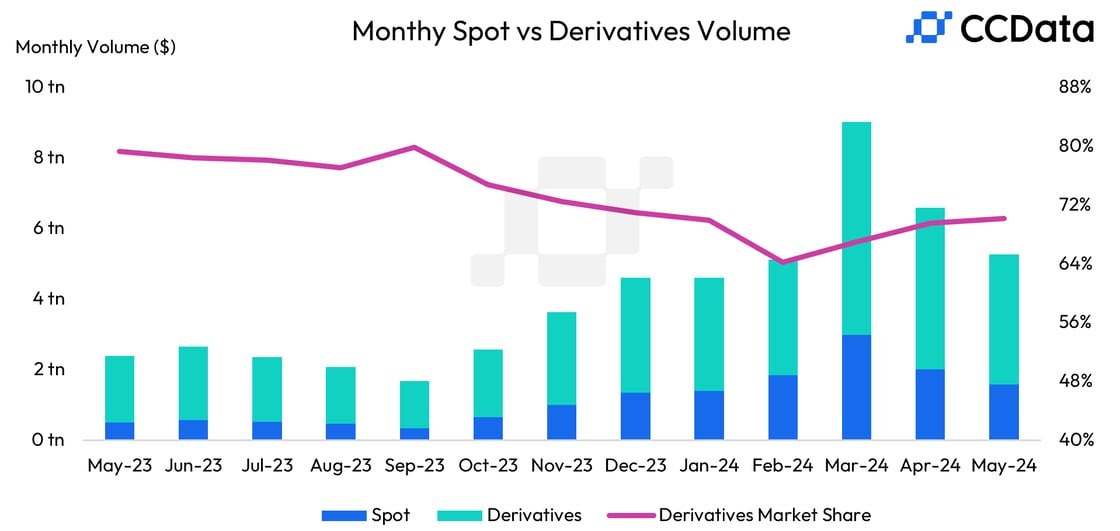

The total cryptocurrency trading volume on centralized exchanges has plunged 20.1% last month to a total of $5.27 trillion while major cryptocurrencies including Bitcoin and Ethereum remained rangebound, with a sudden volatility spike after the Securities and Exchange Commission approved spot Ether exchange-traded funds in the US.

According to CCData’s latest Exchange Review report, spot trading volumes on centralized exchanges last month fell 21.6% to $1.57 trillion to record their second consecutive monthly decline in trading activity.

Derivatives trading volumes were also hit, dropping 19.4% to $3.69 trillion, in a smaller decline that meant the market dominance of derivatives products has grown to its highest level since December 2023.

The derivatives market share growth can be attributed to a surge in interest from traders following the unexpected approval of spot Ethereum ETFs by the SEC, which as CryptoGlobe reported led to an ETH price rise of over 20% in a single day. The report suggests that traders flocked to the derivatives markets to capitalize on this regulatory development.

The report adds that open interest on centralized exchange rose by 30.5% to $55.2 billion in May with the three largest derivatives trading platforms – Binance, OKX, and Bitget – seeing rises of 33.2%, 22.1%, and 39.2% respectively.

On the CME, open interest for Ethereum futures notably rose 59.3% to $1.25 billion with sentiment for the second-largest cryptocurrency by market capitalization growing significantly after the SEC’s surprised approval of spot Ether ETFs.

That same exchange, as a result of the approval, saw Ethereum options trading volumes rise to a new all-time high of $931 million, while ETH futures contracts rose 37.5% to $20.5 billion in a month in which the CME saw overall derivatives volumes drop 7.42% to $115 billion.

Open interest for Ethereum instruments across the cryptocurrency space notably rose 50.3% to $14 billion, according to CCData’s report. Notably, Ethereum whale accumulation has been growing, as according to an analyst from cryptocurrency analytics firm CryptoQuant, over 800,000 ETH worth around $3 billion has moved off of centralized cryptocurrency exchanges in little over a week.

The analyst noted that institutions preparing for a spot Ethereum ETF to start trading in the United States could be behind the centralized exchange outflows in a bid to meet the potential demand from investors for such a fund.

IntoTheBlock, a cryptocurrency intelligence firm, has noted that whale accumulation has recently intensified, with 41% of the supply of the second-largest cryptocurrency now being held by addresses with more than 1% of its total circulating supply, up from 36% at the beginning of the year.

Per the firm, the trend highlights the increasing confidence in ETH among large holders.

Featured image via Unsplash.