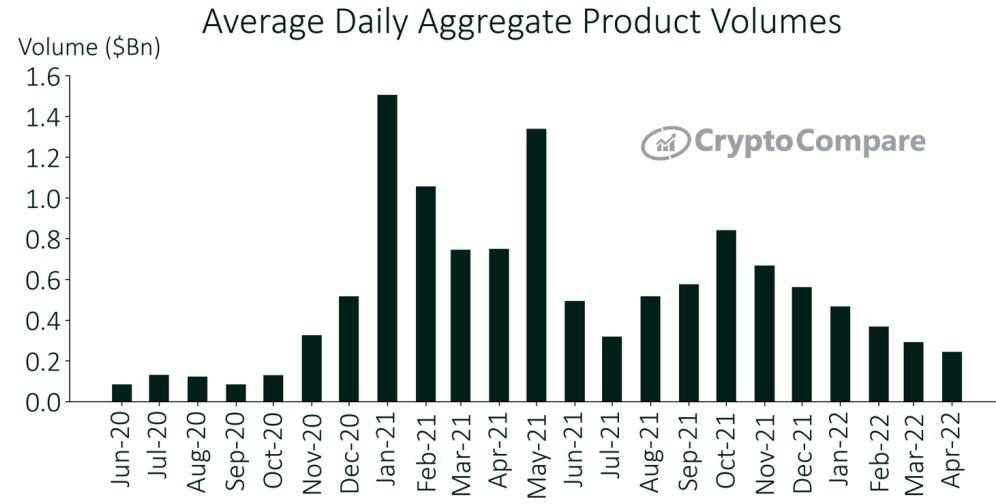

As cryptocurrency prices keep on dropping, investors flooded out of cryptocurrency investments products in April and their average daily trading volumes fell 16.3% to $244 million, marking the sixth consecutive month of declining trading volumes.

According to CryptoCompare’s Digital Asset Management Review report, the trading volumes of cryptocurrency investment products have fallen 71% since October 2021, when they stood at $841 million. From their all-time high of $1.5 trillion in January 2021, they’ve fallen 83.8%.

Grayscale’s Bitcoin Trust (GBTC) remained the highest traded product in April, even after seeing daily volumes drop 17.3% to $104 million. It was followed by Grayscale’s Ethereum trust, which saw daily volumes of $66.3 million, down 11.5%. Most outflows were seen in BTC investment products.

CryptoCompare points out that while trading volumes on centralized exchanges have “weakened over the last six months,” the “decline in digital asset investment products is more severe.” This decline, the firm adds, suggests market participants “have moved further away from these products in preference for more direct exposure to crypto assets.”

The report further shows that last month average weekly outflows totaled $79.5 million, with the largest weekly outflow being of $134 million on the week ending on April 8. April has seen the largest average weekly outflows so far this year, the report adds.

Despite the waning trading volumes, total aggregate assets under management across cryptocurrency investment products “fell marginally by 1.34% to $48.1 billion, the report adds. Assets under management have, in fact, remained “relatively stable so far this year.”

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Pixabay