Goldman Sachs is raising a bullish flag for the stock market in early July, anticipating a surge driven by a ‘wall of money’ from passive investment vehicles over the beginning of the third quarter and second half of the year.

According to Scott Rubner, managing director and tactical specialist in Goldman’s global markets division, share prices could also benefit from strong seasonal trends and a potential increase in retail investor participation, as Bloomberg reported.

In a note, Rubner wrote he is seeing a “re-emergence in retail traders during the summer, they tend to come around in July,” and noting that since 1928 the first 15 days of that month have been the best two-week stretch for equities, with returns tending to taper off after July 17.

The S&P 500 itself boasts a winning streak in July for nine consecutive years, averaging a return of 3.7%. The Nasdaq 100 fares even better, with 16 straight Julys in positive territory and an average return of 4.6%.

Based on his calculations, Rubner estimates an influx of roughly nine basis points of new capital each July. In the context of today’s market, this translates to approximately $26 billion considering the $29 trillion pool of passive assets available for investment.

Retail investors could also benefit the cryptocurrency space, which has been seeing institutional investors add to their exposure via the spot Bitcoin exchange-traded funds (ETFs) launched in the United States back in January.

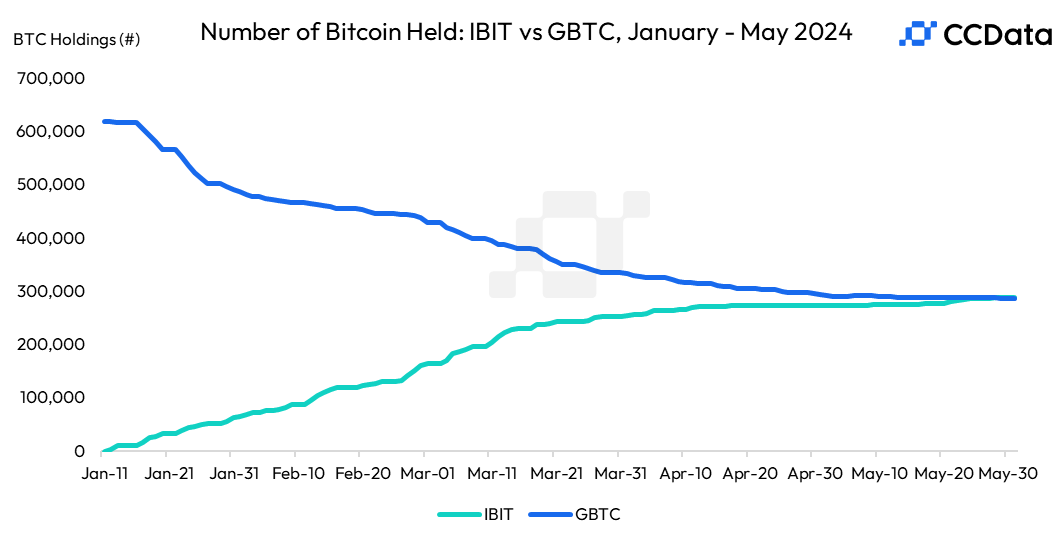

As CryptoGlobe reported, earlier this year BlackRock’s iShares Bitcoin Trust (IBIT) saw its BTC holdings surpass those of the Grayscale Bitcoin Trust (GBTC), making it the world’s largest exchange-traded fund offering investors exposure to the price of Bitcoin.

Analysts attribute this shift to Grayscale’s higher fees, which have driven investors towards BlackRock’s lower-cost alternative after GBTC was converted into a spot Bitcoin ETF at the same time several of these ETFs started trading in the United States.

Notably, BlackRock’s income and bond-focused funds have recently added exposure to its own spot Bitcoin ETF, with regulatory filings showing that BlackRock’s Strategic Income Opportunities Fund and Strategic Global Bond Fund purchased shares of iShares Bitcoin Trust.

Featured image via Unsplash.