while its three largest holdings are in Apple, Microsoft, and Nvidia.

Norway’s wealth fund saw a record $213 billion in profit last year over the performance of the tech sector. Notably, earlier this year a BlackRock executive revealed sovereign wealth funds are showing interest in gaining exposure to Bitcoin through its iShares Bitcoin Trust (IBIT) ETF, and could start trading it over the next few months.

Foreign wealth funds like Kuwait’s Invstment Authority (KIA), the oldest sovereign wealth fund in the world, and Norway’s well-known $1.7 trillion wealth fund, could make ripples in the market with even conservative allocations.

Featured image via Pexels.