CCData, a benchmark administrator sanctioned by the Financial Conduct Authority (FCA), stands at the forefront of digital asset information, delivering top-tier data and indices for settlement purposes. The firm excels in compiling and interpreting tick data from internationally recognized trading platforms, offering a detailed and extensive view of the digital asset market. This view encompasses a wide array of data points, including trading activities, derivatives, order books, historical insights, social media trends, and blockchain analytics.

The company’s Exchange Review is a pivotal resource that sheds light on the evolving landscape of the cryptocurrency exchange sector. This report delves into various aspects of exchange volumes, with a particular emphasis on derivatives trading in the crypto realm, the division of market segments based on exchange fee structures, and the comparative analysis of crypto-to-crypto versus fiat-to-crypto transaction volumes. Additionally, the review provides a thorough examination of Bitcoin’s trading patterns with different fiat currencies and stablecoins, a snapshot of leading crypto exchanges ranked by spot trading volume, and a historical perspective on volume trends for prominent trans-fee mining and decentralized trading platforms.

Issued monthly, the Exchange Review serves a diverse audience, from crypto aficionados seeking a comprehensive summary of the exchange market to professional investors, analysts, and regulatory bodies looking for in-depth analytical insights. Earlier today, CCData released the November 2023 edition of its Exchange Review report.

In the remainder of this article, we highlight some of the findings of this report.

Key Market Insights:

