A key recession indicator has just been triggered after the unemployment rate in the United States rose to 4.3% in July, leading to a massive stock market sell-off that saw the S&P 500 index lose more than $1.2 trillion in hours and Bitcoin plunge to $63,000.

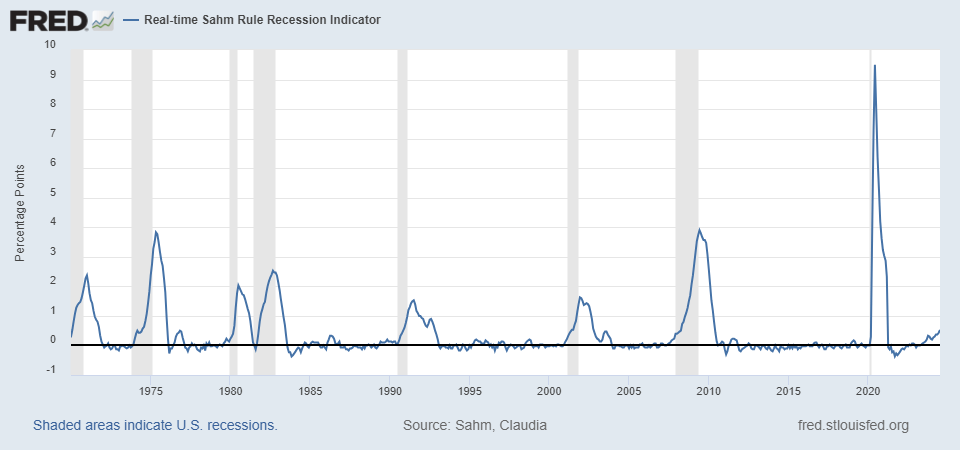

The unemployment rate rise triggered the Sahm Rule, a recession indicator that measures the three-month moving average of the U.S. unemployment rate against its previous 12-month low, and is triggered when the rate rises 0.5% from that low.

The Sahm rule, according to Investopedia, is named after Claudia Sahm, a macroeconomist who worked at the Federal Reserve. According to Yahoo Finance, Sahm herself has said that the unique dynamics of the labor market after the COVID-19 pandemic, however, could render the rule less useful in calling a recession.

Sahm reportedly said that she doesn’t believe the US economy is currently in a recession over resilient consumer spending, but said that problems in the labor market are “worrisome” and that “we should be very concerned” as the could point to a recession in the near future.

The current market rout came as data from the Bureau of Labor Statistics revealed that the U.S. labor market added 114,000 nonfarm payroll jobs last month, against the 175,000 economists expected.

That data was release while the unemployment rate in the country rose to 4.3%, up from 4.1% in June, to its highest level since October 2021.

The drop comes shortly after a group of seven megacap tech stocks – often referred to as the Magnificent 7 – has lost more than $2.6 trillion in value over a 20-day period, making for an average of $125 billion per day over the period. In total, these stocks lost “triple the value of Brazil’s entire stock market.”

The tech titans, which have outperformed the broader S&P 500 since the market trough of 2022, are now facing a reckoning as investors are increasingly wary about the sustainability of their meteoric rise, with Nvidia for example surging more than 2,300% in the last five years.

Their poor performance comes after a prominent macroeconomist, Henrik Zeberg, reiterated his prediction of a looming recession that will be preceded by a final surge in key market sectors, but can potentially be the worst the market has seen since 1929, the worst bear market I Wall Street’s history.

Notably the Hindenburg Omen, a technical indicator designed to identify potential stock market crashes, has started flashing just one month after its previous signal, raising concerns that a stock market downturn could be coming.

The indicator compares the percentage of stock reaching new 52-week highs and lows to a specific threshold. When the number of stocks hitting both extremes surpasses a certain level, the indicator is said to be triggered, suggesting an increased risk of a crash.

Featured image via Unsplash.