A new report published by financial services and banking giant Wells Fargo suggests cryptocurrencies could be near a “hyper-adoption phase” similar to the one that the internet saw during the mid-to-late 1990s.

According to the report from the bank’s Global Investment Strategy Team, Wells Fargo believes cryptocurrencies are “viable investments today,” even though they “remain in the early stages of their investment evolution.”

Analysts at Wells Fargo recommend investors stick to “professionally managed private placements for now” as the investment landscape for cryptocurrencies is still maturing. They added they do not recommend “any of the other current investment options” including mutual funds, exchange-traded funds (ETFs), grantor trusts, and even individual cryptocurrency speculation.

Wells Fargo’s report details the analysts are “hopeful” this year can bring greater clarity when it comes to cryptocurrency regulations, which could lead to “higher quality” investments. Addressing the argument that it may be too late to invest in the cryptoasset space, Wells Fargo noted it understands it but does not “subscribe to it.”

The analysts argued that crypto’s performance numbers have been skewed as the assets grew from “virtually zero” to where they are now. The bank points out that the cryptocurrency industry is “relatively young” and the vast majority of projects within it are less than five years old.

Crypto’s Potential ‘Hyper-Adoption Phase’

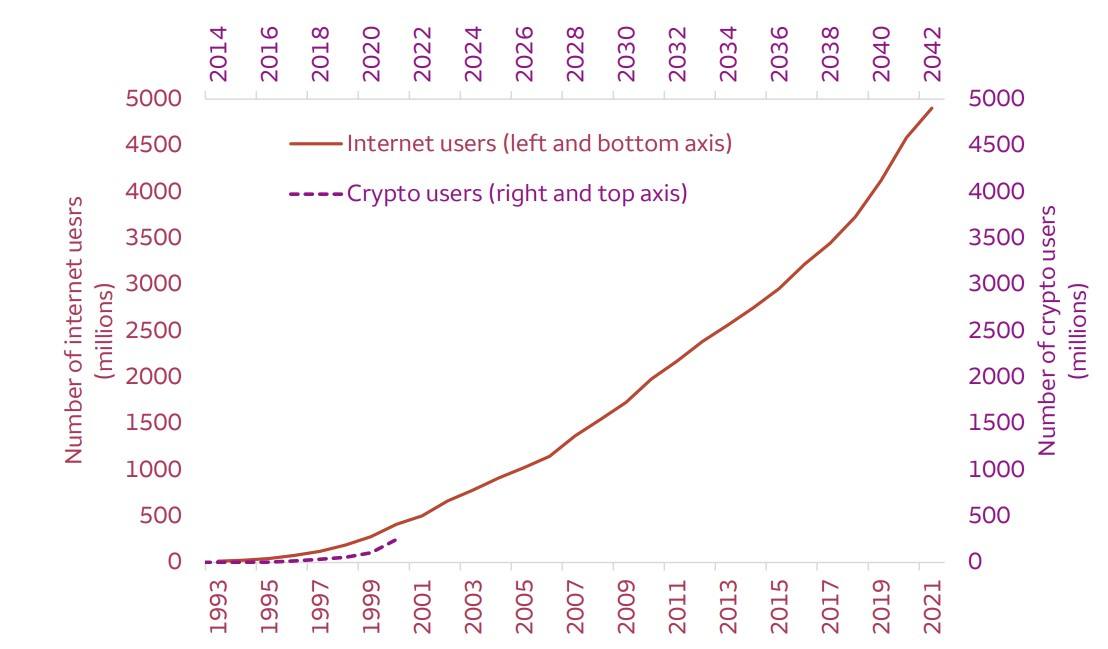

In the report, Wells Fargo argued that there’s a need for investment education when it comes to cryptocurrency space and pointed out that the market’s adoption rates are similar to those of the internet in the mid-to-late 1990s.

The bank’s report compared the internet’s adoption during that time to that of the cryptocurrency space. It added that this means there is “no doubt that global cryptocurrency adoption is rising, and could soon hit a hyper-inflection point.”

Wells Fargo’s new report comes after one it published last year calling crypto a “viable investment asset.” In late 2020, it compared bitcoin investing to the early days of the 1850s gold rush, claiming the market involves more speculating than investing.

The Wells Fargo Investment Institute has, nevertheless, moved to offer a “professionally managed solution” for its wealthiest clients to gain access to the cryptocurrency space. In August, it registered a passive bitcoin trust with the U.S. Securities and Exchange Commission.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Unsplash