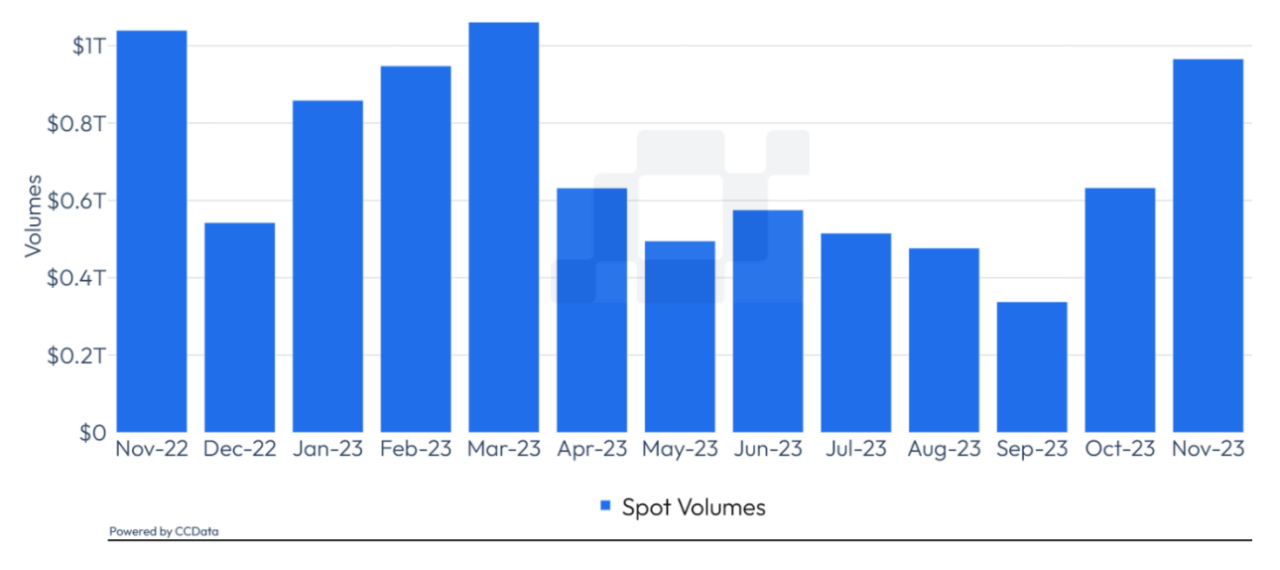

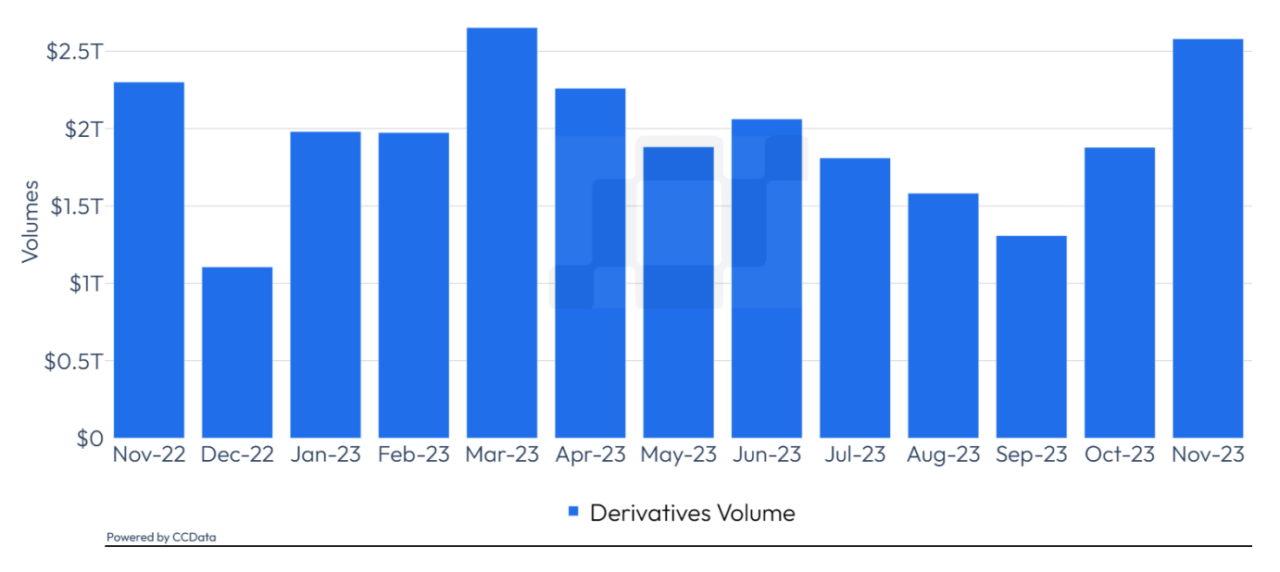

November saw a marked increase in both spot and derivatives trading volumes on centralized exchanges. The combined volume rose by 40.7% to $3.61 trillion, the highest since March 2023. This surge aligns with the bullish price action of major cryptocurrencies, notably Bitcoin and Ethereum, which reached new yearly highs. The anticipation of a potential spot Bitcoin ETF early next year further fueled this positive market sentiment.

- Spot Trading: Centralized exchanges experienced a 52.8% increase in spot trading volumes, totaling $965.8 billion.

- Derivatives Trading: There was a 37.3% rise in derivatives trading volume, reaching $2.58 trillion. Despite this increase, the derivatives market share dropped to 73.3%, the lowest since March 2023.

Exchange Dynamics

- Binance: Despite a 34.2% increase in combined spot and derivatives trading volumes, Binance’s market share continued its nine-month decline to 43.4%.

- OKX and Bybit: These exchanges saw significant gains, with their combined volumes rising by 58.0% and 45.5%, respectively, marking all-time highs in market share.

CME Institutional Volume

- BTC Futures: Trading volumes rose by 16.6% to $51.4 billion.

- ETH Futures: Volumes increased by 13.9% to $13.9 billion.

- Open Interest: CME overtook Binance in BTC Futures open interest, indicating a growing institutional interest in Bitcoin.

Exchange News Highlights

- Coinbase: Now offers regulated leveraged crypto futures for US traders.

- Binance: Introduced a self-custody Web3 wallet and resolved U.S. charges, potentially reducing regulatory risk.

- Gemini: Launched crypto derivatives trading on its mobile app.

Market Liquidity Analysis

- BTC Trading Pairs: There was a decline in market liquidity for BTC pairs across several exchanges.

- CEX.io and LMAX Digital: Saw an increase in market depth, while others like Kraken experienced a decrease.

Key Market Insights

November saw a marked increase in both spot and derivatives trading volumes on centralized exchanges. The combined volume rose by 40.7% to $3.61 trillion, the highest since March 2023. This surge aligns with the bullish price action of major cryptocurrencies, notably Bitcoin and Ethereum, which reached new yearly highs. The anticipation of a potential spot Bitcoin ETF early next year further fueled this positive market sentiment.

Spot and Derivatives Volumes

- Spot Trading: Centralized exchanges experienced a 52.8% increase in spot trading volumes, totaling $965.8 billion.

Derivatives Trading: There was a 37.3% rise in derivatives trading volume, reaching $2.58 trillion. Despite this increase, the derivatives market share dropped to 73.3%, the lowest since March 2023.

Exchange Dynamics:

Binance: Despite a 34.2% increase in combined spot and derivatives trading volumes, Binance’s market share continued its nine-month decline to 43.4%.

OKX and Upbit: These exchanges saw significant gains, with their combined volumes rising by 58.0% and 45.5%, respectively, marking all-time highs in market share.

CME Institutional Volume:

BTC Futures: Trading volumes rose by 16.6% to $51.4 billion.

ETH Futures: Volumes increased by 13.9% to $13.9 billion.

Open Interest: CME overtook Binance in BTC Futures open interest, indicating a growing institutional interest in Bitcoin.

Exchange News Highlights:

Coinbase: Now offers regulated leveraged crypto futures for US traders.

Binance: Introduced a self-custody Web3 wallet and resolved U.S. charges, potentially reducing regulatory risk.

Gemini: Launched crypto derivatives trading on its mobile app.

Exchange Benchmark Analysis:

The report evaluates exchanges based on operational transparency, security, data provision, and other factors. It categorizes exchanges into ‘Top-Tier’ and ‘Lower-Tier’ based on CCData’s benchmarks.

Top-Tier Exchanges: Experienced a 57.3% increase in spot volumes, reaching $700 billion.

Market Segmentation: Analyzed the changes in market share among various exchanges, with significant shifts observed in the spot market.

Market Liquidity Analysis:

BTC Trading Pairs: There was a decline in market liquidity for BTC pairs across several exchanges.

CEX.io and LMAX Digital: Saw an increase in market depth, while others like Kraken experienced a decrease.

Derivatives Market Overview:

Volume Increase: Derivatives volumes rose by 36.8% to $2.65 trillion.

Market Share Changes: Binance, OKX, and Bybit saw significant changes in their market share.