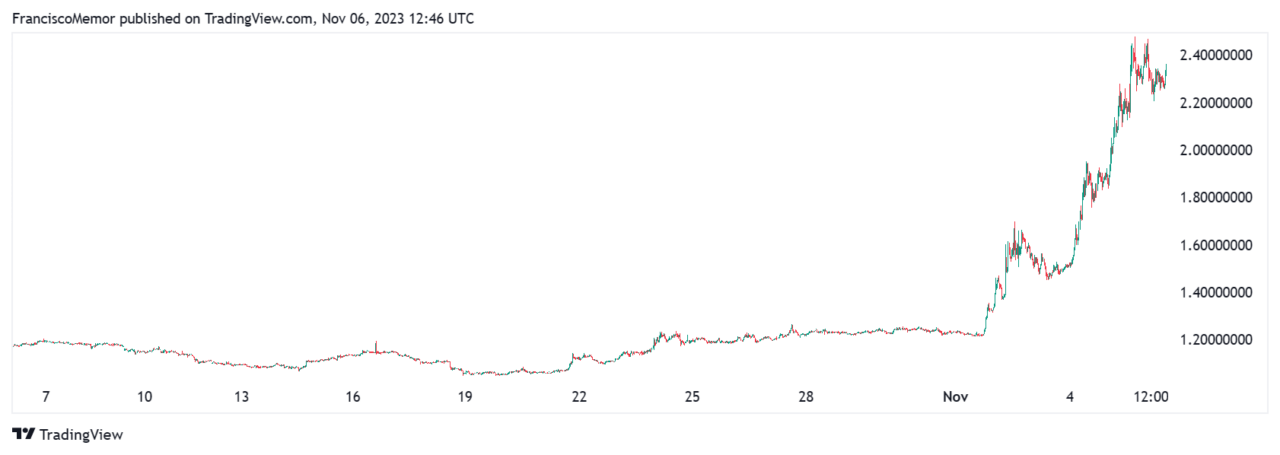

Popular decentralized cryptocurrency exchange PancakeSwap has seen the price of its native $CAKE token surge by over 90% over the past week after rolling out a new position manager tool, which it describes as a tool “designed to enhance the user experience for liquidity providers.”

The new feature, designed in partnership with decentralized finance protocol Bril Finance, allowing liquidity providers on the platform to seamlessly deposit their assets into single-asset vaults right from the exchange’s interface.

The tokens that are deposited into this system become part of a smart algorithm that adjusts liquidity automatically. PancakeSwap and Bril’s developers claim that this new system lets users earn more returns with less risk than other methods. The announcement details PancakeSwap collaborated with other protocols to provide users with a “range of strategies for optimal LP position management.”

Liquidity providers, it’s worth noting, are those who deposit tokens to the liquidity pools used on the decentralized exchange’s trading pairs, which facilitate trading. The tool’s launch saw the price of CAKE surge over 90% in a week, to now trade at $2.33 per token, up from $1.22 earlier in the month.

The system allows users to deposit different kinds of cryptocurrencies, such as Tether, Bitcoin, and Ether, among others. The developers say that the protocol has shown a high internal rate of return (IRR) of more than 24% in the testing phase.

As CryptoGlobe reporte,d back in August PancakeSwap revealed it was set to disburse a share of its trading fee revenue amounting to millions of dollars to CAKE token stakers.

PancakeSwap, according to popular decentralized finance analytics platform DeFiLlama, currently has a total value locked of $1.489 billion and a market capitalization of $560 million, with a 24-hour trading volume of $404 million.

Featured image via Unsplash.