The total assets under management (AUM) of cryptocurrency investment products has risen in February to reach $44.9 billion as the prices of Bitcoin and Ethereum rose by 1.5% and 5.7% respectively last month.

According to CryptoCompare’s new Digital Asset Management Review report, macro sentiment around risk-assets like equities and cryptocurrencies has been leading the narrative n the markets, with investors expecting up to nine rate hikes from the U.S. Federal Reserve throughout this year.

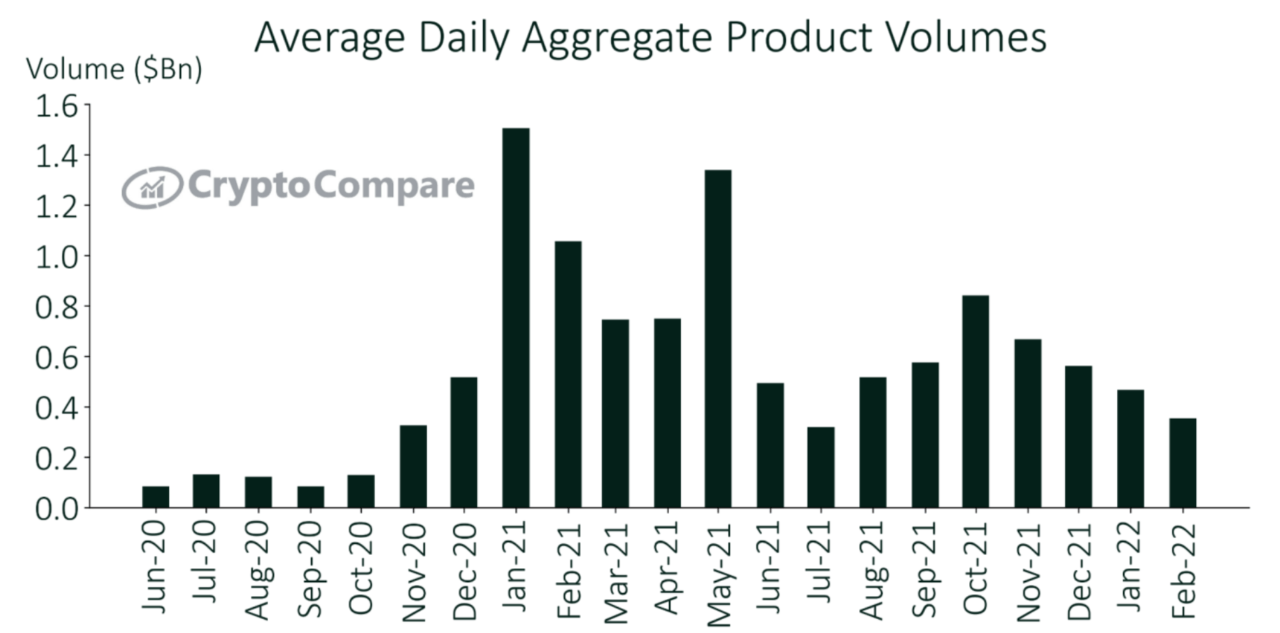

As a result of this sentiment, digital asset investment products experienced inflows throughout last month, averaging $76.4 million, up from %61.5 million in January, the report details. The total assets under management rise for the first time in four months over these inflows to hit $44.9 billion. The figure is still down 39.8% from an all-time high seen in October, however.

CryptoCompare’s report details that the increase was consistent across all product types with exchange-traded certificates rising 17% month-on-month to $3.6 billion. Exchange-traded notes, exchange-traded funds and trust products’ assets under management also rose 6.7% to $3.1 billion, 3.3% to $3 billion, and 0.7% to $35.3 billion respectively.

The growth wasn’t focused on a specific cryptocurrency, as products offering investors exposure to BTC, ETH, and baskets of cryptocurrencies all saw moderate growth. Notably, products offering investors ETH exposure saw their AUM grow 4.6% to $11.6 billion, while those offering BTC exposure grew 1.7% to $31.2 billion.

The report adds that average weekly net inflows reversed a downtrend that started after hitting an all-time high in October. Cryptocurrency investment products, it adds, maintained net inflows since the third week of January, with average weekly inflows reaching levels that hadn’t been seen since the first week of December, when they averaged $184.1 million.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Pixabay