On Monday (June 27), Coinbase Derivatives Exchange, which is “a CFTC regulated Designated Contract Markets (DCM) futures exchange”, is launching Nano Bitcoin futures (BIT), its first crypto derivative product and one that was “built with the retail trader in mind.”

As you may already know, on January 12, Coinbase announced that it was “acquiring FairX, a CFTC-regulated derivatives exchange”, that this acquisition was “a key stepping stone on Coinbase’s path to offer crypto derivatives to retail and institutional customers in the US,” and that this acquisition was “expected to close in Coinbase’s first fiscal quarter.”

Then, last Friday (June 24), Coinbase published a blog post, in which Boris Ilyevsky, Head of Coinbase Derivatives Exchange, announced that BIT future would be launching on June 27.

Ilyevsky then provided details on how BIT futures would initially be made available:

“Initially, BIT futures will be available for trading via several leading broker intermediaries, including retail brokers EdgeClear, Ironbeam, NinjaTrader, Optimus Futures, Stage 5, and Tradovate, and clearing firms ABN AMRO, ADMIS, Advantage Futures, ED&F Man, Ironbeam and Wedbush.“

He then mentioned that once Coinbase receives regulatory approval on its own futures commission merchant (FCM) license, it would be able to provide “margined futures contracts” directly to its clients.

This new product was designed for (advanced/experienced) retail traders:

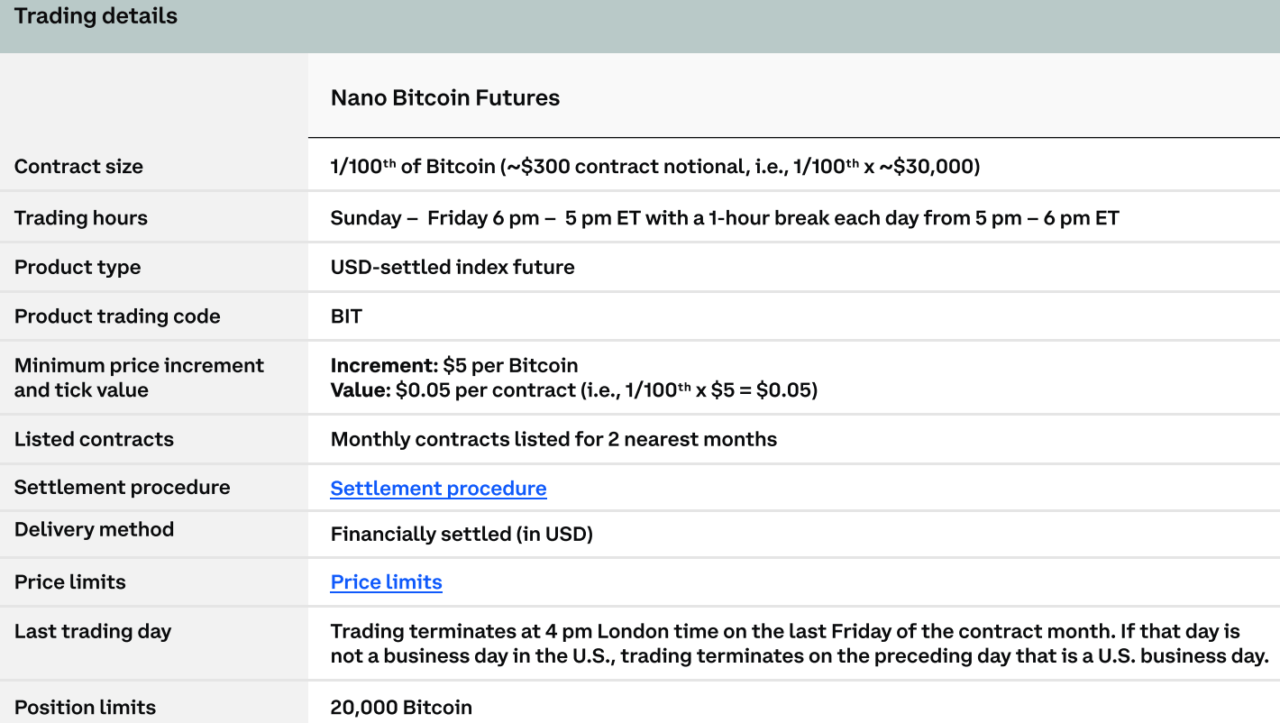

“Our BIT Futures contract will offer the same benefits but is built with the retail trader in mind. At 1/100th of the size of a Bitcoin it requires less upfront capital than traditional futures products and creates a real opportunity for significant expansion of retail participation in US regulated crypto futures markets.“

According to this product’s fact sheet, the Coinbase Nano Bitcoin Future is “a monthly cash-settled futures contract that allows participants to manage risk, trade on margin, or speculate on the price of Bitcoin.”

