Earlieer today, Robinhood’s co-founder and CEO, Vlad Tenev, appeared on CNBC’s ‘Squawk Box’ to unveil the company’s first credit card alongside a redesigned brokerage app, aiming to expand Robinhood’s financial services. Tenev expressed his vision for Robinhood to become a central hub for its customers’ financial transactions and asset custody, highlighting the credit card as a step towards realizing this vision.

Robinhood is a financial services company that revolutionized the investment landscape by offering commission-free trading of stocks, ETFs, options, and cryptocurrencies. Their user-friendly mobile app made investing accessible to a younger generation of traders, disrupting the traditional brokerage model.

The Robinhood CEO says that the new credit card, aimed at adding more value to Robinhood Gold, is positioned uniquely in the market with no fees and a 3% cashback on purchases, surpassing the usual offerings of 1.5% to 2% by other cards. He also mentions that the card, which is designed both for high net-worth individuals and those building credit, presents an opportunity for all its users to benefit from higher cashback rates without any limitations.

Robinhood plans to leverage this card to deepen customer engagement by offering it as a free upgrade to Gold members, encouraging the use of other Robinhood products. Tenev shared insights into how Gold customers tend to adopt more products, increase their balances, and become more profitable for Robinhood, emphasizing the ecosystem benefits of the new credit card.

According to Tenev, Robinhood aims to democratize financial services traditionally reserved for high-net-worth individuals by offering them to the mass market at a low cost through Robinhood Gold. This includes services like high-yield cash accounts and the new premium credit card, making financial luxury services accessible to a broader audience.

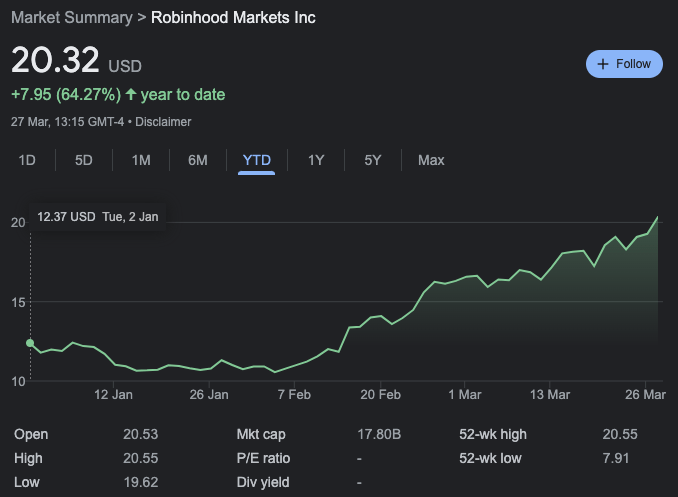

Reflecting on Robinhood’s performance, Tenev highlighted the company’s significant growth, with a 51% increase in stock value and an expansion in its customer base. The conversation also touched upon the excitement around spot Bitcoin ETFs, with Robinhood’s stock (NASDAQ: HOOD) up over 64% in the year-to-date period.

The discussion moved towards the challenges Robinhood faced during the 2021 trading restrictions, raising concerns about the company’s risk management capabilities. Tenev addressed these concerns by acknowledging the lessons learned from the past and outlining the steps Robinhood has taken to strengthen its team and operations. With the acquisition of credit company X1 (which happened in June 2023) and the hiring of experienced credit officers, Robinhood is confident in its ability to manage the new credit card product effectively and safely.

The Robinhood Gold Card, which is constructed from stainless steel and weighs 17 grams, aims to simplify the rewards system by offering a flat 3% cash back across all spending categories.

The absence of annual and foreign transaction fees enhances its appeal, particularly to those who value simplicity and efficiency in their financial transactions. Moreover, the opportunity to earn an elevated 5% cash back on travel bookings made through the Robinhood travel portal signifies an added benefit for users who frequently travel or are looking to maximize rewards on their travel expenditures.

The Gold Card is not just about cash back; it is complemented by a suite of benefits often associated with premium credit card offerings. These include Trip Interruption Protection, Purchase Security, and an Auto Rental Collision Damage Waiver, among others. Additionally, features such as Extended Warranty and Return Protection, coupled with the Zero Liability Protection, underscore the card’s utility in safeguarding users’ purchases and personal information. The inclusion of Visa Signature Concierge Service alongside Travel and Emergency Assistance services further enriches the cardholder experience, providing support that extends beyond financial transactions.

Finally, the Gold Card’s provision for virtual card numbers allows cardholders to engage in online transactions with enhanced security and privacy.

Featured Image via Unsplash