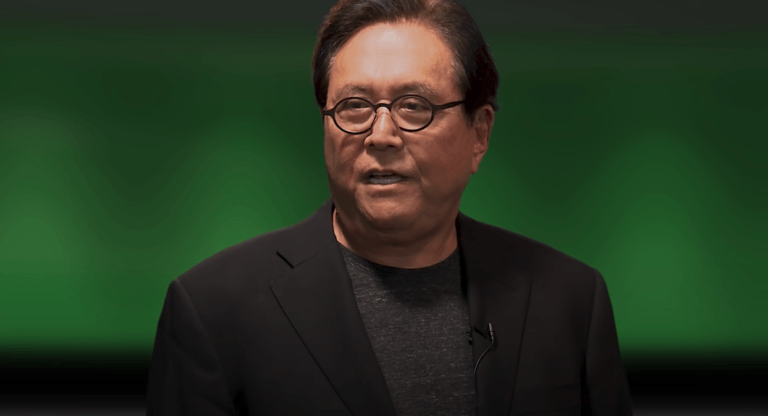

In an insightful interview with Jeremy Szafron of Kitco News, Robert Kiyosaki, the renowned author and financial expert, shared his analysis of the current economic climate. Kiyosaki’s discussion spanned a wide range of topics, from the potential crash of the stock market to the financial challenges facing the baby boomer generation, offering valuable insights into commodities, geopolitical tensions, and his views on gold, silver, and Bitcoin.

Economic Outlook and the Baby Boomer Generation

Kiyosaki paints a grim picture for the baby boomer generation, pointing out the precarious position they find themselves in due to the transition away from traditional pension plans to reliance on the stock market through 401(k)s and IRAs since 1974. He underscores the vulnerability of this generation, which is heavily invested in the stock market, to potential market crashes. Kiyosaki warns of widespread financial distress among baby boomers as their primary source of retirement income—the S&P 500—faces volatility. He relates this impending crisis to the broader economic system that has increasingly favored debt and speculative investments over solid, tangible assets.

Commodities and Investment Strategy

Kiyosaki strongly advocates for commodities, especially silver, highlighting its dual role as both an industrial metal and a monetary asset. He criticizes the prevailing financial system’s reliance on “fake money” and debt, emphasizing the strategic importance of investing in tangible assets like gold, silver, and Bitcoin. His investment philosophy is grounded in skepticism towards paper assets, which he views as vulnerable to inflation, government policies, and market manipulation. Kiyosaki’s stance is that physical commodities offer a hedge against these risks, providing a foundation for a more secure investment portfolio.

Bitcoin and Cryptocurrencies

Kiyosaki reveals that he owns 66 Bitcoins, illustrating his belief in the cryptocurrency’s value despite its volatility. He discusses the impact of US-listed spot Bitcoin ETFs on the market, predicting that the influx of retirement funds into Bitcoin will significantly drive up its price. Kiyosaki’s approach to Bitcoin is emblematic of his investment philosophy: a preference for tangible assets over their paper or digital equivalents, like ETFs. He argues that owning actual Bitcoins offers a level of security and potential for appreciation that paper assets cannot match:

“I’m a broken record: gold, silver, and Bitcoin. No ETFs. Anything someone can print, I don’t want to touch it. I don’t like dollars, I don’t like bonds, I like the hard assets.“

Real Estate and the Housing Market

Predicting a downturn in the real estate market, Kiyosaki connects the dots between rising unemployment and the baby boomers’ financial instability. He anticipates a cascading effect on the housing market as employment declines and baby boomers, heavily reliant on the stock market for retirement, begin to feel the pinch. His critique extends to the conventional wisdom of financial planning, particularly the 60/40 stocks-to-bonds ratio, which he sees as outdated and risky in the current economic climate.

Geopolitical Tensions and Global Economy

Kiyosaki does not shy away from critiquing political decisions and their economic repercussions. He specifically criticizes policies that he believes have led to increased inflation and compromised energy independence, pointing to decisions like the cancellation of the Keystone Pipeline. Kiyosaki views these actions as contributing to economic instability and a weakening of the US’s financial position on the global stage.

Investment Philosophy

Throughout the interview, Kiyosaki emphasizes his investment philosophy, which favors hard assets over paper assets and expresses skepticism towards the traditional financial system. He views the current economic challenges as opportunities for investors to acquire wealth by strategically positioning themselves in tangible assets that offer protection against inflation and economic turmoil.