The World Bank’s new forecast for global economic growth predicts a deceleration for a third consecutive year in 2024, but it optimistically rules out a recession as it sees the global growth rate dipping to 2.4% from an estimated 2.6% last year.

As first reported by Yahoo Finance, the World Bank’s latest Global Economic Prospects report also expects the global economy to grow by 2.7% in 2025, with the slowdown this year being attributed to weaker global trade and the impact of high interest rates that central banks implemented in a bid to rein in on inflation.

While several central banks are expected to cut interest rates this year, the World Bank still sees the global economy reach a “soft landing” in 2024, which is the scenario in which inflation is brought down without sparking a recession.

The US economy was unexpectedly robust last year and has recently surprised with 216,000 new jobs in December, which fueled speculation that the Federal Reserve may soon move to cut interest rates. The World Bank warned, however, that the conflict in the Middle East and potential spikes in commodity prices could still reignite inflation.

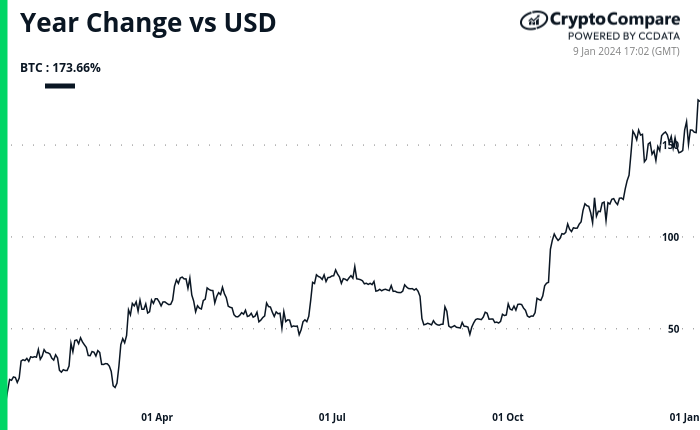

The price of Bitcoin has, meanwhile, surged more than 170% over the last 12 months as major asset managers enter the space after a race to list the first spot Bitcoin exchange-traded fund (ETF) in the US was kicked off by a filing from BlackRock.

Other risks for the global economy include financial strain from high debt and borrowing costs, trade disruptions, climate-related disasters, and a weaker-than-expected economic performance from China, whose growth is expected to slow to 4.5% from over 5% estimated last year – its slowest pace in 30 years (excluding the pandemic period), influenced by a declining property sector.

In the US, growth is expected to cool to 1.6%, with high real interest rates acting as a growth deterrent. Consumer spending is likely to decrease due to depleted savings, higher borrowing costs, and a relaxing job market.

While global headline inflation has reduced, core inflation, excluding unstable food and energy prices, persists, particularly in advanced economies with robust job markets. Consequently, the World Bank predicts a slow reduction in interest rates in advanced economies, leading to higher long-term market rates than pre-pandemic levels.

Even though overall inflation has gone down, core inflation, which does not count volatile food and energy prices, remains high, especially in more advanced economies. As a result, the World Bank expects that interest rates in these countries will drop slowly, causing long-term market rates to be higher than before the pandemic.

Featured image via Unsplash.