Over the past week, cryptocurrency investment products saw total inflows of $1.35 billion, bringing their ttotal inflows over the last three weeks to $3.2 billion, with Bitcoin investment products bringing in the lion’s share of funds, followed by ETH, Solana, and multi-asset vehicles.

According to CoinShares’ Digital Asset Fund Flows report, BTC-focused products saw $1.27 billion in inflows over the past week, bringing their month-to-date flows to over $3 billion, and their year-to-date flows to nearly $18.5 billion.

Ethereum’s Ether, the second-largest cryptocurrency by market capitalization, meanwhile, saw $45.3 million coming in over the past week and $128 million so far this month, bringing the total for the year to little over $100 million.

Beyond Ethereum, Solana stood out among other altcoins as it saw $9.6 million inflows for the week, far outpacing the $2.2 million inflows Litecoin-focused investment products saw, but falling behind the $16.7 million multi-asset investment products brought in.

Other altcoins, including Binance’s BNB, XRP, Cardano’s ADA, and LINK, saw inflows between $400,000 and $700,000. Exchange-traded product trading volumes, according to the firm, rose 45% week-on-week, while still representing a 22% drop when compared to the usual broader crypto market volumes.

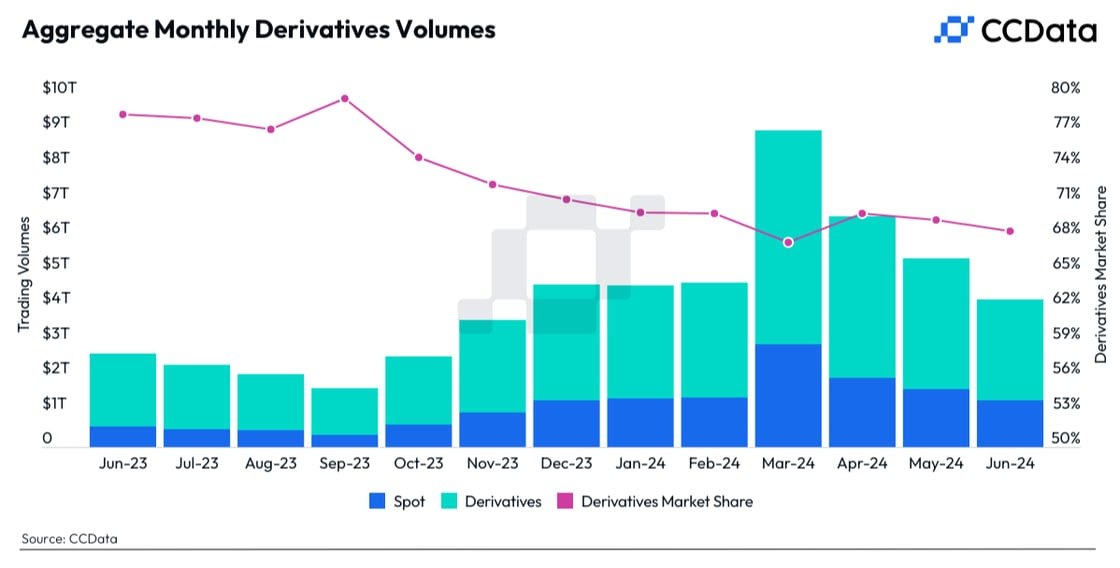

Notably, as CryptoGlobe reported, the June 2024 edition of CCData’s Exchange Review report revealed several significant trends in the digital asset market, including a decline in crypto trading volumes.

The report details that combined spot and derivatives trading volume on centralized exchanges continued to decline for the third consecutive month. June saw a 21.8% drop, bringing the total volume to $4.22 trillion. This decline follows the all-time high of $9.05 trillion recorded in March 2024.

It attributes this decrease to major crypto assets, including Bitcoin and Ethereum, remaining largely rangebound and experiencing significant drawbacks in June.

Featured image via Unsplash.