Here are some more details:

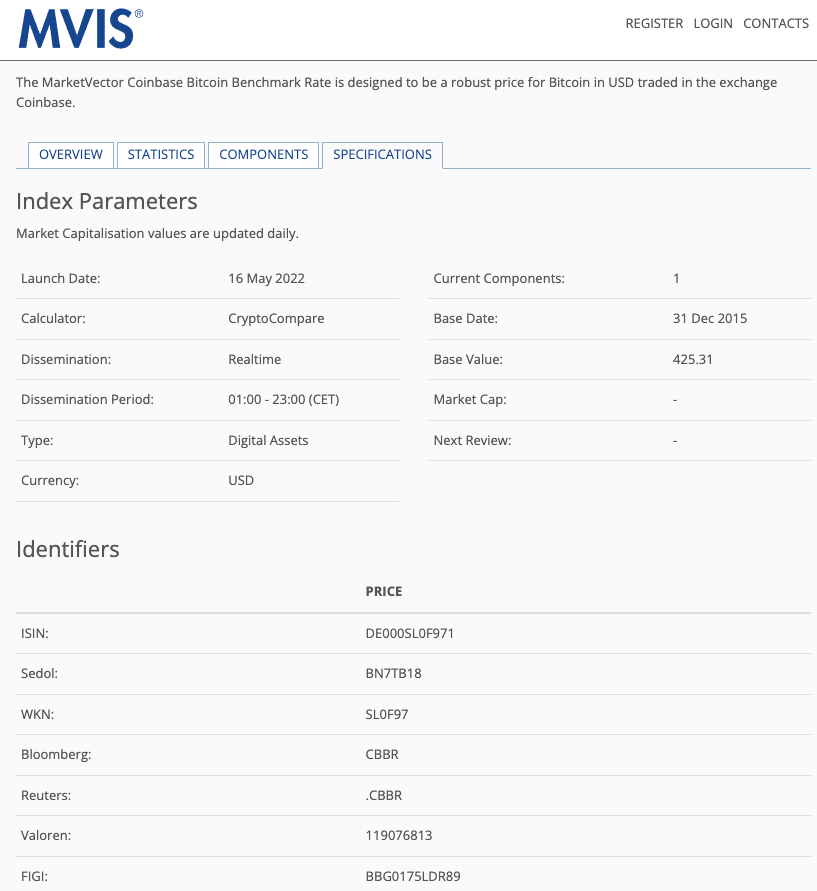

According to a press release issued earlier today by MarketVector Indexes GmbH (“MarketVector”), which “develops, monitors and markets the MVIS indexes, a focused selection of pure-play and investable indexes,” it has licensed the “MarketVector Coinbase Bitcoin Benchmark Rate (ticker: CBBR) and the MarketVector Coinbase Ethereum Benchmark Rate (ticker: CETBR), to crypto industry leader Coinbase.”

The press release went on to say that “these indexes are the first to underlie Coinbase’s Derivatives Exchange’s latest Nano Bitcoin futures contract and future Ethereum product line.”

It is worth pointing out that on May 6, MV Index Solutions GmbH (MVIS), which “develops, maintains and licenses the MVIS and BlueStar Indexes”, announced that it had “changed its name to MarketVector Indexes GmbH (MarketVector), effective 13 April 2022.”

Here is some information about MVIS indexes:

“The introduction of MVIS® indexes has expanded VanEck’s successful brand from exchange-traded products to indexes, and the current portfolio of MarketVector indexes reflects the company’s in-depth expertise when it comes to emerging markets, hard assets, fixed income, and special asset classes. Approximately USD 30.86 billion in assets under management are currently invested in financial products based on MVIS® indexes. MarketVector Indexes is a VanEck® Company.“

Steven Schoenfeld, CEO of MarketVector Indexes, had this to say:

“We are proud to launch our innovative new MarketVector Coinbase Bitcoin and Ethereum indexes, which will be the benchmark for Coinbase Derivatives Exchange’s new and forthcoming crypto futures contracts. We’re confident that the new Nano Bitcoin futures contract will help bring the utility and price discovery function to a broad new set of users.“

And Boris Ilyevsky, Head of Coinbase’s Derivatives Exchange, stated:

“We’re excited to be launching our crypto derivatives offering using MarketVector Indexes. As the world’s most trusted crypto platform, it was essential for us to work with a partner who shares similar values.“

Below are the specifications for the MarketVector Coinbase Bitcoin Benchmark Rate:

The data provider and the calculation agent is CryptoCompare, a global cryptocurrency market data provider, which was co-founded in 2014 by Charles Hayter (CEO) and Vlad Cealicu (CTO).