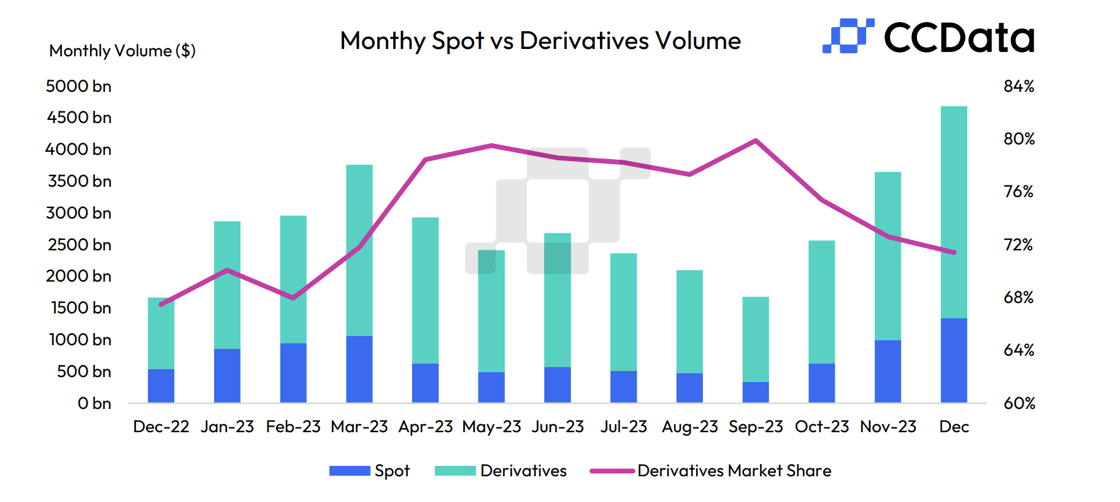

Last month, spot cryptocurrency trading volumes on centralized trading platforms rose for the third consecutive month to reach their highest level since June 2022, topping $1.34 trillion after a 34% rise.

That’s according to CCData’s latest Exchange Review report, which details that centralized exchanges, as a result of the significant trading volume rise, recorded a quarterly spot volume of $2.99 trillion in the last quarter of 2023, a figure that’s 125% above the lows recorded in the previous quarter.

The report also points out that derivatives trading volumes on centralized trading platforms rose 26.3% over the past month to $3.34 trillion, the highest monthly figure seen since December 2021 after a third consecutive monthly increase.

CCData’s Exchange Review adds that in December, Binance saw a significant 38.3% increase in spot trading volumes, reaching $425 billion in a surge that marked the third month of consecutive growth and represents the highest monthly trading volumes since March 2023.

As a result, Binance’s market share among centralized spot exchanges climbed by 0.70% to 32.5%, marking the first rise in ten months. On top of that, Binance’s derivatives trading volume also witnessed a notable increase of 25% to $1.58 trillion, the highest monthly volume recorded since March 2023.

The report also adds that trading activity on the CME exchange saw a notable uptick, with derivatives trading volume climbing by 3.35% to reach $70.2 billion, the highest since November 2021.

Within this, BTC futures experienced a modest increase of 1.09%, totaling $52 billion, while ETH futures trading grew by 3.20% to $14.3 billion.

Bitcoin is, at the time of writing, trading at $45,600 after surging by more than 170% over the last 12 months amid expectations a spot Bitcoin exchange-traded fund (ETF) could soon be launched in the United States.

Bitcoin ETF proponents believe that the fund could bring in institutional and retail investors looking to gain exposure to the flagship cryptocurrency without having to actually control the private keys to a cryptocurrency wallet or dig into how blockchain-based transactions work.

As reported, major r financial powerhouses that collectively manage an astounding $27 trillion in assets are making inroads into the world of Bitcoin and cryptocurrency after a race to list the first spot Bitcoin ETf kicked off in the country.

At least eight financial behemoths, which include BlackRock, Fidelity, JP Morgan, Morgan Stanley, Goldman Sachs, BNY Mellon, Invesco, and Bank of America, are “actively working to provide access to Bitcoin and more,” according to CoinShares CSO Meltem Demirors.

The $27 trillion figure, it’s important to point out, represents a grand total of assets under management across the aforementioned institutions, and only a minuscule fragment of this gargantuan sum is anticipated to be channeled into cryptocurrency investments.

Featured image via Pixabay.