ARK Invest’s New Crypto ETFs in Collaboration with 21Shares

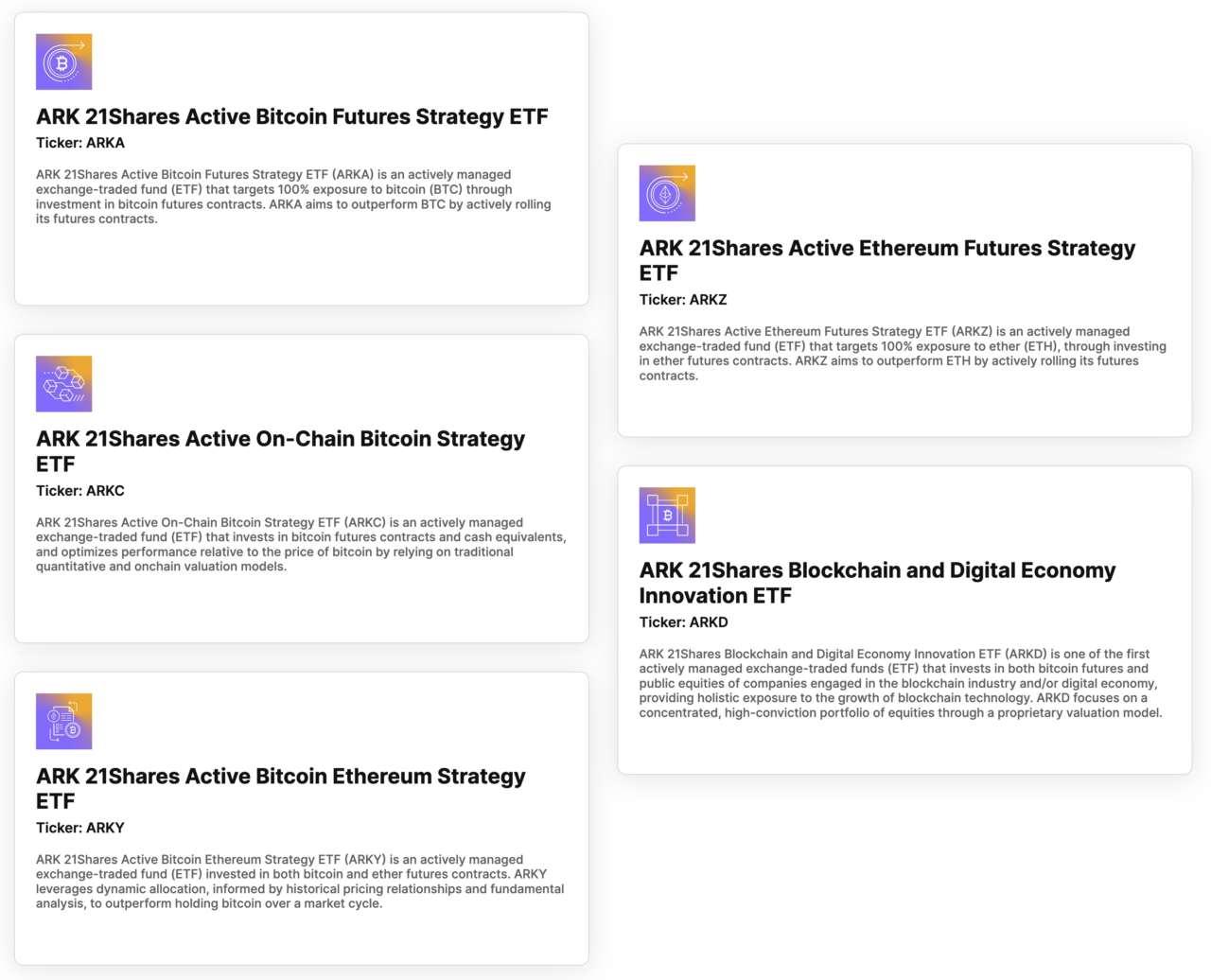

Earlier today, Cathie Wood, the Founder, CIO, and CEO of ARK Investment Management, LLC, shared insights on CNBC’s “Squawk Box” about ARK Invest’s latest venture into the crypto space. In partnership with 21Shares, known for being the largest crypto EFT provider in the world, ARK is launching five new ETFs this week on Cboe Digital. These ETFs include a mix of Bitcoin futures and cash, Bitcoin futures and Ethereum futures, and a broader range of Bitcoin and equity-exposed companies.

Institutional and Retail Focus

Wood highlighted that these strategies would likely have a more institutional focus, while the Bitcoin ETF would be more retail-oriented. She expressed optimism about the potential approval of a spot Bitcoin ETF in the U.S., indicating that it is next in line for ARK.

SEC’s Changing Stance

Wood observed a significant shift in the U.S. Securities and Exchange Commission’s (SEC) approach to crypto ETFs. Unlike previous rejections, the SEC is now engaging with applicants like ARK, BlackRock, and others, asking detailed and consumer-focused questions. This change, according to Wood, is a positive sign of movement within the regulatory body.

Bitcoin’s Transparency and Market Dynamics

Addressing concerns about Bitcoin’s potential for manipulation, Wood emphasized the transparency of the Bitcoin network, where all activities are visible online. She speculated on various factors influencing the recent movements in Bitcoin’s price, including anticipation of ETF approvals and fundamental network health. Wood also mentioned the concept of Bitcoin as a ‘flight to quality’ or ‘flight to safety’ asset, highlighting its lack of counterparty risk.

Bitcoin vs. Bitcoin-Related Equities

When asked about the future performance of Bitcoin compared to equities related to it, Wood expressed a stronger belief in Bitcoin itself. She mentioned the search for a company that could dominate the digital wallet space, citing examples like Coinbase, Square’s Cash App, Robinhood, and Nubank in Latin America.

The Digital Wallet Space and Fintech Innovations

Wood discussed the potential of various companies in the digital wallet space, drawing parallels with WeChat Pay. She sees significant opportunities in this area, particularly in the U.S., where existing financial rails have been adequate but not innovative like WeChat’s model.

Ethereum and Infrastructure Players

Wood acknowledged the role of Ethereum and other infrastructure players like Solana in the blockchain space. She noted that while Ethereum was initially faster and more cost-effective than Bitcoin, Solana has now surpassed Ethereum in these aspects.

The Concept of Web 3 and Digital Assets

Wood touched upon the concept of Web 3 and digital assets, emphasizing the novelty of online property rights. She dismissed the notion of a ‘Bitcoin 2.0’, asserting that Bitcoin remains the revolutionary money system, being the first global, private, government-independent, digital, and rules-based monetary system.

Featured Image via Pixabay