In a recent interview with David Lin, Jack Mallers, the CEO of Strike, shared profound insights into Bitcoin’s potential trajectory and its broader implications for the financial world.

Jack Mallers began the interview with a bold forecast, suggesting that Bitcoin’s price could surge to $1 million. He bases this prediction on the financial instabilities within the bond markets, which heavily involve banks. According to Mallers, the potential bailout required to stabilize these markets could lead to massive liquidity injections, thus inflating asset prices, including Bitcoin. He emphasized the scarcity of Bitcoin and its fixed supply, which, combined with increased demand amidst financial instability, supports its dramatic appreciation.

Mallers described Bitcoin as the “hardest” money ever created, attributing this to its capped supply — a stark contrast to fiat currencies, which are subject to inflation. This intrinsic hardness makes Bitcoin an attractive store of value, superior even to traditional assets like gold, whose quantity can still be increased.

One of the pivotal topics discussed was the Lightning Network and its role in enhancing Bitcoin’s utility as a currency. Mallers explained that the Lightning Network addresses Bitcoin’s scalability issues by enabling faster and cheaper transactions. Strike leverages this technology to facilitate real-time, global Bitcoin transactions, emphasizing the network’s ability to handle up to a million transactions per second. This capability, Mallers argued, is transforming Bitcoin into a more practical medium for daily transactions, not just an investment asset.

A significant portion of the conversation revolved around central banking systems and their influence on economies. Mallers criticized central banks for their ability to debase currency, effectively diminishing people’s wealth. He posited Bitcoin as a revolutionary tool that could return power to individuals by offering a decentralized and stable alternative to fiat currencies.

Mallers expressed skepticism about altcoins, including Ethereum, questioning their viability as true money. He argued that many altcoins are primarily technological plays rather than genuine monetary instruments, often designed to capitalize on trends rather than offer substantive monetary solutions. He was particularly critical of Ethereum’s shift to proof-of-stake, which he viewed as a move away from being a neutral, immutable monetary system.

Looking forward, Mallers shared ambitious plans for Strike, aiming to make it a leading financial service for Bitcoin, which he believes will become the world’s reserve currency. He discussed Strike’s expansion into new markets, particularly in Europe, and underscored the company’s focus on treating Bitcoin as actual money — a tool for financial empowerment rather than just speculative investment.

Interestingly, Mallers shared his personal financial strategy, which involves exclusively owning Bitcoin and spending through credit, thus maintaining exposure only to an appreciating asset. This approach, he noted, is a practical application of his confidence in Bitcoin’s future.

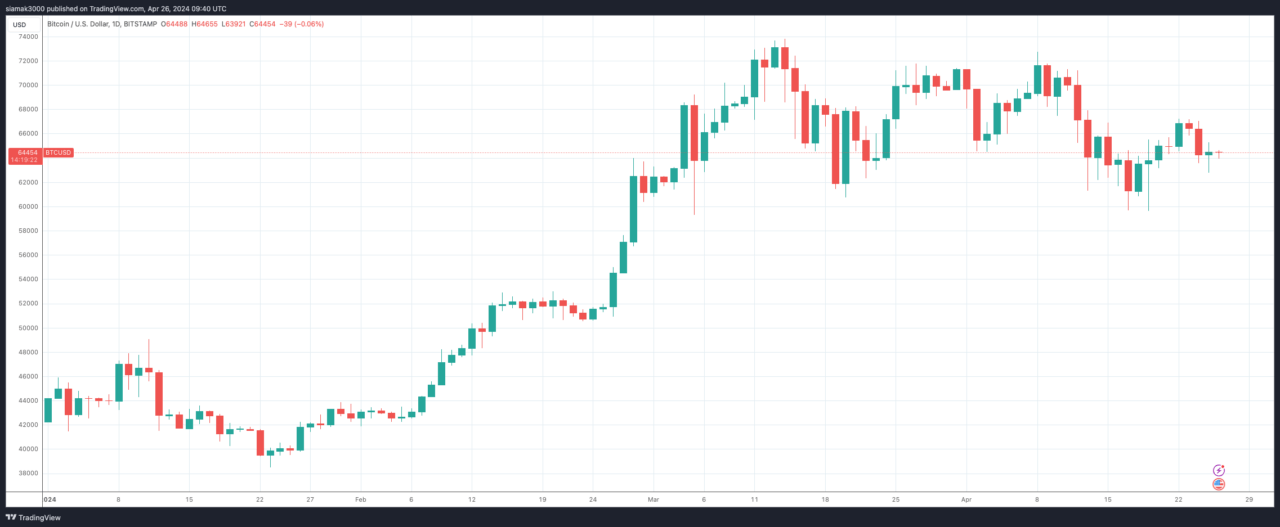

At the time of writing (

Featured Image via Pixabay