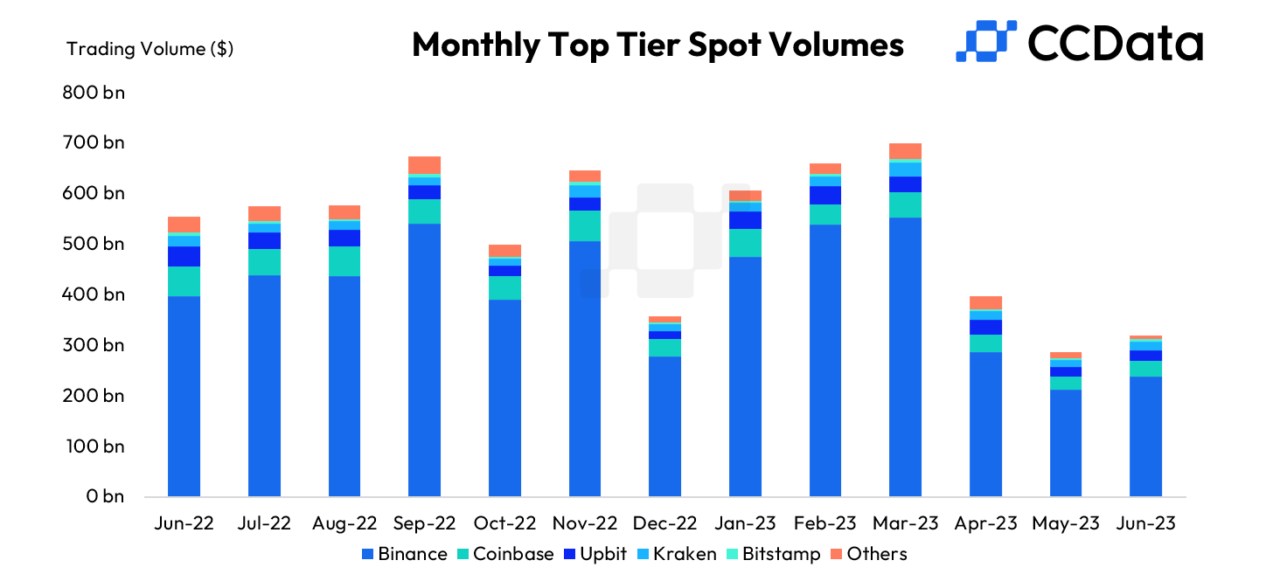

Last month, spot trading volumes on centralized cryptocurrency exchanges rose 16.4% to $575 billion, the first increase in trading volumes since in three months. Trading volumes, however, remain at historically low levels, recording the lowest quarterly volumes since Q4 of 2019.

According to CCData’s latest Exchange Review report, the increase in trading volumes came amid rising volatility over the U.S. Securities and Exchange Commission’s (SEC) lawsuits against leading cryptocurrency exchanges Binance and Coinbase, and amid a renewed positive outlook in the space triggered by the filing of spot Bitcoin exchange-traded funds (ETFs) by financial behemoths including BlackRock and Fidelity.

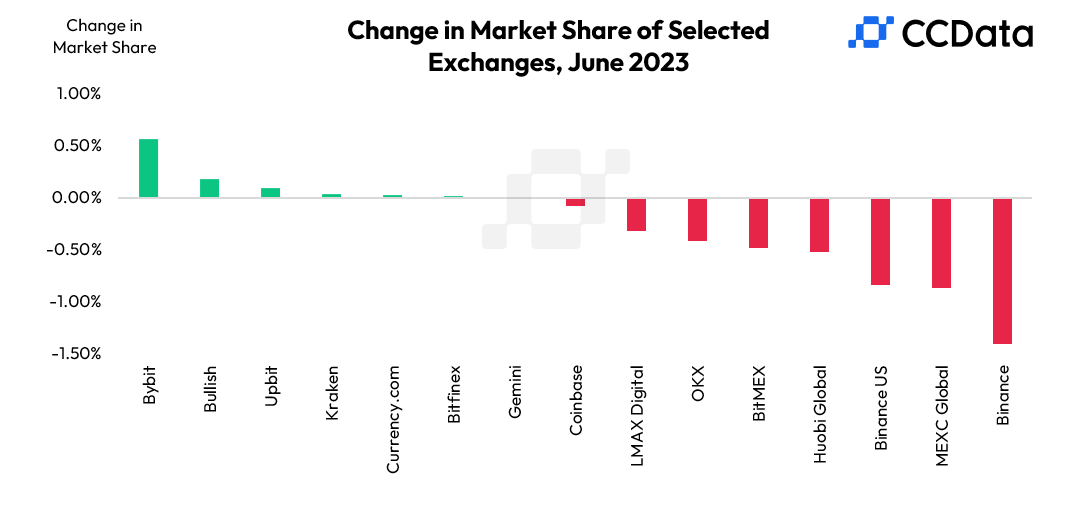

Per the report, as of July 4, Coinbase was leading in terms of Bitcoin trading volumes among exchanges registered in the US with a 61% market share, and is poised to increase its hold in the region for the third consecutive month.

Despite this, the overall presence of the US exchanges in the global Bitcoin trading volumes remains low at 9.49%, with Coinbase contributing 5.83%. Binance’s market share of the spot trading market notably fell for a fourth consecutive month to 41.6% in June, marking its lowest level since August 2022.

Binance is nevertheless the largest derivatives trading platform in the cryptocurrency space, with $1.21 trillion in volumes, above OKX’s $416 billion that came after a 44.9% surge in volumes last month.

Meanwhile, the Chicago Mercantile Exchange (CME) recorded a 23.6% increase in the total derivatives volume traded, reaching $48.3 billion in June. Notably, there was a marked increase in institutional interest in BTC futures, which saw volumes rise by 28.6% to $37.9 billion, marking the highest volume traded on the exchange since November 2021.

In comparison, ETH futures trading volume rose by a more modest 9.93% to $8.91 billion, while the ETH options trading volume fell by 45.8% to $129 million.

These volumes come as major financial powerhouses that collectively manage an astounding $27 trillion in assets are making inroads into the world of Bitcoin and cryptocurrency after a race to list the first spot Bitcoin exchange-traded fund (ETF) in the United States kicked off.

Featured image via Pixabay.