After a months-long drawdown for most top cryptocurrencies marked by large losses and high-profile contagion events, in the month of July digital assets investment products longing crypto recorded gains. The 21Shares short Bitcoin ETP was the only one reporting losses.

That’s according to CryptoCompare’s July 2022 Digital Asset Management Review, which details that in July every cryptocurrency investment product covered in the report saw positive 30-day returns, with Ethereum-based products “leading the bounce-back” while being driven “by price movements in the underlying asset.”

CryptoCompare’s report notes that Ethereum investment products have seen gains ranging from 25.9% to 37.8% in July, while the underlying cryptocurrency experienced a 13.6% rise so far this month. XBTPRovider’s XETHEUR ETC product was the top performer in this category, registering a 30-day return of 37.8%.

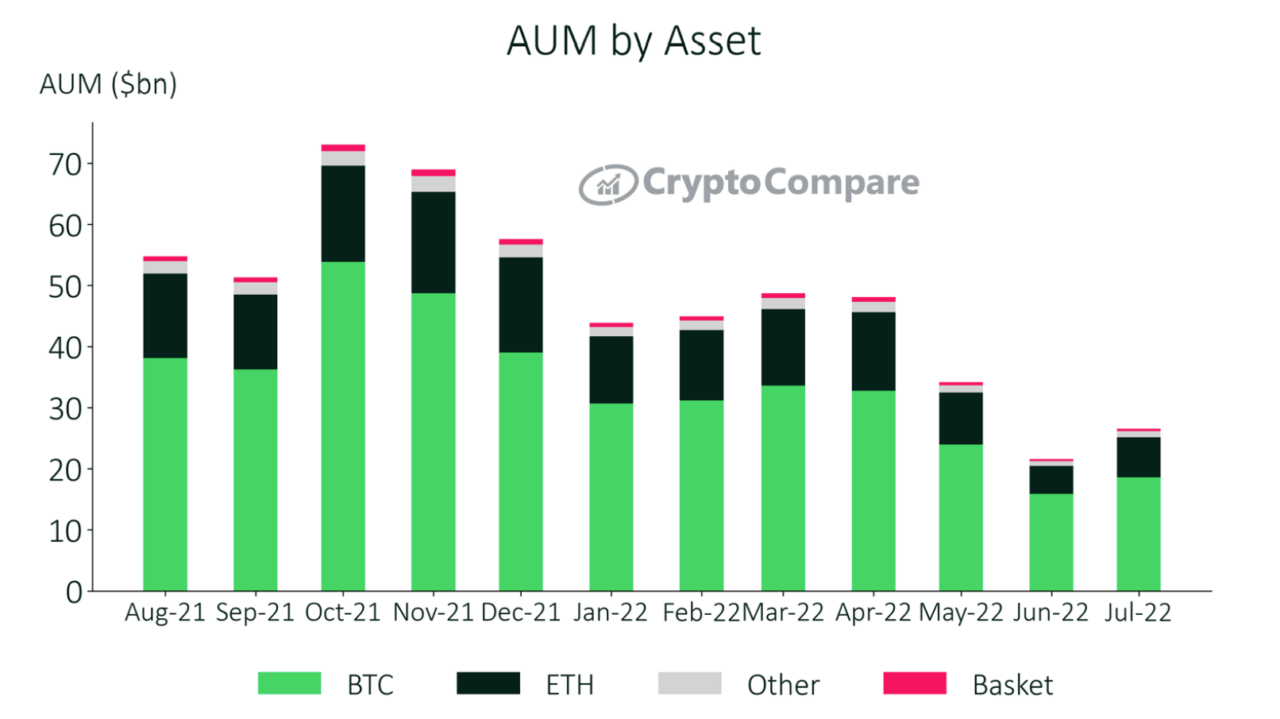

Ethereum investment products’ assets under management rose 44.6% to $6.57 billion this month, compared to BTC investment products, which saw their assets under management rise 16.9% to $18.6 billion.

In July, the report adds, trading volumes tumbled as the average daily aggregate volumes across all products fell by an average of 44.6%. This is the lowest average daily aggregate volume since September 2020, CryptoCompare adds.

Per the digital asset data aggregator, the assets under management of exchange-traded funds rose marginally by 0.63% in July, as the U.S. Securities and Exchange Commission (SEC) has kept on denying the approval of a spot bitcoin ETF.

Trust products, on the other hand, saw their assets under management rise 18.7% to $0.6 billion, while exchange-traded notes (ETNs) and exchange-traded commodities saw AUM rise 18% and 15% to $1.9 and $1.54 billion, respectively.

CryptoCompare’s report comes at a time in which cryptocurrencies have seemingly started to recover and bullish predictions are coming back. Bloomberg Intelligence analyst Mike McGlone has suggested that the flagship cryptocurrency Bitcoin ($BTC) could “outperform” other assets in the second half of the year as it moves “toward global collateral” with performance aligned to that of Treasury bonds or gold.

In a post shared on the microblogging platform Twitter, McGlone noted that Bitcoin “may be regaining its propensity to outperform in H2” as he believes that a series of factors in wider equities and commodities markets may “coincide with a bottoming crypto.”

Image Credit

Featured image via Pixabay