Written by: Simon, a crypto analyst from Footprint Analytics, focus on blockchain data such as DeFi, NFT, GameFi. Data source is Footprint Analytics.

Although “gaming” is the first part of GameFi, “finance” is the main reason for its rapid growth. GameFi is still in the early stages of growth and games within that space are far less developed than traditional ones.

The main source of profit for players in the game is non-fungible token (NFT) trading, as well as mining and trading of gaming tokens. Therefore, it is important for players to understand the economic model of these tokens.

The Economic Model of Tokens

GameFi tokens link the game, NFTs and financial attributes. A sustainable, fair and attractive token model will have a significant impact on the game.

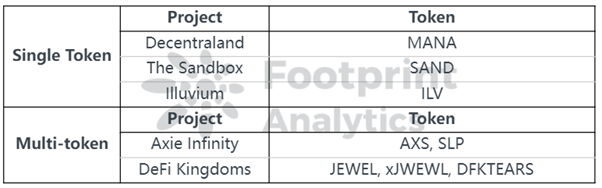

The current token model in the game is mainly divided into single token and multi-token economies.

1. Single Token

The single token economy model uses one token for all things related to the platform, such as in-game activities, project governance, and transactions in the secondary market.

The advantage is that the model is simple. Players only need to obtain one token to experience the game, which facilitates player transactions and reduces the difficulty of resource integration.

The disadvantage is also obvious, because the token used is also an asset that the player wants to hold to increase its value. The player’s willingness to hold it contradicts the game’s setting of having to consume tokens in order to advance.

Players can easily be affected by fluctuations in the token’s price. When its price is too low, players will likely lose some of their interest in playing the game because of its lack of potential profitability; When the price is high, players will lose their assets by taking advantage of the high-value token.

In addition, if a project adopts a model of constantly issuing additional tokens, inflation will be a result. Since the single token model can easily affect the token’s ecosystem, more game projects prefer to adopt a multi-token model.

2. Multi-token

Games with multiple tokens generally separate between platform governance tokens and tokens circulating within the game’s ecosystem..

- The platform governance token is mainly used to encourage players to contribute to community governance and thus increase the recognition of the platform value.

- The token(s) used in the game is mainly used for in-game tasks, trading, daily quests, level-ups, etc. There is usually no maximum issuance amount set, and some of them do not even need to be virtual currencies a blockchain and are often not traded on secondary markets.

The multi-token model has various forms according to different games, and also has obvious advantages and disadvantages compared to the single token model.

The main advantage is the stabilization of the economic system in the game. The model allows players to play without being affected by the main token’s fluctuating price. The separation of in-game tokens also allows developers to adjust the economic model of different tokens flexibly.

The disadvantage is that it increases the integration difficulty for the gamers and the learning difficulty for the players.

Examples of GameFi Projects

The top-ranked games using the single token model are mostly focused on the metaverse concept of purchasing land.

For example, Decentraland’s token MANA can be used to buy land and goods and services in the virtual world;In the Sandbox, SAND is used to be the basis token of transactions and interactions, which players can use SAND to buy, rent, hire, vote, stake, etc; The ILV can be used in addition to the in-game activities, and can also be staked to rewards in the pool, as well as participating in governance.

Other projects mostly use multi-token models. For example, in DeFi Kingdoms, JEWEL is the main token used to buy Heroes and props, and xJWEWEL is used for governance after staking. DFKTEARS is the token used to summon Heroes in the game.

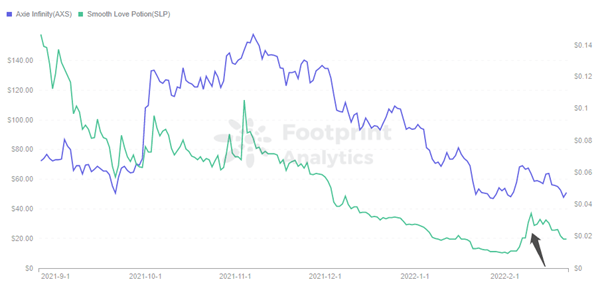

In Axie Infinity, AXS are governance tokens that can also be staked for rewards, and SLPs can be earned through battles in the game, where players can burn them to breed their own unique Axie.

Key Economic Aspects of GameFi

It is also important to understand the economic system within a GameFi project. A token can be evaluated using the following points.

