The cryptocurrency ecosystem endured a market-wide sell-off last month over macroeconomic factors that continued to weigh down risk assets, including equities. The fall was reflected in spot trading volumes, which rose significantly last month.

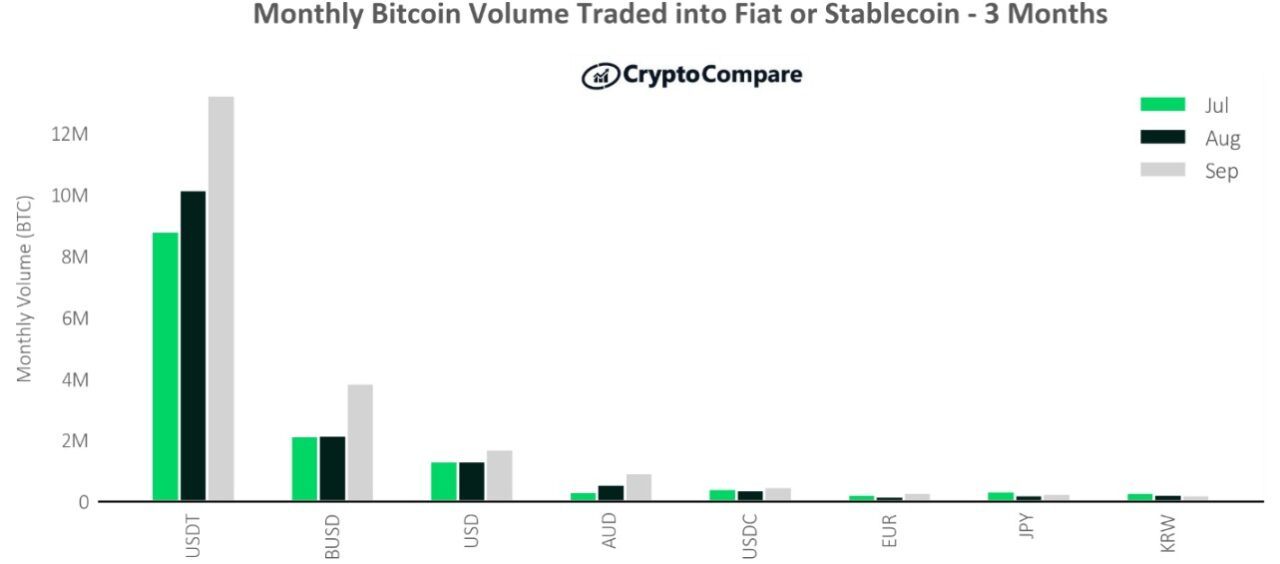

According to CryptoCompare’s latest Exchange Review report, BTC spot trading into BinanceUSD ($BUSD), the stablecoin issued by leading cryptocurrency exchange Binance, jumped 79.2% to 3.84 million BTC last month, benefitting from the exchange’s move to auto-convert users’ USDC, USDP, and TUSD into BUSD.

The move, according to Binance, is intended to “enhance liquidity and capital efficiency for users.” The exchange will also remove and stop trading on spot pairs involving USDC, USDP, and TUSD.

Analysts at JPMorgan have said that Binance’s move will benefit Tether, as it will increase the cryptocurrency’s importance in crypto trading. The investment bank noted that Tether’s market share in the stablecoin ecosystem has been declining over the past 18 months, which shows its importance has been dwindling.

CryptoCompare’s report adds that fiat trading pairs also saw an increase in BTC spot trading volume “amid the weakening of several currencies worldwide,” adding that BTC spot trading into USD rose 29.5& to 1.7 million BTC, while trading to Australian Dollars, Euros, and Great British Pounds rose 65.1%, 68.3%, and 233% respectively.

According to CryptoCompare, last month total spot trading volumes in the cryptocurrency space rose 3.58% to $1.56 trillion, with Top-Tier exchanges seeing their volumes rise 4.48% to $1.46 trillion, and Lower-Tier exchanges seeing their volumes drop 8.1% to $99.5 billion.

Per the report, in September the spot trading volume of the Nasdaq-listed cryptocurrency exchange Coinbase fell 17.6% to $48.1 billion, its lowest since January 2021.

Coinbase’s competitors Binance, OKX, and FTX all saw their spot trading volumes rise, with gains of 23.5%, 8.26%, and 5.49% respectively. The drop came even after Coinbase introduced changes in its fee schedule in a bid to attract more retail and institutional trading.

Image Credit

Featured Image via Unsplash