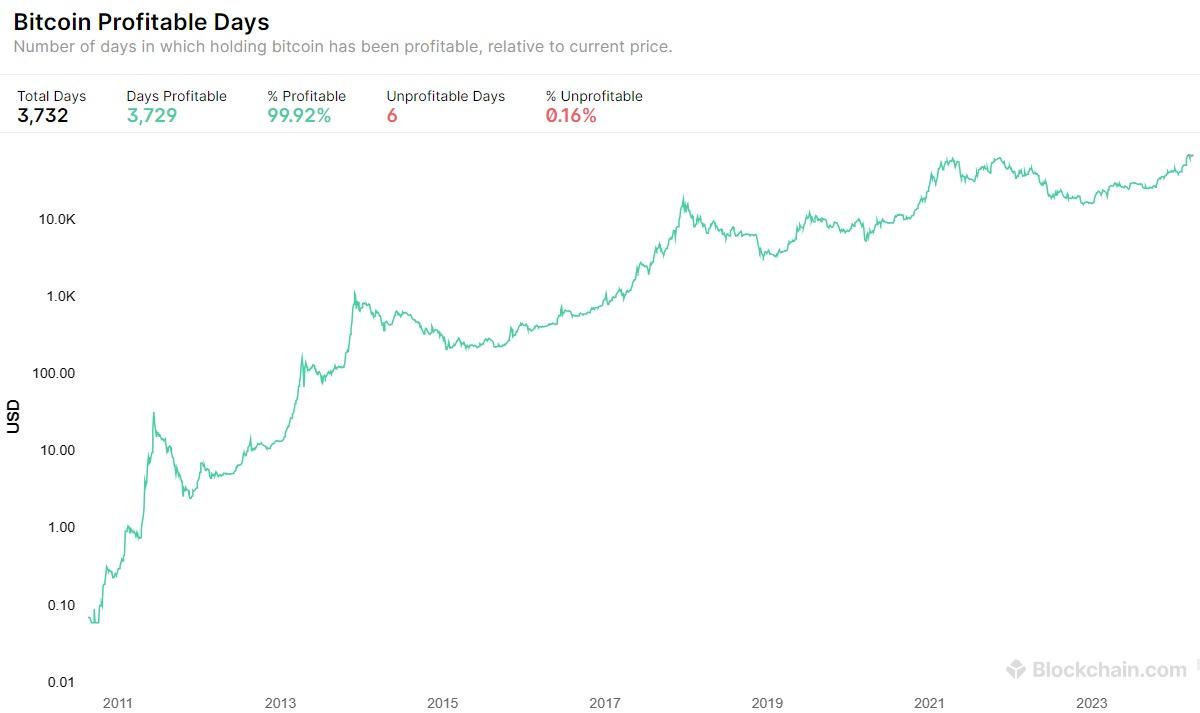

For Bitcoin ($BTC) holders the last few months have been largely profitable as the price of the cryptocurrency moved up over 140% over the last six months, in a rise that has meant only a minuscule 0.16%, or six days out of the past 3,732 trading days, have resulted in losses for investors based on current prices.

That’s according to data from Blockchain.com, which shows holding Bitcoin has been profitable in 99.92% of the last 3,732 days, with the six days that it was unprofitable to hold onto the cryptocurrency falling between March 9-13 and Mach 25-29, as Cointelegraph reported.

This resilience highlights the strategic value of holding Bitcoin through periods of market volatility. While short-term fluctuations can be dramatic, Bitcoin’s historical price trajectory suggests long-term gains are more likely.

The price of Bitcoin reached a new all-time high earlier this year above the $73,400 mark after the launch of spot Bitcoin exchange-traded funds (ETFs) in the United States, with Wall Street giants including BlackRock and Fidelity launching their own spot Bitcoin ETFs.

The cryptocurrency’s upcoming halving event, expected to occur later this month, will see the coinbase reward miners receive for finding blocks on the network get cut in half, which will effectively halve the newly minted supply.

Bitcoin is at the time of writing trading at $66,600 after losing around 5% of its value over the past week amid a significant downturn. As CryptoGlobe reported, Bitcoin’s potential price floor could be around the $56,000 mark, according to a Bitfinex Alpha report.

The price floor Bitfinex found is “just above the Realised Price for the short-term holder cohort,” which is currently at around $58,000, while also being the estimated cost basis for those who invested through spot ETFs.

The report details that a fall to $56,000 would be “the maximum downturn we would expect from a new local high” and would represent a drop of around 23% to 24%, which is “consistent” with the firm’s earlier analysis of corrections to market bottoms.

This pattern held after Bitcoin’s price reached its floor in November 2022 after dropping below $15,500. The current correction aligns with this trend, falling within the average range of 20% to 22% observed this cycle, even considering intraday flash crashes.

The Realised Price level for the short-term holder cohort has acted as a significant support and resistance point throughout the current trading cycle, further supporting Bitfinex’s BTC price floor.

Featured image via Unsplash.