The Terra community has voted through the protocol’s governance system to burn all TeraUSD ($UST) that the project’s community pool held, along with the UST deployed for past liquidity incentives on the Ethereum network.

As first reported by TheBlock, roughly 11% of the cryptocurrency’s existing supply is now being burned, meaning 1.3 billion UST are being effectively removed from circulation thanks to the governance proposal, which was approved with 99.39% of votes.

The vote will see Terraform Labs, Terra’s core development organization, move to execute the burn. The burn will first see Terra’s community pool move 1 billion UST to a burn module, where it will be permanently removed,

A second step will see the team behind the project manually bridge 370 million UST back from the Ethereum blockchain so they can then destroy the tokens.

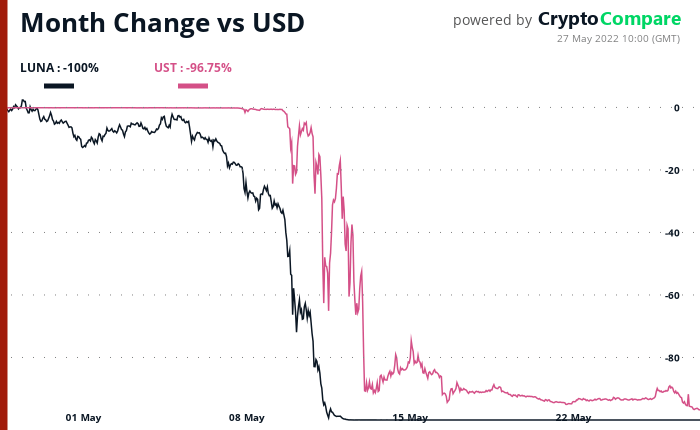

Earlier this month, the Terra ecosystem collapsed after the TerraUSD ($UST) stablecoin lost its peg over a $500 million sale on the Curve Protocol, which had low liquidity. The sale saw UST’s peg drop below the $1 mark and triggered a bank run that saw LUNA’s circulating supply inflate by over 6 trillion.

The Luna Foundation Guard, a non-profit organization set up to oversee the Terra ecosystem, deployed billions In Bitcoin reserves in a bid to defend the peg, but ultimately failed to do so. The collapse saw both currencies lose their value in what was deemed one of the largest wealth destruction events in the crypto space, and the ensuing chaos affected the broader market.

The approval of the burn comes shortly after the community approved Terraform’s revival plan to relaunch the Terra network and create new LUNA 2.0 tokens that will e airdropped to LUNA token holders. The snapshot for the airdrop has already been taken.

LUNA 2.0 tokens will be airdropped to token holders after the launch of the new network, which will exist without UST in it and will instead be useful as a smart contract platform.

As CryptoGlobe reported, the co-founder of Terraform Labs, Do Kwon, has said that $LUNA holders are “literally burning money” when they send tokens to a dead address in a bid to reduce the cryptocurrency’s circulating supply.

HODLers’ plan is to reduce the circulating supply of the cryptocurrency in a bid to prop up prices as demand remains constant or picks back up. To Do Kwon, doing this is just “literally burning money,” which seems odd in a community that lost billions earlier this month.

Newsletter

To make sure you receive a FREE weekly newsletter that features highlights from our most popular stories, click here.

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

Image Credit

Featured image via Unsplash