Africa’s Financial Landscape and Market Potential

According to a recently published guide by Ripple (titled “Faster Payments into Africa”), Africa presents a substantial market opportunity, valued at $2.7 trillion, set to become a key driver in global business. Ripple says the continent has witnessed a remarkable increase in fintechs, especially in the payments sector, responding well to more affordable and accessible financial services. McKinsey anticipates the financial services revenue in Africa could reach $230 billion by 2025.

Fintech Growth and Mobile User Expansion

Ripple highlights the promising growth of fintech, skyrocketing mobile phone usage, and a growing consumer appetite for digital banking in Africa. It believes that these factors contribute to making Africa an attractive opportunity for the finance sector. First-movers in meeting the African market’s needs could see substantial gains.

Africa’s Financial Revolution

Per Ripple’s guide, financial institutions have the opportunity to tap into Africa’s booming market and new revenue streams. Ripple mentions that countries like South Africa, Nigeria, Kenya, Ghana, and Egypt are leading the payments revolution, with the African fintech market projected to surpass $60 billion by 2030. In particular, it points out that in Nigeria, 73% of adults own mobile phones, but credit card usage is under 5%, indicating a significant gap that financial services can fill.

Ripple and Onafriq Partnership

Ripple has partnered with Onafriq to address frictions and bottlenecks in cross-border payments, such as high fees, slow payment settlements, and the need for physical bank branches. Ripple Payments offers real-time settlement to enable faster transactions. According to Ripple, Onafriq connects 400 million mobile wallets across 35 African countries, operating over 800 payment corridors.

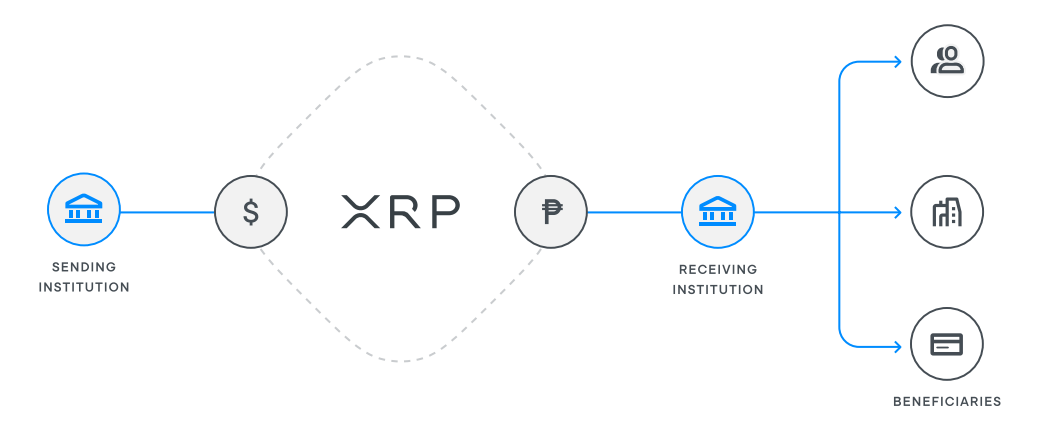

Ripple’s Payment Solutions

Ripple has developed a liquidity solution for instant settlement of cross-border payments. This solution allows financial institutions worldwide to process transactions faster and at lower costs compared to legacy payment rails. Ripple claims that its approach provides real-time settlement, global payout rail access, upfront visibility of fees, and a seamless customer experience.

Use Cases for Ripple Payments

The FinTech firm adds that Ripple Payments is adaptable for various business models and use cases, including individual payments, bulk funding for remittances, and intra-company transactions for senders with foreign accounts. It goes on to say Ripple Payments facilitates real-time settlement, 24/7/365 availability, competitive exchange rates, and instant position top-ups with payout partners globally.

Ripple’s Global Mission

Ripple is on a quest to transform the global landscape of value movement, management, and tokenization. The company designs solutions that promise speed, transparency, and cost-effectiveness, specifically targeting enduring inefficiencies within the financial sector. Ripple places a strong emphasis on sustainability, utilizing carbon-neutral technology and advocating for the use of green digital assets such as XRP. Their strategy is geared towards creating a more inclusive and scalable global economy, one that operates beyond the constraints of traditional economic borders.