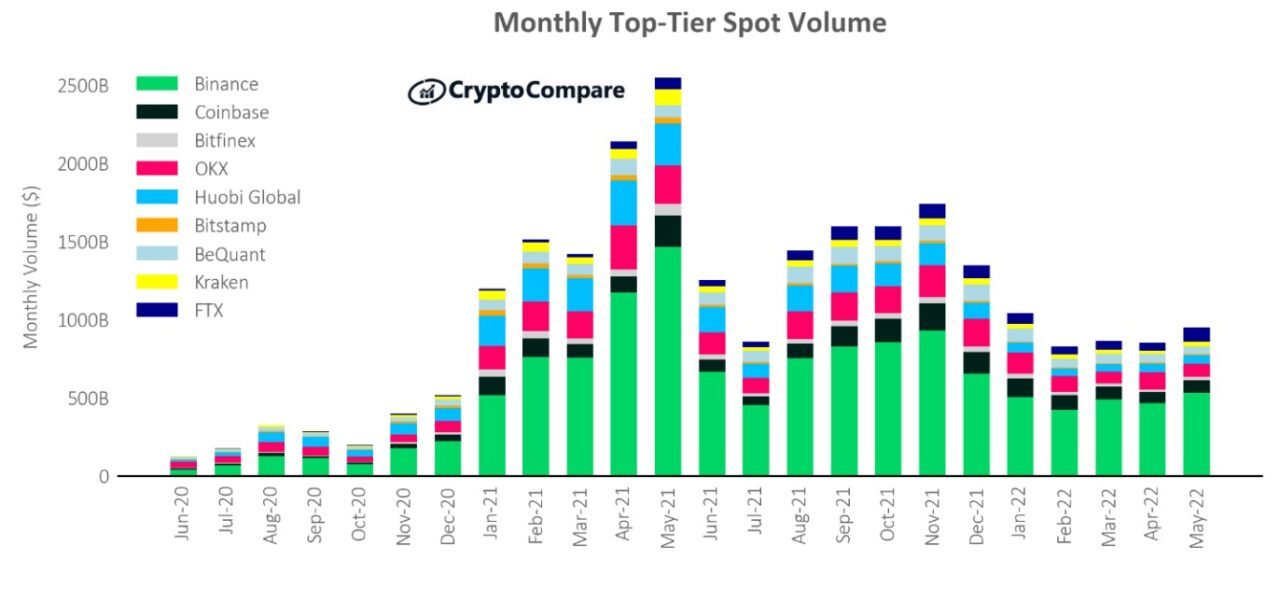

Sam Bankman-Fried’s cryptocurrency trading platform FTX has managed to overtake two major cryptocurrency exchanges in spot trading last month: Coinbase and OKX. FTX overtook these exchanges after seeing its volume rise 90% from the month prior.

According to CryptoCompare’s May 2022 Exchange Review, FTX’s May trading volume surged 80.8% to $69.4 billion, making it the second-largest cryptocurrency trading platform by spot volume behind Binance, which saw its trading volume rise 14.3% to $532 billion last month. Binance commands a market share of 50.9%.

FTX also managed to overtake OKX as its trading volume plunged 29.4% to $82.1 billion. Coinbase put up a fight, however, with its trading volume rising 10% to $79.7 billion in spot trading. CryptoCompare’s report that in May, the spot volume for the 15 largest Top-Tier exchanges increased 9.67% to $1.06 trillion.

Notably, last month the cryptocurrency space witnessed the collapse of the Terra ecosystem, with both LUNA and the UST token becoming nearly worthless. On May 8, when the collapse started, Binance, FTX, Coinbase, OKX, and Bequant were the five largest exchanges experiencing a surge in trading volume.

The report further details that last month, BTC spot trading into fiat or stablecoins “experienced a spike as investors fled to the safety of these assets following the fall of the Terra ecosystem.”

Tether’s USDT notably remained the preferred satefy asset for investors and saw its trading volume against BTC surge 68.9% last month. BTC trading volumes into fiat currencies exploded with USD volumes jumping 103% to 1.43 million BTC, and volumes into EUR and JPY jumping 190% and 82.7% respectively.

Concerns over the backing of USDT saw the trading volumes of other stablecoins, including Circle’s USDC, rise as well. Meanwhile, CME’s monthly futures volumes across BTC and ETH contracts surged “indicating a rise in speculative activity.” Bitcoin futures contracts on the CME “recorded the highest number traded since February 2021,” while Ethereum futures contracts saw their trading volume hit a new all-time of 136,165 contracts traded.

Image Credit

Featured image via Pixabay