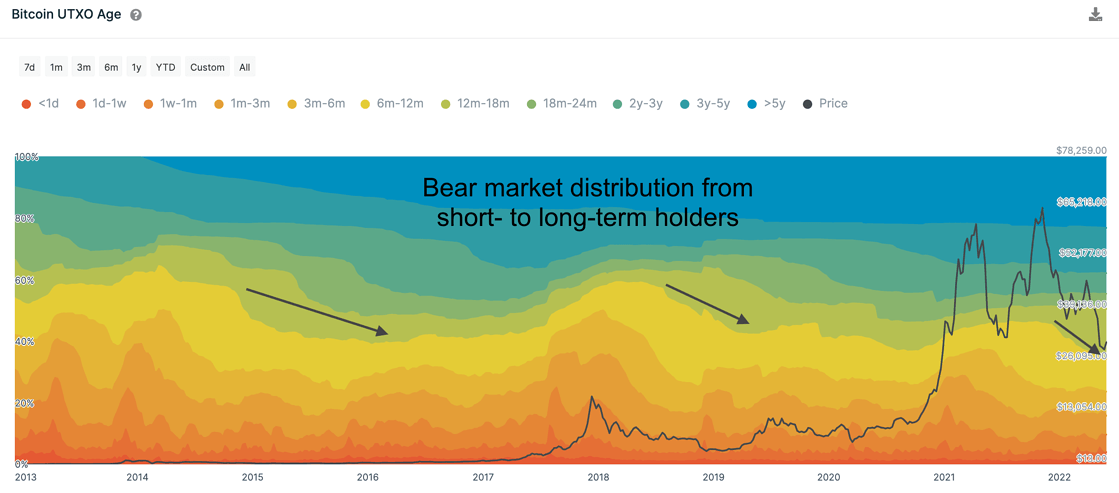

HODLers of the flagship cryptocurrency Bitcoin ($BTC) with long-term time horizons are doubling down on their exposure to the cryptocurrency, as the percentage of BTC owned by addresses holding for one year or longer has expanded, while short-term traders are “fading away.”

According to an analysis conducted by the head of research at analytics firm IntoTheBlock, Lucas Outumuro, the recent market drawdown has made it “harder and harder to argue we are not in a bear market,” and made it “clear that crypto is not for the faint of heart.”

In his analysis, first spotted by Daily Hodl. Outumuro noted that key indicators have dipped less than they did in previous bear markets and argued 80% drawdowns for top cryptocurrencies like Bitcoin may be a thing of the past, as cryptos like BTC are maturing and as a result “the chances of it disappearing increase as it gains broader adoption.”

As an example, the analyst pointed to Amazon’s 95% crash during the dot-com bubble, and a less significant 65% crash during the financial crisis, as it was a more established business. The analyst noted that this may apply to established cryptoassets, but not to newer ones.

The report adds that a “high portion of demand [for crypto] comes from speculation” and as such “it is normal for transaction fees to plummet severely as trading sentiment dwindles through bear markets.” As fees remained at higher levels this “suggests stickier demand,” he said.

The analyst added:

Bitcoin has been averaging above $500k in daily transaction in May 2022, compared to $130k in May 2018. Ethereum and other crypto-assets mirror this same pattern of less pronounced drops in on-chain activity than in prior bear markets

Development activity for both Bitcoin and Ethereum has shown “consistent progress,” regardless of price action. Commits to the Bitcoin network, Outumuro added, have “grown over 50% in the past two years as developer efforts consistently improve.”

As CryptoGlobe reported Bitcoin’s “investor tool” metric, which is designed as a tool for long-term investors to find periods where prices may be approaching cyclical tops or bottoms, has started flashing a buy signal for the first time since the COVID-related crash of March 2020.

Last month, JPMorgan said that cryptocurrencies are now the bank’s preferred alternative asset, as a major sell-off in the cryptocurrency space after the collapse of the Terra ecosystem hurt cryptos more than other alternative investments including private equity and private debt.

To JPMorgan’s analysts, the fair price for BTC is $38,000, Investors have moved away from riskier assets including cryptoassets this year over rising inflation and interest rates and Russia’s invasion of Ukraine.

Image Credit

Featured image via Pixabay