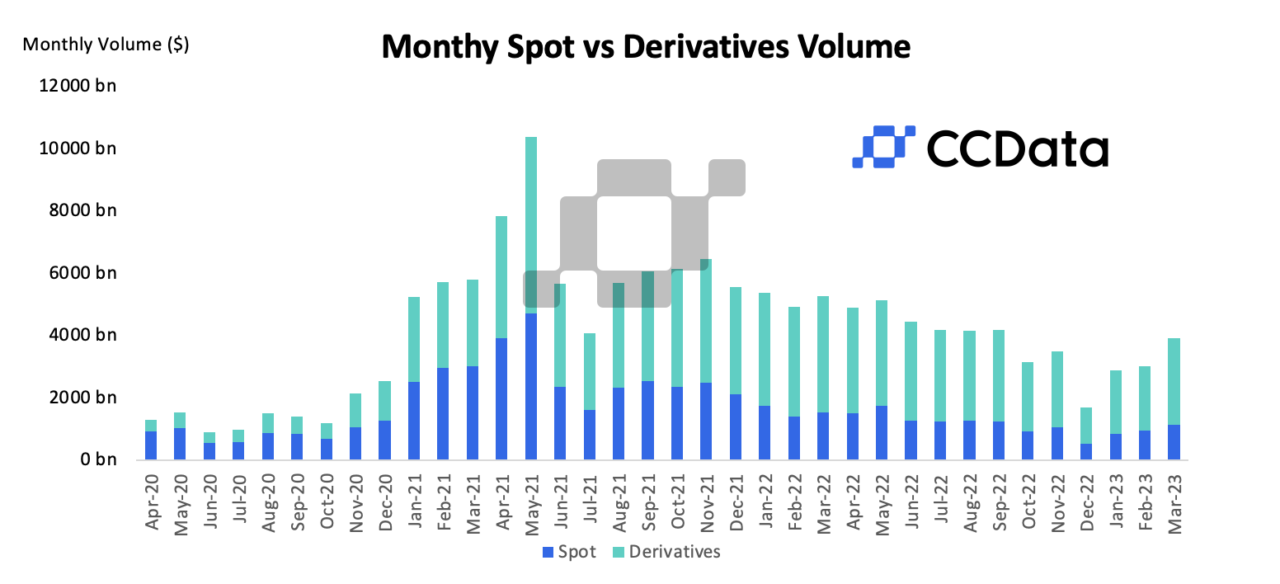

Cryptocurrency exchange trading volumes rose 25.9% to $3.81 trillion last month when combining volumes from both spot and derivatives markets, recording the third consecutive month of increases. The rise, however, saw Binance’s spot market share drop for the first time in five months.

According to CCData’s latest Exchange Review report, centralized cryptocurrency exchanges have recorded their highest spot and derivatives volumes since September 2022 in a month marked by the depegs of multiple stablecoins, including USDC, and positive market performance.

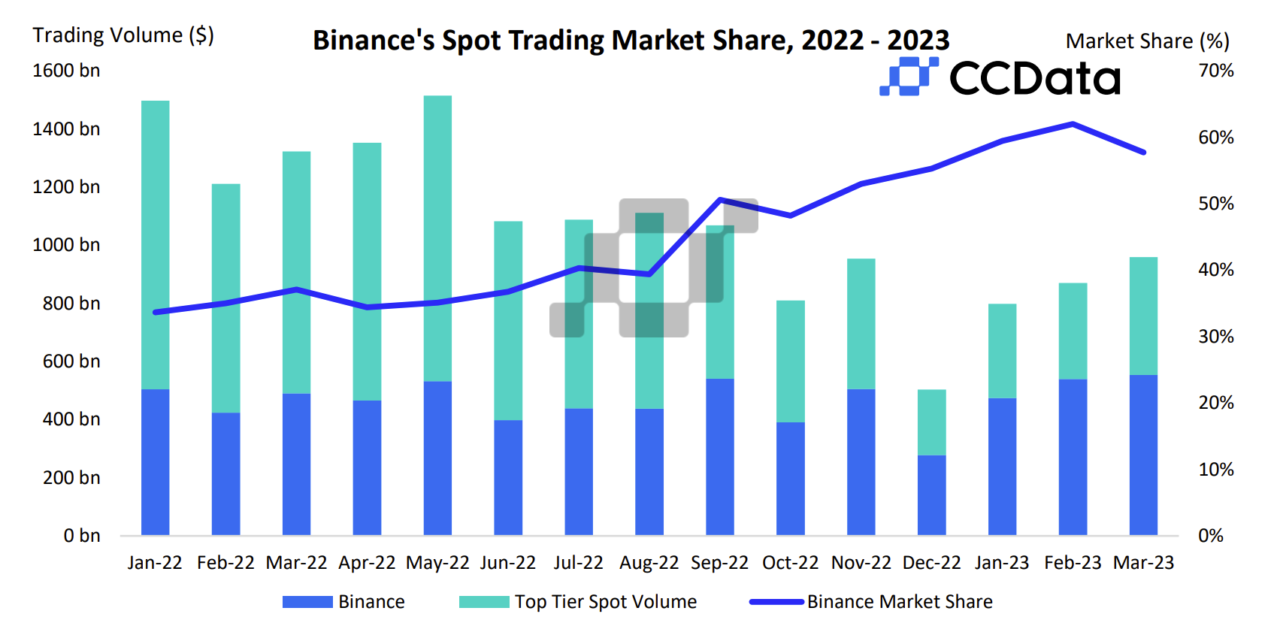

The report details that Binance lost some of its spot market dominance among Top-Tier exchanges for the first time in five months, dropping from 62% in February to 57.7% in March. This happened around the same time that BinanceUSD faced legal issues, and Binance stopped offering free trading for BTC-BUSD and ETH-BUSD pairs.

Nevertheless, Binance’s spot trading volume increased slightly to $554 billion. Other exchanges grew more with OKX and Coinbase rising 29.7% and 23.5% to $54.9 billion and $49.3 billion, respectively.

Binance is still offering zero-fee trading for BTC-TUSD and ETH-TUSD trading pairs. Its derivatives market share has meanwhile risen to a new all-time high of 64%.

The report adds that last month derivatives trading volumes on centralized cryptocurrency exchanges rose 32.6% to $2.77 trillion, the highest volume since September 2022. Meanwhile, spot trading volume on exchanges rose 10.8% to $1.04 trillion.

Derivatives trading on centralized exchanges, the report adds, increased its market share to a record high of 72.7%, up from 69% in February. The higher volume of derivatives trading may be due to market speculation after several stablecoins, including USDC, lost their peg.

USDC lost its peg after it was revealed that $3 billion of the stablecoin’s reserves were being held at Silicon Valley Bank, just as the financial institution was collapsing. The cryptocurrency recovered its peg after the Federal Deposit and Insurance Corporation (FDIC) revealed it would make depositors whole.

CCData’s report also adds that the CME’s BTC Futures volume increased by 40.5% in March, reaching $35.1 billion the highest level since May 2022. CME’s BTC Micro Futures also saw a 46.2% rise in monthly volume, trading $697 million.

Image Credit

Featured Image via Unsplash