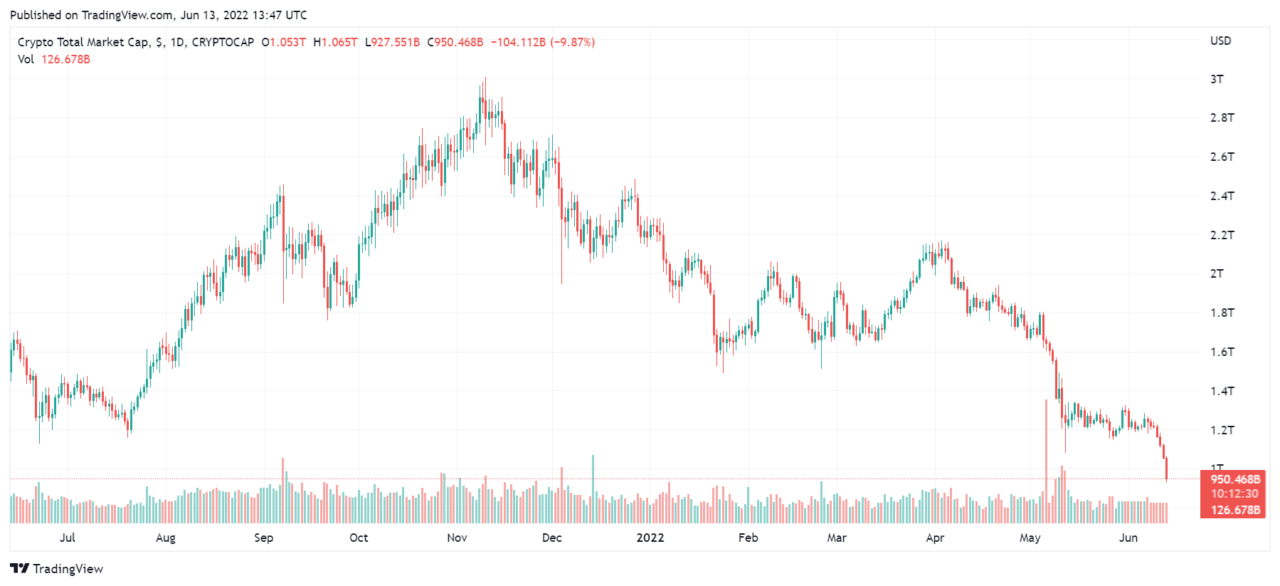

The total market capitalization of all cryptoassets has dropped below the $1 trillion mark for the first time since early 2021 amid a widespread crypto market sell-off that has seen top cryptoassets post double-digit losses.

According to data from TradingView, the total market capitalization of the cryptocurrency space has dropped to $950 billion, meaning it’s below the $1 trillion mark for the first time since early 2021. At its peak, the crypto market’s capitalization was close to $3 trillion.

The fall comes at a time in which the flagship cryptocurrency Bitcoin ($BTC) lost 13.5% of its value over the last 24 hours to now trade at $23,600, while the second-largest crypto by market capitalization, Ethereum, is down 14.7% to 1,230 according to CryptoCompare data.

Other top cryptocurrencies are also down significantly. Binance’s BNB token is now down 12.6% over the past 24 hours to trade at $224, while Cardano’s ADA is down 11% to $0.45 and XRP is down 9.4% to $0.31. Solana (SOL) lost 15.7% of its value and is now trading at $27, while meme-inspired cryptocurrency Dogecoin (DOGE) is trading at $0.054, down 16% in a day.

The market crash is believed to be a result of wider macroeconomic factors, which include soaring inflation throughout the world and the ongoing Russian invasion of Ukraine, coupled with crypto lender Celsius Network freezing withdrawals from its platform citing “extreme market conditions.”

Celsius’ CEL token has lost over 40% of its value over the past 24 hours, while decentralized finance (DeFi) governance tokens have been plunging in the fallout of Celsius’ withdrawal halt. DeFi lending platforms have seen their total value locked plunged between 5% and 10% as well as investors move away from lending products.

The cryptocurrency’s market crash has seen total liquidations in the space surpass $990 million over the last 24-hour period, Despite the sell-off, some are still bullish on BTC in the long term. Bloomberg commodity strategist Mike McGlone has revealed he believes the price of Bitcoin BTC could still hit $100,000 by 2025 once the ongoing bear market in risk assets subsides and valuations recover again.

As CryptoGlobe reported, the percentage of Bitcoin’s circulating supply being held on cryptocurrency exchanges has dropped below the 10% mark for the first time since the $BTC price hit a $3,200 low back in December 2018, at the bottom of the so-called Crypto Winter.

Bitcoin’s supply on cryptocurrency exchanges is a closely tracked metric, as it’s used to gauge the supply of BTC that is currently available to be sold on the market. A smaller amount of BTC on exchanges means that if demand rises enough, a supply shock that leads to upward price movement is a possibility.

Image Credit

Featured image via Unsplash