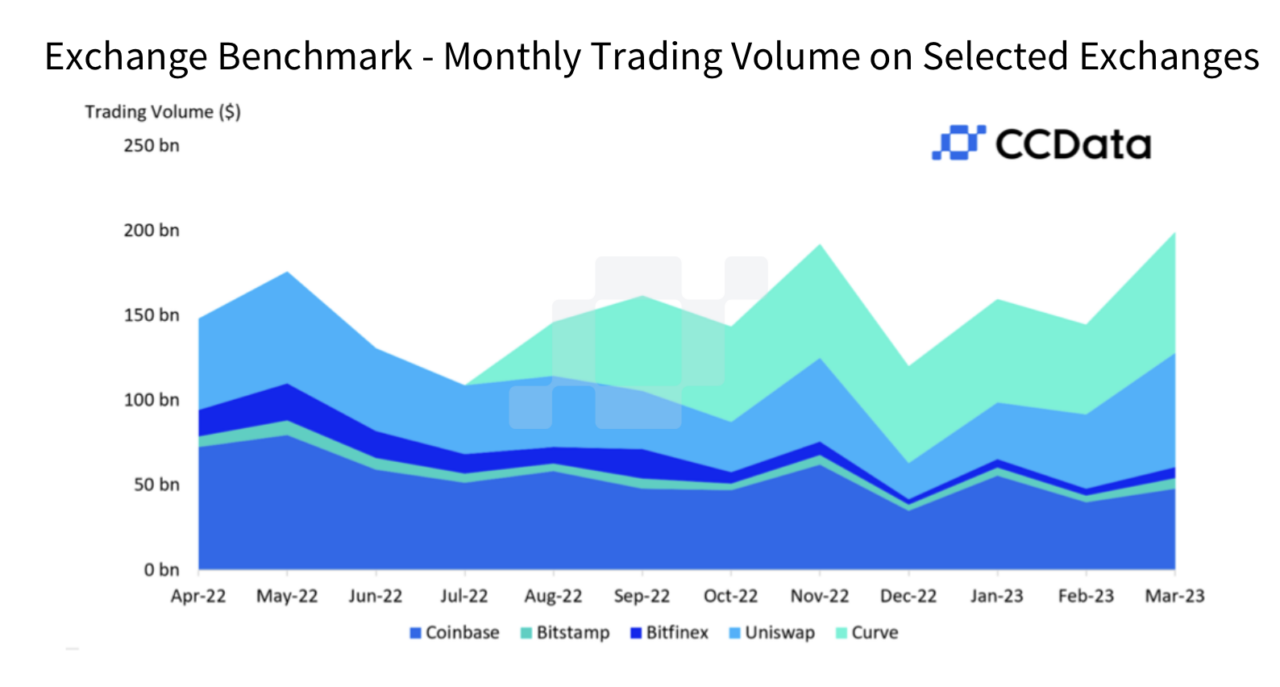

The average daily trading volume of leading decentralized exchanges (DEXs) in the cryptocurrency space, Uniswap and Curve, has surpassed that of top centralized cryptocurrency trading platforms Coinbase and Bitstamp.

That’s according to CCData’s latest Exchange Benchmark report, which is a bi-annual report that helps set the industry standard for evaluating the risks linked to digital asset exchanges and ranks cryptocurrency exchanges based on its methodology.

Per the report, last month 71% of total trading volumes in the space came from Top-Tier cryptocurrency exchanges, compared to 92% in October 2022. The decrease in volume follows a decrease in the number of Top-Tier exchanges, which can be attributed to more stringent grading requirements being implemented by the assessing firm.

Nevertheless, transparency in centralized cryptocurrency trading platforms, the report adds, increased after the collapse of FTX. 20% of these exchanges adopted a Proof-of-Reserves mechanism or an alternative, while 13% started being audited or incorporated a Proof of Liabilities mechanism to respond to growing market participant concerns.

FTX collapsed in November 2022 after a bank run on it revealed that it did not safeguard users’ funds and was unable to meet withdrawals. The cryptocurrency exchange’s founder and former CEO, Sam Bankman-Fried, has been charged with fraud and conspiracy for misusing customer funds and diverting them to crypto hedge fund Alameda Research. He was also charged with money laundering and campaign finance violations.

That collapse has seemingly led to the growth of decentralized exchange trading volumes, with Uniswap and Curve surpassing the trading volumes of top exchanges Coinbase and Bitstamp.

CCData noted, however, that even though it added 10 new decentralized exchanges to its Benchmark, the total value locked (TVL) on them dropped to $16.9 billion, down from $21.7 billion on the October 2022 version of the report.

Users, the report notes, appear to “have been drawn to DEXs for their security benefits over centralized exchanges,” with the trading volumes of decentralized platforms remaining unchanged while that of centralized exchanges dropped amid a market slowdown.

Also read: How to Use Uniswap With MetaMask

The report notably also adds that security vulnerabilities “remain prevalent in DEXs,” with 43.2% of the analyzed decentralized exchanges having been hacked in the past, and 68.4% of them having these security breaches occur over the last 12 months.

Per the report, of the 19 hacked decentralized exchanges, 12 lost over $1 million in these incidents. As CryptoGlobe reported, CCData’s Q2 2023 Outlook report revealed that in the first quarter of the year Uniswap ($UNI) saw its liquidity skyrocket.

Image Credit

Featured Image via Pixabay