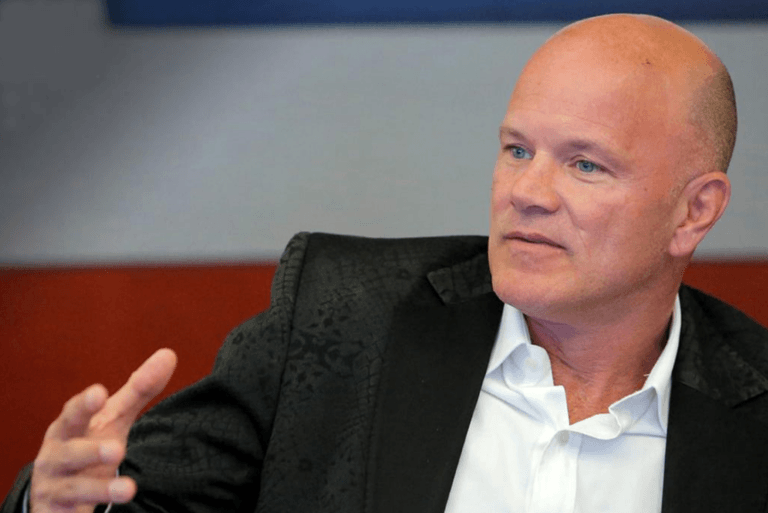

American billionaire investor Mike Novogratz says that Bitcoin has “crushed” gold in terms of performance and adoption.

Former hedge fund manager Novogratz is the Founder and CEO of Galaxy Digital, “a diversified financial services and investment management innovator in the digital asset, cryptocurrency, and blockchain technology sector.”

During Galaxy Digital’s Q3 2021 earnings call, Novogratz highlighted how gold’s performance has been disappointing in light of favorable monetary conditions around the world.

As reported by The Daily Hodl, Novogratz said,

I think if you had asked gold bugs two years ago where the price of gold would be, given what’s happened in monetary and fiscal conditions around the world, they would have all answered far higher than here at $1,800.

Novogratz explained that gold was failing to live up to its potential as a result of being substituted by Bitcoin:

What’s happened? There’s been a substitution of Bitcoin for gold. We’ve seen it directly [and] indirectly. You see it in the charts. I still think gold was probably an okay asset to own in this environment, but it’s just gotten crushed by Bitcoin.

Novogratz predicted Bitcoin adoption would continue to grow and compared blockchain technology in finance to the impact of digital cameras on photography. Compared to gold, Novogratz called Bitcoin a “better version” for store-of-value and said its adoption globally was occurring at an accelerated pace.

He highlighted the more than 200 million people worldwide participating in the Bitcoin ecosystem, which he said would increase with time.

The billionaire also claimed Bitcoin had solidified itself as a store-of-value asset, ending the debate “over nine months ago” when the price skyrocketed. He mentioned that the focus is now on adoption, despite the volatility of the crypto markets.

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.