U.S. presidential candidate Robert F. Kennedy Jr. has declared his opposition to the development of central bank digital currencies (CBDCs) in the United States, aligning his views with those of fellow candidate Donald Trump. Kennedy, notable for being the first presidential candidate to accept Bitcoin for campaign donations, has voiced concerns over the privacy and civil rights implications associated with CBDCs.

RFK Jr. is an American environmental attorney, author, and activist. Born on January 17, 1954, he is the son of former U.S. Attorney General Robert F. Kennedy and the nephew of former U.S. President John F. Kennedy. Kennedy Jr. has been a prominent figure in environmental advocacy, particularly through his work with the Waterkeeper Alliance, a non-profit organization focused on protecting and enhancing waterways worldwide.

In a video clip shared via a post on social media platform X, Kennedy discussed the potential threats posed by CBDCs, emphasizing the risk of government overreach and the invasion of privacy. He argued that CBDCs could enable comprehensive government monitoring of all citizen transactions, leading to possible blackmail or undue pressure. Citing the example of China’s digital yuan, which is integrated into a social credit system, Kennedy highlighted the potential for governments to control and restrict access to funds based on citizen behavior.

Despite his apprehensions about CBDCs, Kennedy expressed a contrasting view on Bitcoin. He sees the cryptocurrency as a more protective option than traditional cash, suggesting that Bitcoin offers better safeguards against the issues he associates with CBDCs.

Kennedy’s stance on financial privacy and digital currencies aligns him with Donald Trump, who has also promised to oppose the development of CBDCs in the U.S. This opposition to CBDCs is part of a broader political narrative, with figures like Vivek Ramaswamy and Florida Governor Ron DeSantis expressing similar pro-crypto and anti-CBDC positions in their presidential campaigns.

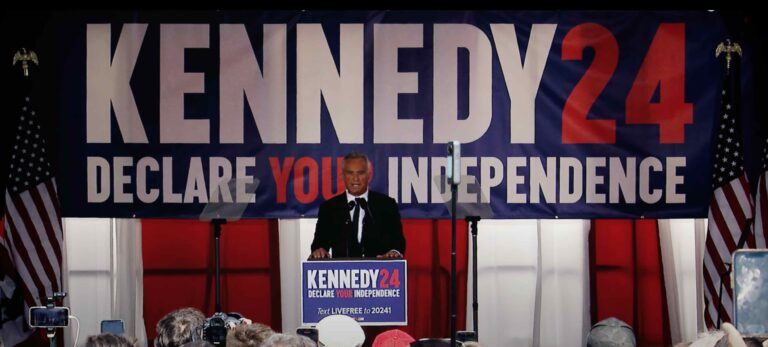

After leaving the Democratic Party in October 2023, he said during a speech:

“I’m here to declare myself an independent candidate for president for the United States. I’m here to join you in making a new declaration of independence for our entire nation … A rising tide of discontent is swamping our country. There’s a danger in this discontent but there’s also opportunity and promise … We seem to be cycling from despair to rage and back to despair. This country is ready for a history making change. They are ready to reclaim their freedom, their independence.“

Last week, former U.S. President Donald Trump linked his strong resistance to the development of Central Bank Digital Currencies (CBDCs) in the United States to the economic principles advocated by Vivek Ramaswamy. Trump made this connection clear during a campaign event in Laconia, New Hampshire, where he consistently voiced his opposition to the idea of the U.S. government launching a digital version of the dollar. In a speech at the rally, Trump stated, “Vivek wanted this: I will never allow the creation of a Central Bank Digital Currency.”

Trump’s stance against CBDCs is in line with his wider economic and political views, striking a chord with his conservative supporters. He has been vocal about the dangers he perceives in a government-issued digital currency, labeling it a significant threat to individual freedoms. Trump contends that a CBDC would give the federal government an unprecedented level of control over citizens’ finances, raising alarms about potential government intrusion and the unauthorized seizure of personal assets.

His position on CBDCs, which are digital versions of national currencies like the dollar or euro, is part of an ongoing debate in financial and political circles. While supporters of CBDCs view them as tools to improve transactional efficiency and combat fraud, critics, including Trump, worry about the implications for increased government monitoring and control over financial activities.

The Federal Reserve has been investigating the possibility of introducing a Central Bank Digital Currency (CBDC) but hasn’t yet decided to implement one. In January 2022, the Fed published a discussion paper titled “Money and Payments: The U.S. Dollar in the Age of Digital Transformation,” which explored the pros and cons of CBDCs in the U.S. The purpose of this paper was to gather feedback from the public and experts on this topic.

The Federal Reserve’s investigation into a CBDC focused on several critical areas:

- Financial Inclusion: The Fed looked into how a CBDC might offer a reliable, digital payment method for both individuals and businesses, particularly for those not adequately served by the existing banking infrastructure.

- Safety and Efficiency: The potential for a CBDC to enhance the safety and efficiency of the U.S. payment system was evaluated, especially given the rapid pace of technological change and the changing nature of payment methods.

- Domestic and International Considerations: The Fed considered how a CBDC might affect the U.S. financial system and its role in the global economy. This included potential impacts on monetary policy and financial stability.

- Privacy and Security: The Fed addressed privacy and security concerns, focusing on how a CBDC could protect user data while also preventing illegal activities.

- Collaboration with the Private Sector: The role of the private sector in a CBDC ecosystem was another area of focus, particularly how it might work alongside existing monetary and payment systems.

The Federal Reserve made it clear that any move towards a CBDC would require explicit backing from both the executive branch and Congress, ideally through specific legislation. Additionally, the Fed stated that it would not move forward with a CBDC without widespread support from the public and key stakeholders.

Featured Image via YouTube (Robert F. Kennedy’s YouTube Channel)