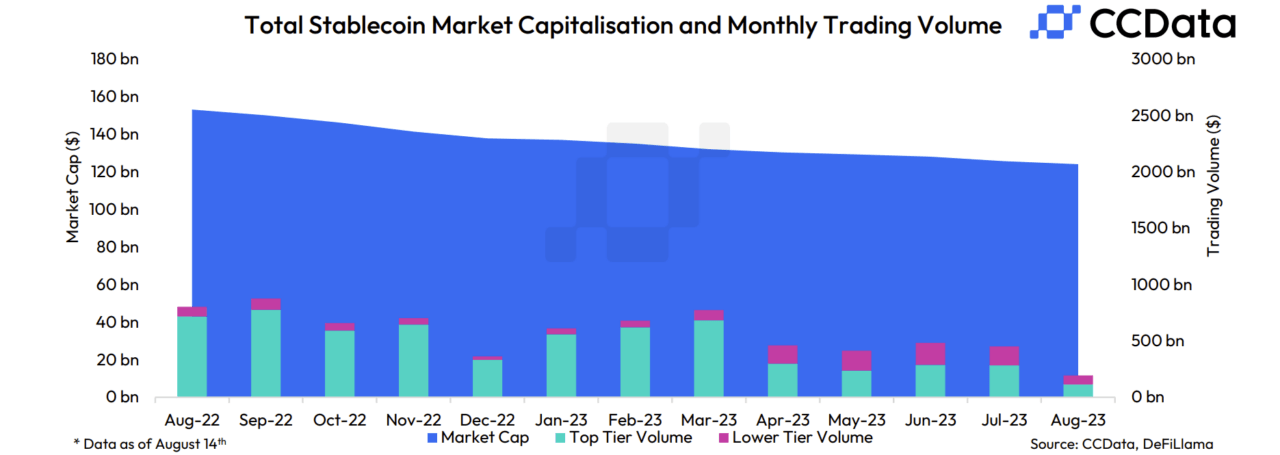

The total market capitalization of the stablecoin sector in the cryptocurrency space has endured its 17th consecutive monthly decline in August, falling by 1.28% to $124 billion, the lowest level since August 2021.

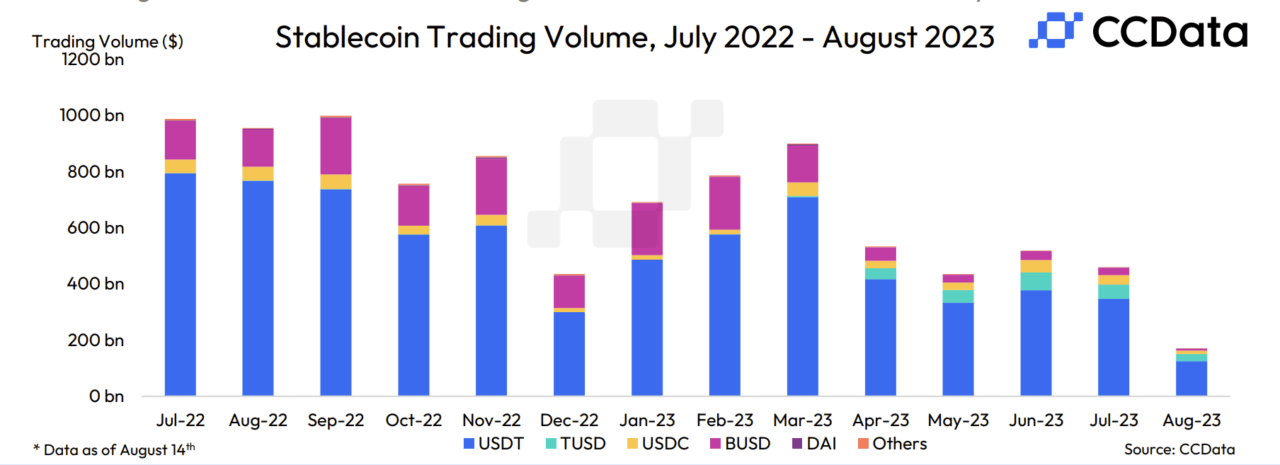

According to CCData’s latest Stablecoins & CBDCs report, both BUSD and TUSD stood out in experiencing significant declines of 9.35% and 9.15% to $3.37 billion and $2.75 billion respectively, after leading cryptocurrency exchange Binance adopted First Digital USD (FDUSD).

Meanwhile, First Digital Labs’ FDUSD has seen its market capitalization skyrocket 1,410% to $305 million after being launched last month after being adopted by the leading cryptocurrency exchange. Trading volumes on pairs involving FDUSD surpassed $500 million last month, while the stablecoin is still only the fifth-largest on Binance.

FDUSD’s trading volumes are also set to benefit from Binance’s zero-fee trading promotion, with more trading pairs set to be listed in the near future. Per CCData’s report, the USDT/FDUSD trading pair saw $437 million in volumes, accounting to 86.2% of the stablecoin’s volume.

The report also details that in July, stablecoin trading volumes fell 6.14% to $453 billion, making it the second-lowest monthly stablecoin trading volume on centralized cryptocurrency trading platforms seen this year, and the third-lowest since April 2019.

As of August 13, stablecoin trading volumes on centralized trading platforms reached $194 billion, which means they’re on track to record historically low monthly figures.

When it comes to central bank digital currencies (CBDCs), the report details that China’s Central Bank Governor has revealed that the Digital Yuan, the country’s CBDC, reached 1.8 trillion RMB in transaction volume, equivalent to $248 billion, in June.

The number of transactions using the Digital Yuan, the report adds, surged to 950 million, representing a 1,600% rise in transaction volume and a 164% rise in transaction count from August 2022’s update.

Featured image via Pixabay.