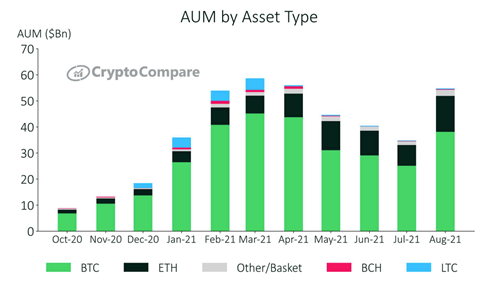

The total assets under management (AUM) across all cryptocurrency investment products have increased 57.3% to $54.8 billion as the prices of most top cryptocurrencies have started recovering in late July.

According to the August edition of CryptoCompare’s Digital Asset Management Review, Bitcoin-focused investment products saw their total assets under management rise 51.9% to $38.1 billion but lost market share while other products saw greater inflows. BTC products now represent 69.6% of the total.

Ethereum-focused products saw their AUM rise 72.8% to $13.8 billion, while products offering baskets of assets saw their AUM rise 67.8% to $2.3 billion. Exchange-traded funds (ETFs) and Exchange-traded notes (ENS) both saw large increases of 79.1% and 91.4% respectively.

Notably, data has shown institutional investors have been betting on Solana ($SOL) and Cardano ($ADA) investment products as the cryptocurrency market recovers and bitcoin moved back toward the $50,000 mark.

Last week, institutional investors moved $7.1 million into Solana investment products, seemingly reacting to SOL’s recent price surge that saw it jump from little over $35 to a new all-time high then above $75. The cryptocurrency has since broken the $80 mark.

Behind Solana investment products, the most popular ones were those tracking the price of Cardano’s ADA, with inflows of over $6.4 million. Behind these two were bets on ETH and LTC investment products.

Average daily aggregate product volumes rose 46.6% to $544 million, CryptoCompare’s Digital Asset Management Review details. The average daily volume for GBTC, the investment trust bought by Morgan Stanley, stood at $240 million after rising 17.4%, while Grayscale’s Ether investment product saw its average daily volume rise 105.9% to $193.3 million.

Grayscale’s Digital Large Cap (GDLC) fund also saw its volume increase by 117.4% in July to $6 million.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image viaPixabay