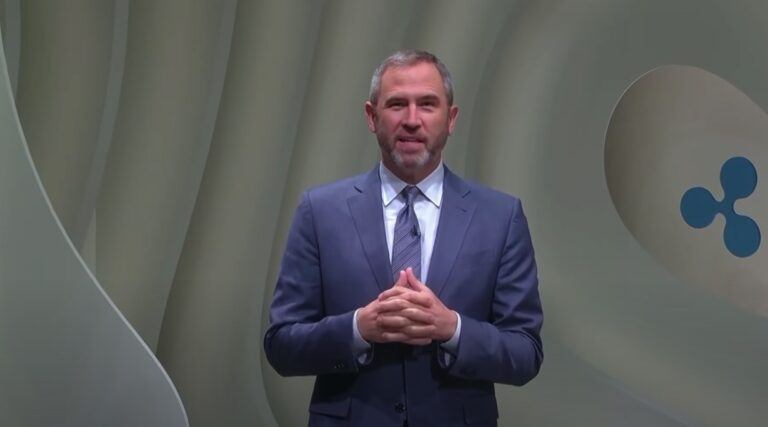

Yesterday, during an interview on Bloomberg TV’s “Bloomberg Crypto,” Ripple CEO Brad Garlinghouse shared his perspectives on the need for clearer cryptocurrency regulations, the future of spot crypto ETFs, and the potential impact of the 2024 elections on the crypto industry.

Here’s a detailed exploration of the key points discussed:

The Quest for Regulatory Clarity

Garlinghouse highlighted Ripple’s longstanding call for clearer regulations in the cryptocurrency space. He criticized the U.S. SEC’s approach of regulation through enforcement, noting that it has led to litigation rather than clear guidelines. Despite facing legal challenges from the SEC, Garlinghouse pointed out that Ripple had seen significant victories, with courts ruling in favor of Ripple and determining that XRP is not a security. He expressed hope for an end to regulatory overhang, either through consistent court victories against the SEC or through legislative action by Congress.

The Future of Spot Crypto ETFs

The Ripple CEO welcomed the approval of spot Bitcoin ETFs, viewing it as a positive development for the crypto industry. He argued that such spot ETFs enhance market safety and robustness, benefiting the investment community. Garlinghouse anticipated the emergence of more spot crypto ETFs, including potentially an XRP ETF, to offer diversified risk to investors. He sees the growth of spot crypto ETFs as inevitable, driven by investor demand for broader exposure to the cryptocurrency market.

The 2024 Elections and Crypto Regulation

Garlinghouse stressed the importance of the United States regaining leadership in crypto regulation. He criticized the country’s lag in establishing clear crypto regulations compared to other major economies. Ripple, along with other industry leaders, has formed a super PAC to support pro-crypto and pro-innovation candidates, highlighting the bipartisan nature of Ripple’s advocacy efforts. Garlinghouse also mentioned John Deon’s candidacy against Elizabeth Warren as a development indicating increasing political interest in pro-crypto regulation.

Addressing Misconceptions about Crypto Regulation

Contrary to Senator Elizabeth Warren’s claims, Garlinghouse argued that the crypto industry is not opposed to regulations like Know Your Customer (KYC) and Anti-Money Laundering (AML) laws. He emphasized that most industry participants are compliant and willing to follow clear regulatory guidelines, countering the narrative that the crypto industry seeks to circumvent these regulations.

Acquisitions and Expanding into Custody Solutions

He also mentioned that Ripple’s recent acquisitions, including Standard Custody, aim to strengthen the company’s position in providing secure custody solutions for institutional and corporate clients. Garlinghouse sees custody as a foundational element for the broader adoption of cryptocurrencies, highlighting partnerships with major financial institutions as evidence of Ripple’s momentum in this area.