According to the latest edition of CryptoCompare Research’s “Digital Asset Management Review“, in June, one Bitcoin ($BTC) ETP’s assets under management (AUM) managed to hit an all-time high despite the current crypto bear market.

The ongoing crypto bear market saw the price of BTC plunge from around $69,000 back in November 2021 to around $19,000 at the time of writing amid risk-off sentiment in the markets driven by inflation fears, interest rate hikes, and the war in Ukraine.

In the cryptocurrency space, the sell-off this year was exacerbated by embattled cryptocurrency firms who both have been laying off staff and freezing withdrawals from their platforms citing “extreme market conditions.” Crypto lender Celsius Network has reportedly been advised to file for bankruptcy, while rival lender babel Finance and crypto exchange CoinFLEX froze withdrawals.

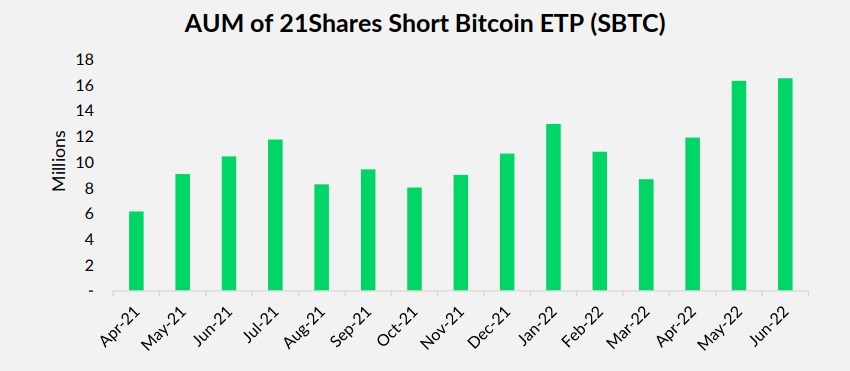

CryptoCompare’s report shows that the exchange-traded product that saw its assets under management hit a new high this year was the 21Shares Short Bitcoin ETP (SBTC), which “seeks to provide a -1x return on the performance of Bitcoin for a single day.”

The product, launched in October 2020, obtains short exposure by borrowing BTC and simultaneously selling it on an execution platform, its documentation reads. The ETP had a 30-day return of 30.8% according to CryptoCompare, making it the third consecutive month where the product’s assets under management have risen, recording a new $16.5 million all-time high this month.

On 21Shares’ website, the firm details that inverse ETPs such as SBTC are “not suitable to all investors,” but are “intended for investors who understand the risks investing in a product with short exposure and intend to invest on a short-term basis.”

The firm’s website details that while ETPs are “structured and operate very similarly to traditional Exchange Traded Funds (ETFs),” their primary difference is that ETPs are “debt securities issued by a Special Purpose Vehicle (SPV) instead.”

Earlier this year, in an interview with CryptoGlobe, 21Shares’ co-founder and president Ophelia Snyder noted the firm has seen huge success for its products offering exposure to Solana ($SOL) and Polkadot ($DOT) as investors were betting on these two altcoins.

21Shares Short Bitcoin ETP’s assets under management rose during a month in which the assets under management of cryptocurrency investment products reached record lows, with CryptoCompare detailing ETFs experienced the largest drop in AUM at 52% to $1.31 billion.

Trust products, which have an 80.3% market share, fell 35.8% to $17.3 billion, while ETCs and ETNs fell 36.7% and 30.6% to $1.34 billion and $1.61 billion respectively. The report also mentions the $500 million outflows from Bitcoin’s biggest ETF that led to a price crash earlier this month.

Image Credit

Featured image via Unsplash