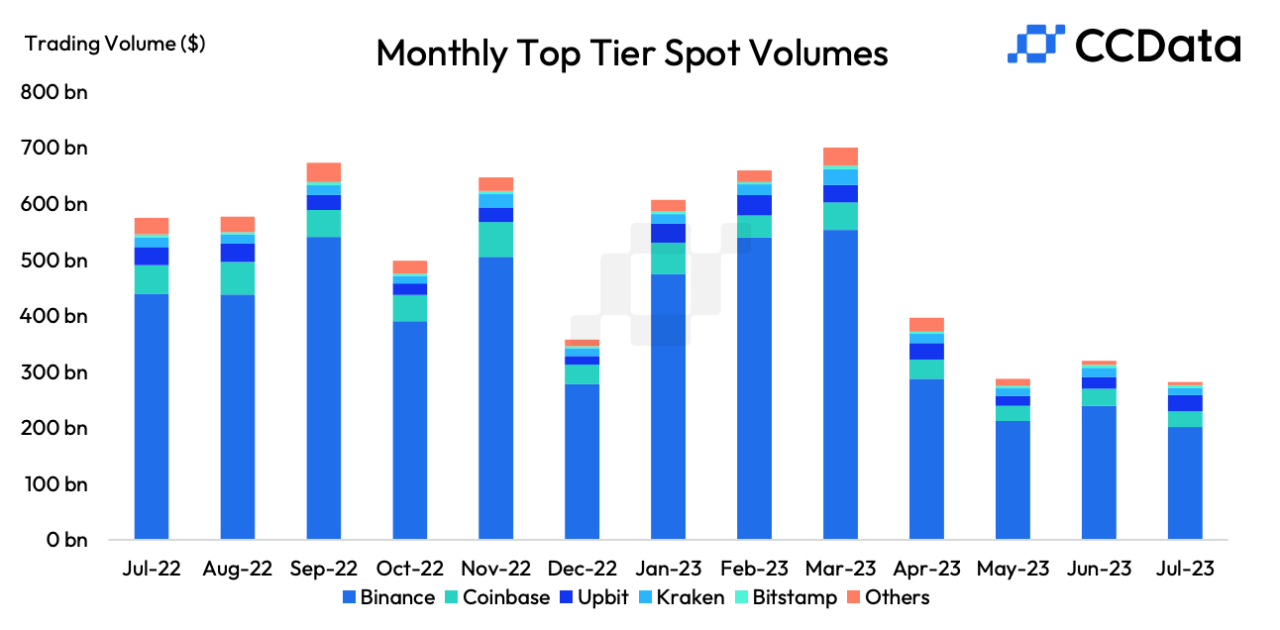

Last month, spot trading volumes on centralized exchanges fell by 10.5% to $515 billion, the second lowest level since March 2019, while derivatives volumes fell 12.7% to $1.85 trillion, the second-lowest recorded since December 2020. Combined trading volumes dropped 12% to $2.36 trillion.

The slump in trading volumes is largely due to the tepid volatility in the price movements of leading crypto assets. Bitcoin and Ethereum, two significant market leaders, have been trading in a tight range throughout July, deterring active trading participation.

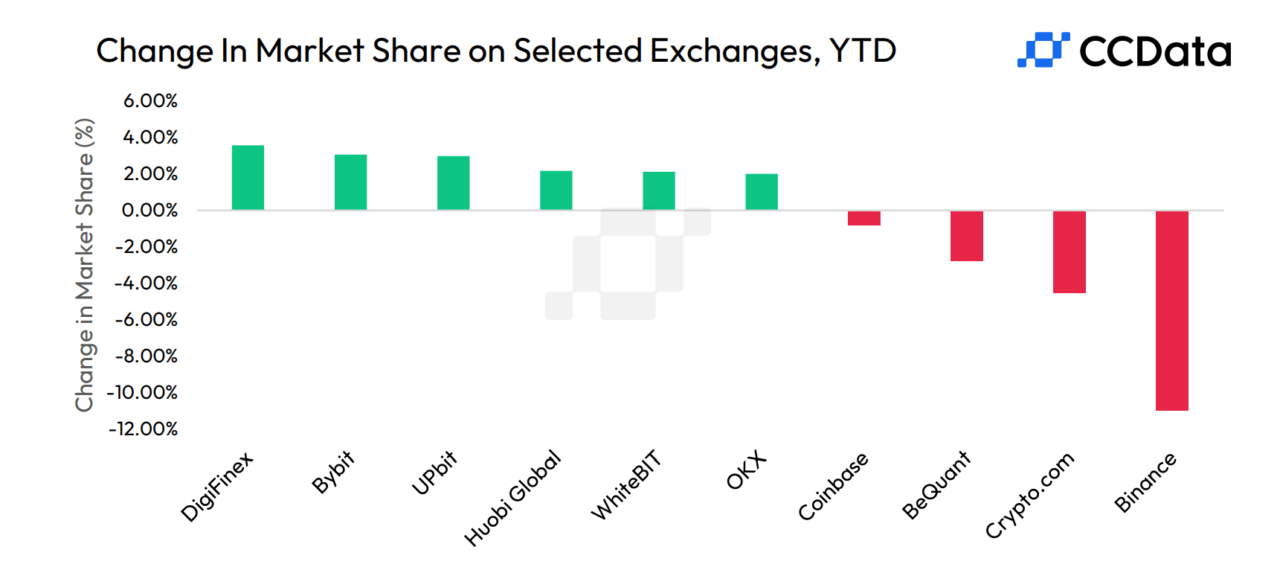

Given the drops, the derivatives share of the trading volumes has declined for a second consecutive month, falling to 78.2%. Leading cryptocurrency exchange Binance, according to CCData’s latest Exchange Review report, recorded $208 billion in trading volume to maintain its lead. However, its market share shrunk for the fifth consecutive month to 40.4%.

In a stark contrast to the general market trend, Upbit witnessed a significant surge in its spot trading volume by 42.3% to $29.8 billion last month, marking the first time Upbit outperformed rivals OKX and Coinbase, whose volumes dropped 11.6% and 5.75% respectively.

Upbit, a South Korean cryptocurrency exchange, rose to second-largest by trading volume (behind Binance). Upbit accounted for 5.76% of the market share of trading volumes on centralized exchanges.

The trading volume of derivatives on the Chicago Mercantile Exchange (CME) fell by 17% to $40.1 billion last month, with futures volumes on the exchange taking a similar plunge of 17.6% to $39.1 billion.

Interestingly, the options trading volume on the CME witnessed a resurgence, rising 24% to $940 million, marking the first rise in four months.

Featured image via Pixabay.