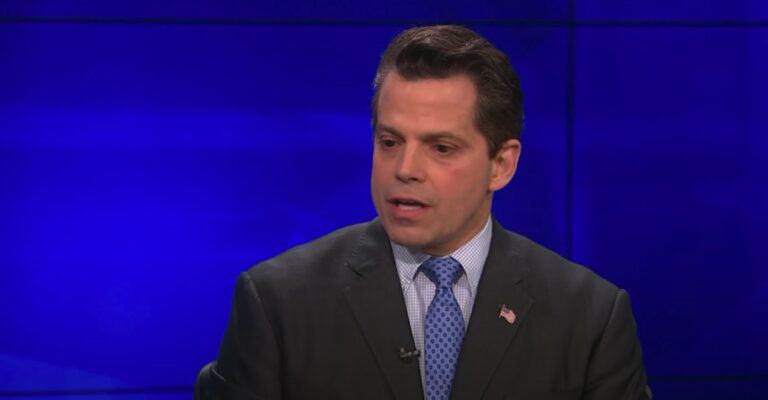

In a recent interview, former White House Director of Communications Anthony Scaramucci, who is the founder and CEO of global alternative investment firm SkyBridge Capital (“SkyBridge”), shared his latest thoughts on Bitcoin and altcoins.

SkyBridge, which was founded in 2005 by Scaramucci, is “a global alternative investments firm specializing in multi-strategy commingled fund of hedge funds products, custom separate account portfolios and hedge fund advisory solutions to address the needs of a wide range of market participants ranging from individual accredited investors to large institutions.”

On 29 December 2020, Scaramucci gave an interview to Peter McCormack for an episode of the “What Bitcoin Did” podcast, which was released on January 4.

Here is what Scaramucci said about Bitcoin in that interview:

“I like the scarcity feature: no one knows who invented it. That was a smart by the inventors of it ,but they’ve only got 21 million coins out there, and so that scarcity provides people with this anti-dilutive quality, and it’s also, as you know, about human minds — when something is scarce, people want it...

“It could glide to $280,000 a coin, have a $5 trillion dollar market value, and still only be half of all of the gold that’s been mined in our global society, and I and I think it’s got a long way to go here… You have this historic opportunity now to get in before the institutions do. Institutions are coming. Could this be a $100,000 per coin at the end of 12-31 2021? I believe it could be….“

Well, last Wednesday (September 8), during an interview with Andrew Ross Sorkin, co-anchor of CNBC’s “Squawk Box”, he had more to say about the crypto market.

According to a report by The Daily Hodl, Scaramucci said:

“It felt like it was peaking as a result of the El Salvador news, there was a lot of leverage in the system, and a lot of leverage blew out… over the last 48 hours. Having said that, the demand and the fundamentals for things like Bitcoin continue to improve. Every day you hear new stories about more wallets, more activity, more potentiality of an ETF (exchange-traded fund) – at least a Bitcoin futures ETF – and so I’m still quite optimistic for year-end…”“

As for the altcoins in particular, he said:

“There’s a lot of great stuff happening in this space… As more digital applications happen, some of those altcoins, stuff like Algorand or Cardano, or things like Ethereum, will continue to rise because there’s actually great use cases for them.“

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.