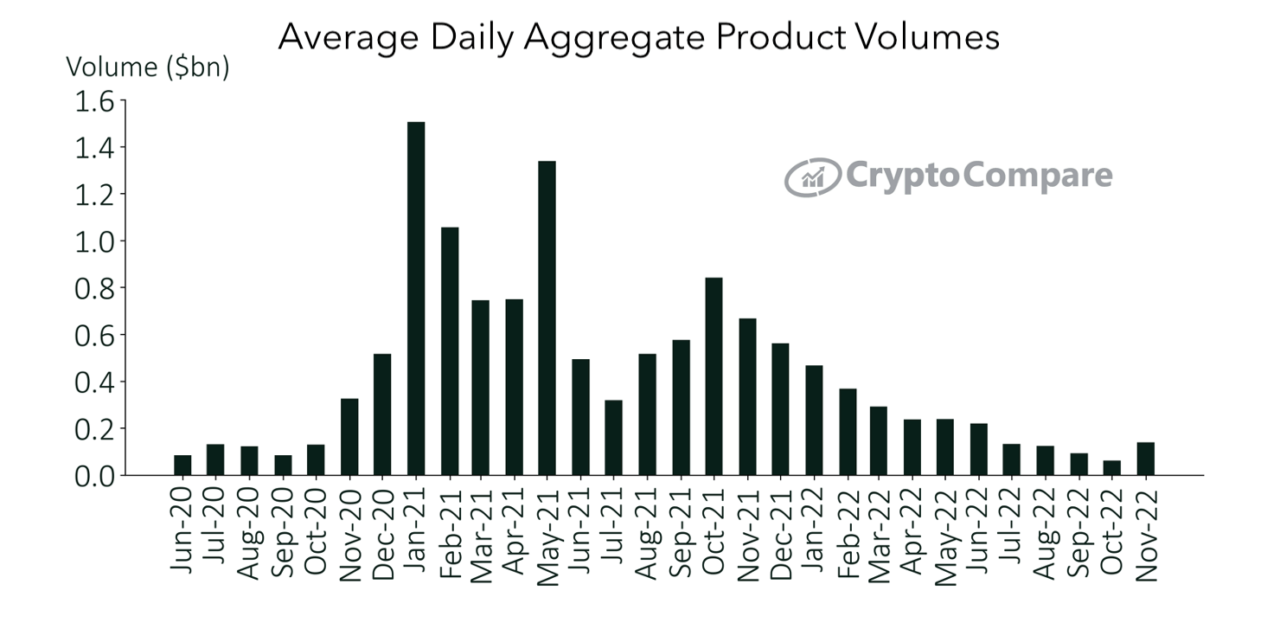

The average daily aggregate trading volume of cryptocurrency investment products has surged 127% in November to $139 million, the highest volumes recorded since June 2022. Volumes rose in the wake of FTX’s collapse, which helped volatility in the space explode.

According to CryptoCompare’s latest Digital Asset Management Review report, the surge in trading volume seen last month helped break a downtrend trend in trading volumes seen since May of this year. Per the firm, the rising volume could be explained by the significant rise in trading activity caused by FTX’s collapse.

CryptoCompare’s report also details that the entire cryptocurrency market has, since February of 2021, been watching the Grayscale Bitcoin Trust (GBTC) discount widen as market stability declines.

The discount represents a gap between the product’s net asset value – or the value of the BTC held by the fund – and its price. Following FTX’s collapse, GBTC’s discount rose by 12%, followed by further increases that saw it hit a new all-time high of 45.1%.

As CryptoGlobe reported, CryptoCompare’s deep dive into FTX’s insolvency revealed that FTX saw outflows of 19,947 BTC, worth over $340 million, on November 7, the largest figure since September 10, 2021 when the exchange recorded more than 45,000 BTC outflows.

Moreover, on November 7 FTX recorded the “largest number of withdrawal transactions in its history,” which suggests users “were concerned about the current situation” and were potentially allocating their assets to other exchanges.

Circle co-founder Jeremy Allaire likened FTX’s liquidity crisis to the Lehman Brothers’ collapse in 2008. Several cryptocurrency exchanges, including Coinbase and Kraken, have distanced themselves from FTX, clarifying they had no exposure to the exchange as confidence in centralized trading platforms was significantly affected.

Notably, FTX hit a valuation of $32 billion at the start of this year, backed by blue-chip investors, including BlackRock, Canada’s Ontario Teachers’ Pension Plan, and SoftBank.

Image Credit

Featured Image via Pixabay