1. Issuance and Burning Mechanism

A reasonable and limited issuance size can prevent token inflation, while an unlimited economic model may cause token devaluation and make players lose confidence in holding them for a long time.

Destruction mechanisms also play an important role in preventing inflation, and active burn mechanisms can help stabilize prices. For example, on Feb. 4, 2022, Axie Infinity announced that it would no longer issue SLP token rewards in daily quests and adventure mode, and added more SLP burn mechanisms (including special cosmetics and skins, upgraded Axie body parts, in-game emojis, Axie naming, etc.)

The launch of this mechanism has led to a rebound in SLP prices, which had been declining.

2. Distribution

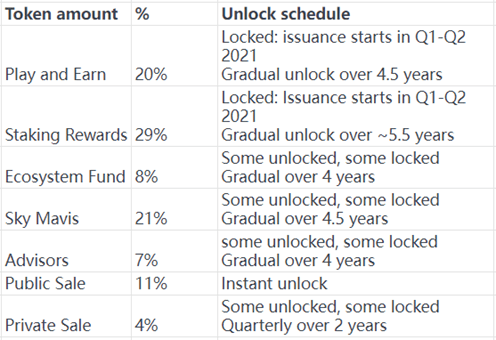

The team’s distribution scheme for tokens is also noteworthy, with more weight given to the community to gain more player preference.

For example, Axie Infinity’s token AXS is allocated 20% to Play to Earn, 29% to Staking Rewards, and nearly 50% to users. A proper allocation mechanism has far-reaching effects on the project. After all, community participation is everything that makes a game successful.

3. Utility

The broader utility of a token is more attractive to players. Most games have tokens for daily quests, in-game level-ups, purchases, PVP, etc., and some can be staked for additional NFTs or token rewards.

Extending the use cases outside of the game will add more capabilities to the token, such as trading in the secondary market, integrating with other projects to gain revenue, etc.

4. Locking Period

Setting the unlocking time helps prevent speculative users influencing the price of the token and retain more users. At the same time, keeping the same lock-up period for the project team and players is also helpful to keep the interests of both aligned.

Axie Infinity allocations to the community and teams basically have a gradual unlock over 4 years. The goal is to attract more players hunting for token rewards while remaining an incentive for teams to build.

A lock-in period is a time during which investors are prevent from selling their assets. These periods both ensure investors focus on the project over a longer period of time while also preventing them form dumping large amounts on the market.

Gaming Tokens’ Data Performance

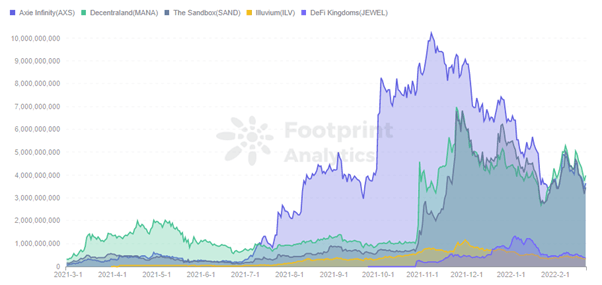

According to Footprint Analytics, the top 5 GameFi token projects by market cap as of March 2022 are Decentraland, Axie Infinity, The Sandbox, DeFi Kingdoms, and Illuvium, with a nearly 10x disconnect between the top 3 starting in fourth.

A good user experience and playability are also crucial, as reflected in Illuvium. Although not officially online, the game has released gameplay trailers with stunning visuals and rich game characters.

Illuvium is still in the Top 5, despite losses in December due to attacks and protocol bugs, which shows that players still have a greater demand for quality games.

DeFi Kingdoms differs from the other top 5 projects in that its main core is decentralized finance (DeFi), and the gaming properties are just the icing on the cake. This fun game-like investment experience has allowed DeFi Kingdoms’ token, JEWEL, to rise all the way to #4 in market cap since its launch.

Summary

With more capital entering the GameFi space, there is no shortage of GameFi projects, but a shortage of projects that are good from game quality to token economic systems.

Compared with more developed traditional games, GameFi projects are still at an embrionary level. However, its financial attributes and high community participation make it open up a new blue ocean in the red sea of the game field.

Improving the in-game economy through gaming tokens is as important as improving the gaming experience. Whether it is for play-to-earn or for those who hold the token to rise, it is also a must to have enough understanding of gaming tokens before starting.

This piece is contributed by Footprint Analytics community.

Featured image via Pixabay.